The British pound has rallied quite significantly during the trading session on Wednesday as the situation in London becomes even more erratic and unpredictable. This leads people to cover short positions as perhaps there is some type of hope for an extension to the Brexit or perhaps a complete reversal of the Brexit altogether. The biggest problem with this argument of course is that over half of the British population voted to leave. If that gets turned around, the political fallout in Great Britain is going to be enormous. This could lead to a short-term pop in the currency but quite frankly the flush lower would be brutal.

Politicians know this, and therefore I don’t think that they are going to completely reverse the entire situation. That being said though, it has been three years which is quite ridiculous. With that in mind any time there is the slightest hope of Great Britain remaining in the EUR, the British pound rallies. However, we also see that it gets squashed yet again at the first signs of trouble. There will be trouble, the question now is whether or not it happens between now and the 50 day EMA?

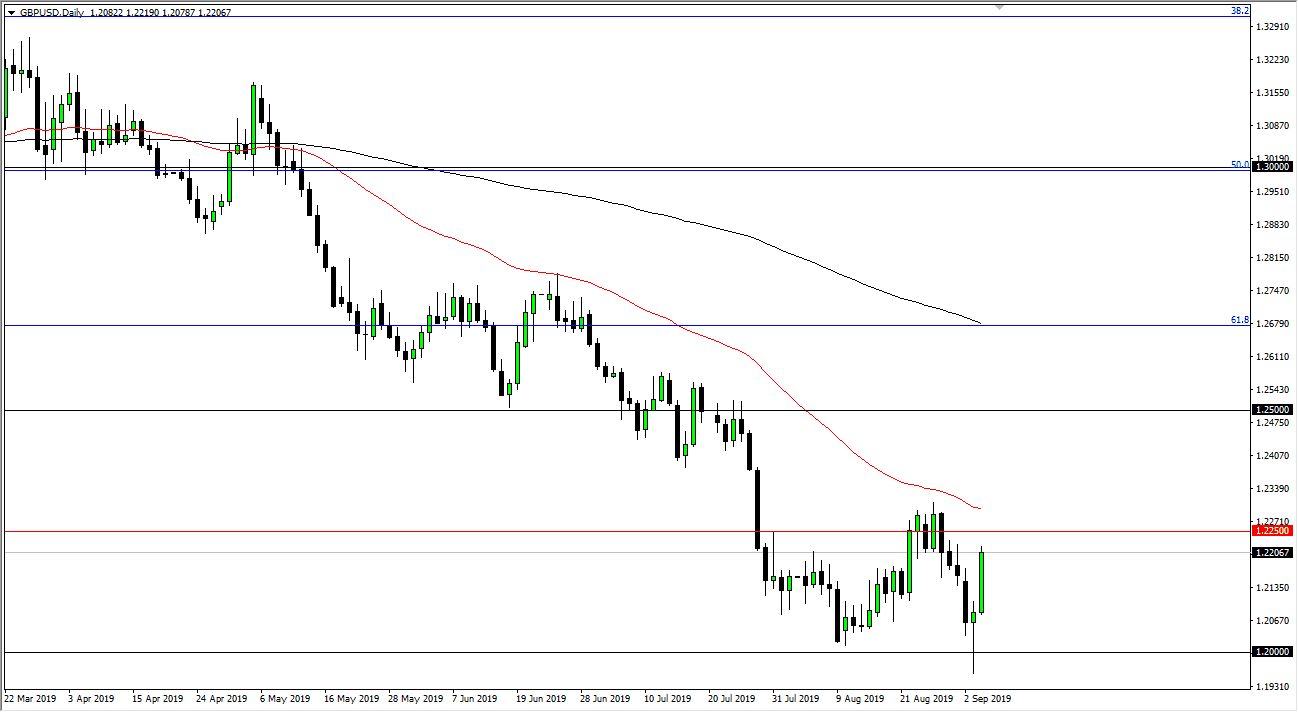

I believe that there is a significant amount of resistance above, and that it’s going to be very difficult for this pair to continue to go higher. I fully anticipate seeing this market reach down towards the bottom again, as not only do we have the 1.2250 level offering significant resistance but we also have the 50 day EMA coming into the picture at the same time. In other words, there is a lot of technical resistance above that will continue to work against the advancement of the British pound.

The US dollar has gotten a bit hammered during the trading session so that could have something to do with it and quite frankly the correlations of most markets I follow are all over the place. We have bonds rising, stocks rising, the British pound rising, oil rising, and everything else is being bid at the moment. Something has to give, and I suspect the British pound will be one of those things. With this I am more than willing to sell the British pound near the 1.2250 level on the first signs of exhaustion as it would be a simple continuation of what we have seen for so long.