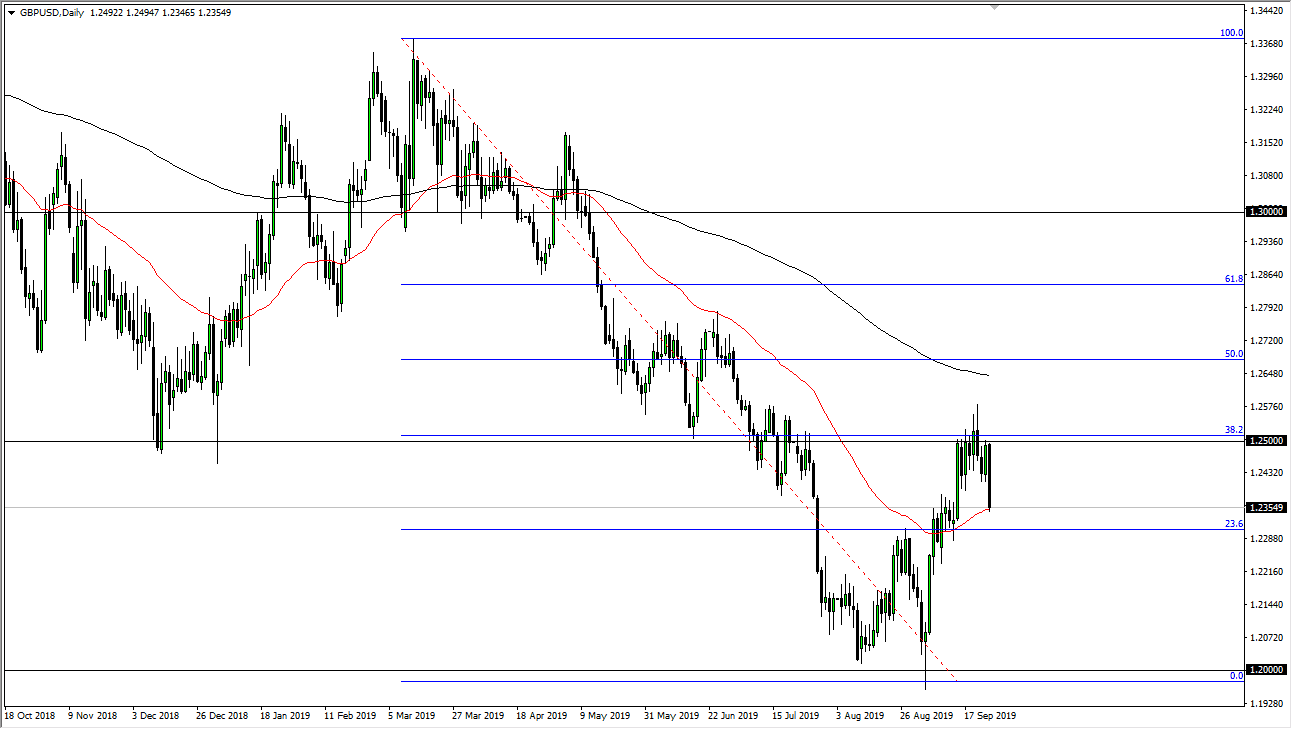

The British pound is likely to look for support underneath, as it has reached towards the 50 day EMA during the Wednesday session. At this point, the market is currently hovering around the 1.2350 level, and the previously mentioned 50 day EMA. At this point, if we were to break down below there it could send the British pound much lower, but at this point it’s likely that we try to find some type of support in this general vicinity, perhaps extending down to the 1.23 level.

The candlestick is very negative, so it would be a selling signal if we were to break down below the bottom of it. If we rally at this point, the 1.25 level above is massive resistance as it is a large, round, psychologically significant figure, and of course an area where we have seen sellers jump in. The 38.2% Fibonacci retracement level is there as well, and it’s also the scene of previous support, which is now likely to be resistance and it has been shown to do so. Beyond that, the 200 day EMA is above the recent highs, so I think at this point it makes sense that we continue to drift lower as we have been in a downtrend for some time.

This doesn’t mean that we break down immediately, but it’s obvious that the Brexit is going to continue to drive where the British pound goes, and even if the UK Parliament gets back to work, it doesn’t necessarily set only thing as there is still a lot of uncertainty and that of course is bad for any currency when there is a lot of uncertainty surrounding it. Beyond that, the US dollar has been getting bid due to the fact that there is a US dollars shortage, and of course there has been a bit of a flight to safety which the greenback represents. This is a continuation of the longer-term trend, so given enough time we may eventually go down to the 1.20 level yet again, but it isn’t necessarily going to be easy to get there. This is a market that continues to see a lot of volatility but I still think it favors the downside overall as we have been selling off for quite some time in this marketplace, going back since the beginning of this entire mess.