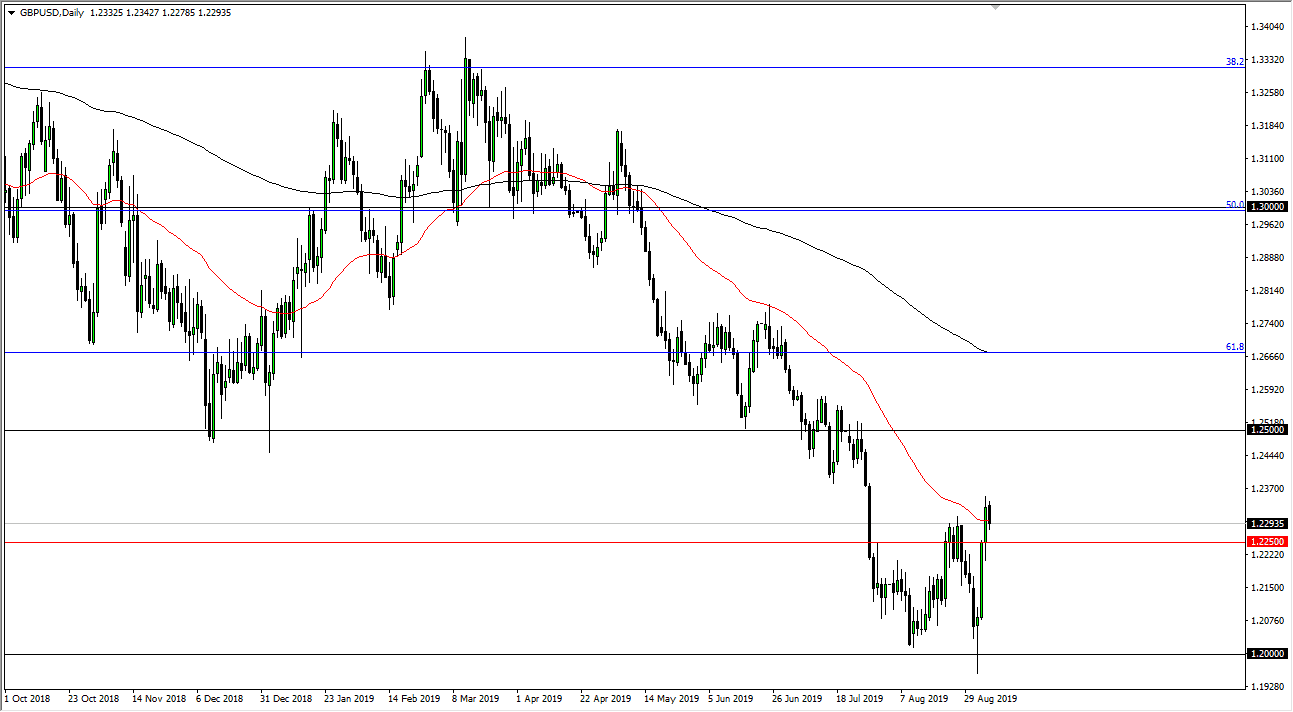

The British pound has pulled back a bit during the trading session on Friday, sitting on the 50 day EMA. We had recently broken out, so it does make sense that we could continue to go higher but at the end of the day we are a bit parabolic over the last week or so, so it makes sense that the British pound needs to calm down. Now that we have essentially seen the Parliament suggest that there is in theory no chance of a “no deal Brexit”, this should be good for the British pound at first blush. The reality is that the European Union has not been offering favorable terms, so therefore it will probably hurt the British economy.

I believe it’s only a matter of time before exhaustion will enter this market again, and therefore I’m more than willing to sell an exhaustive looking candle stick. The 1.25 level above is massive resistance from a structural standpoint not to mention the fact that it’s massive resistance from a psychological standpoint. The alternate selling scenario could be breaking below the 1.2250 level, wiping out the Friday and Thursday candle stick. That would be a resumption of the negativity and could send the market back down to the 1.20 level underneath.

That level has been massive support, but if we can break down through there we could then continue to go towards the 1.15 handle. We are well below the 61.8% Fibonacci retracement level and that generally means we go down to the 100% Fibonacci retracement level. We need to have one more major “flush lower” to get some capitulation with the British pound before we get a longer-term turnaround. That being said, pay attention to rallies that show signs of exhaustion that you can sell, because not only do we have a lot of noise with the Brexit, but we also have the US Treasury markets attracting a lot of inflows as well, and that drives up the value of the US dollar in general. We may have gotten a bit ahead of ourselves when it comes the US dollar strength, but it’s only a matter time before reasserts its dominance, especially when it comes to the British pound. Fading rallies continues to work, but you may need to be patient in order to take advantage of it.