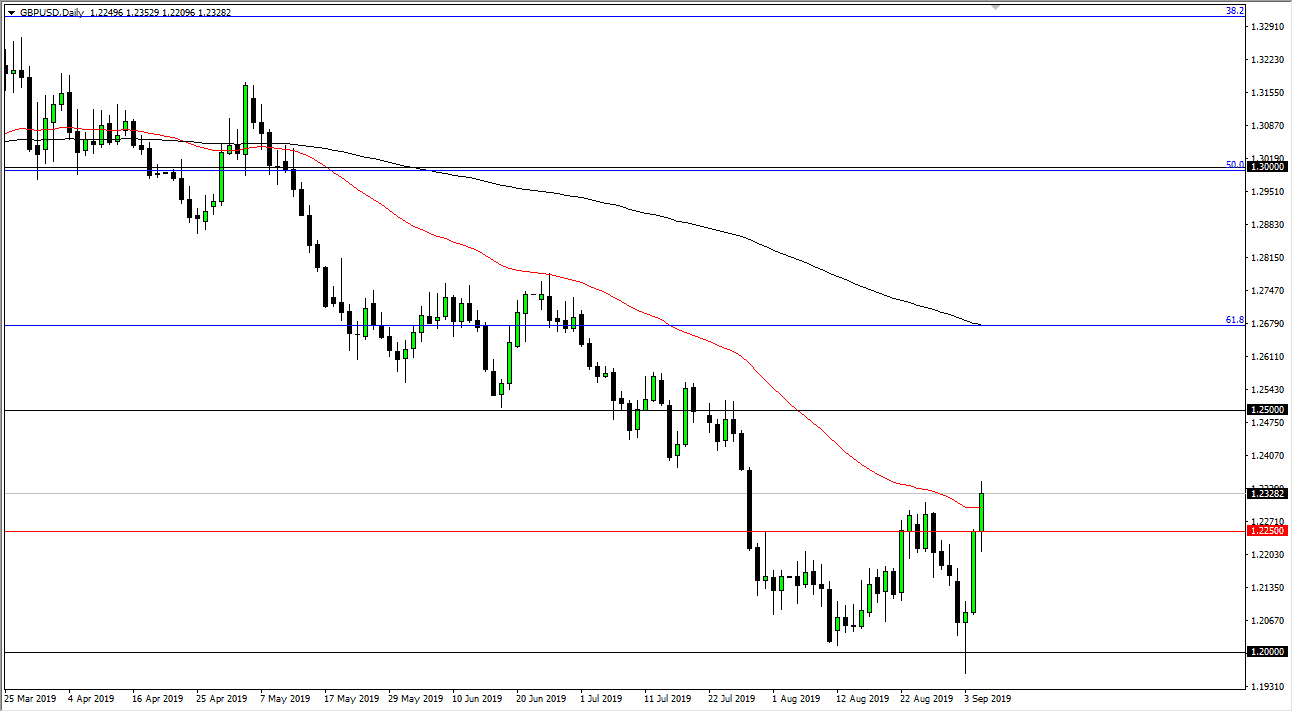

Granted, the British pound has taken off during the last couple of sessions after initially breaking through the 1.20 GBP level. We were oversold at that point, and beyond that it’s very likely that we simply had to rally because we had fallen too far. However, we also have a bit of an overbought situation of the last couple of days, because UK parliament deciding that a “no deal Brexit” it’s off the table, doesn’t necessarily mean that we are going to get a deal anytime soon. This will only throw more hesitation into the market as markets hate uncertainty.

Ultimately, I do think that the 1.25 level above is massive resistance as well, and I don’t have any interest in buying this market until we get above there. Overall, I think it’s a matter of simply waiting out the exhaustion to hit the market as the British pound is going to continue to be plagued by several issues. Not the least of which is the Brexit, but we also have relatively soft economic data. You should also remember that you are trading the British pound against the US dollar, which of course has fairly strong fundamentals when compared to some of the other larger currencies around the world.

The 200 day EMA is above the 1.25 level as well, but it is starting to reach towards that direction. I don’t know that this is a trend change quite yet, but it is the beginning of one. I think all it would take is some type of bad headline to send this market back down though, and therefore I am a bit skittish when it comes to putting on a lot of risk. In fact, if you do find yourself going long for whatever reason, you need to be small in your position. This is because the if it does rally, you will have plenty of time to buy on pullbacks.

Breaking below the 1.2250 level for me at least will confirm that the market is ready to go lower, and then I would probably become a little bit more aggressively short. With Friday being the jobs figure, you can expect a lot of noise due to the US dollar, so you may even be better off waiting until you get a daily close to put money to work.