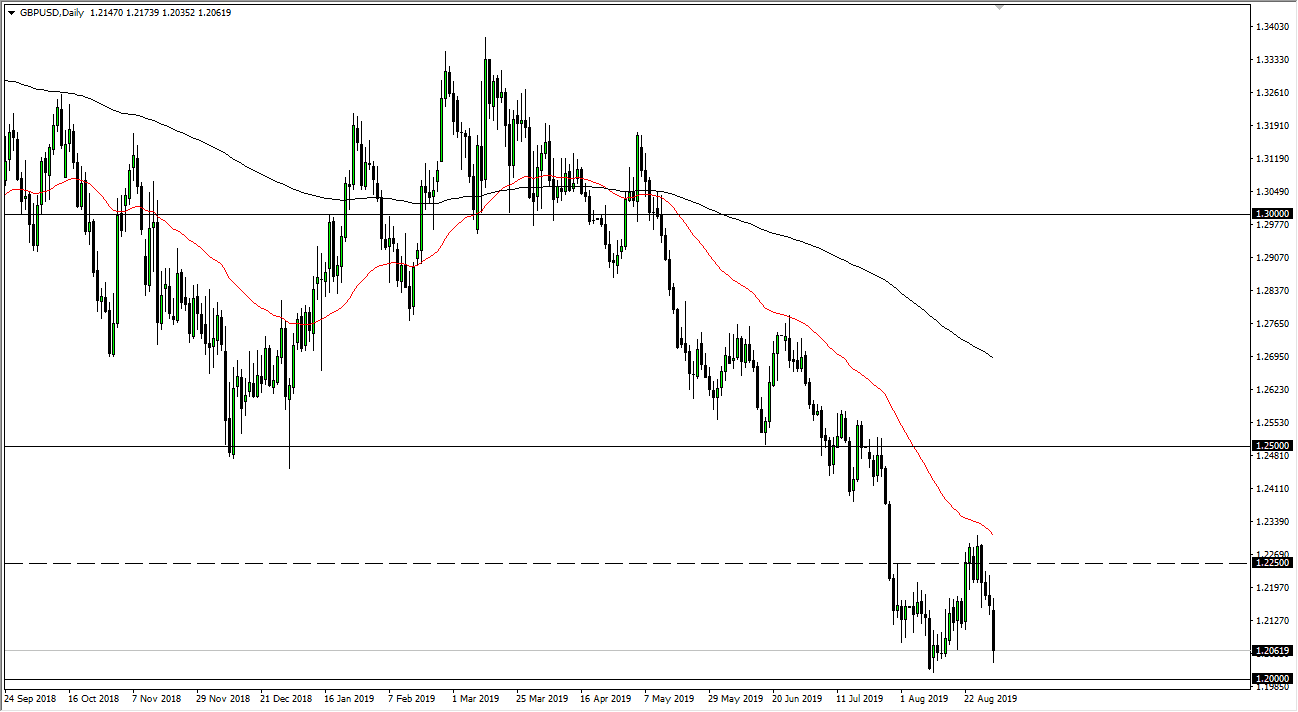

The British pound has initially tried to rally during the trading session on Monday, but then rolled over quite drastically to show extreme weakness. The 1.20 level underneath should be supportive, but the fact that it caused a major bounce previously I think will cause a lot of noise in the same area. After all, is a large, round, psychologically significant figure and it’s likely that we will continue to respect it. However, given enough time we will more than likely not only rally from here but then break down through that level. Once we do, it should bring in a flood of fresh selling in a market that has been completely pummeled.

We continue to see a lot of concerns when it comes to the Brexit, and now there are talks of a potential rebellion against Boris Johnson within the Tory party. Ultimately though, this is a market that is continuing to show a significant amount of negativity as traders hate uncertainty. At this point, we are in a downtrend and there’s no reason to fight it. I think if we can break down below the 1.20 level, then I think it opens up a move down towards the 1.18 level and then possibly the 1.15 level after that. After all, the 61.8% Fibonacci retracement level has been broken through so it’s quite often a sign that we are going to go much lower.

Beyond that, we also have the markets buying US Treasuries, and those of course demand US dollars. With that being the case it makes quite a bit of sense that the US dollar should continue to attract a lot of attention. I like fading rallies, and I believe that the 1.2250 level above will continue to offer resistance that we can take advantage of. All things being equal it’s very likely that the potential rising wedge that we just broke down through is the sign that we are ready to go much lower. You can even make an argument for a bearish flag, so both of these patterns are going to be very bearish to say the least. Either way, I have no interest in buying the British pound as long as we still have so much uncertainty when it comes to the Brexit, the United Kingdom, and for that matter even the European Union and its potential reaction.