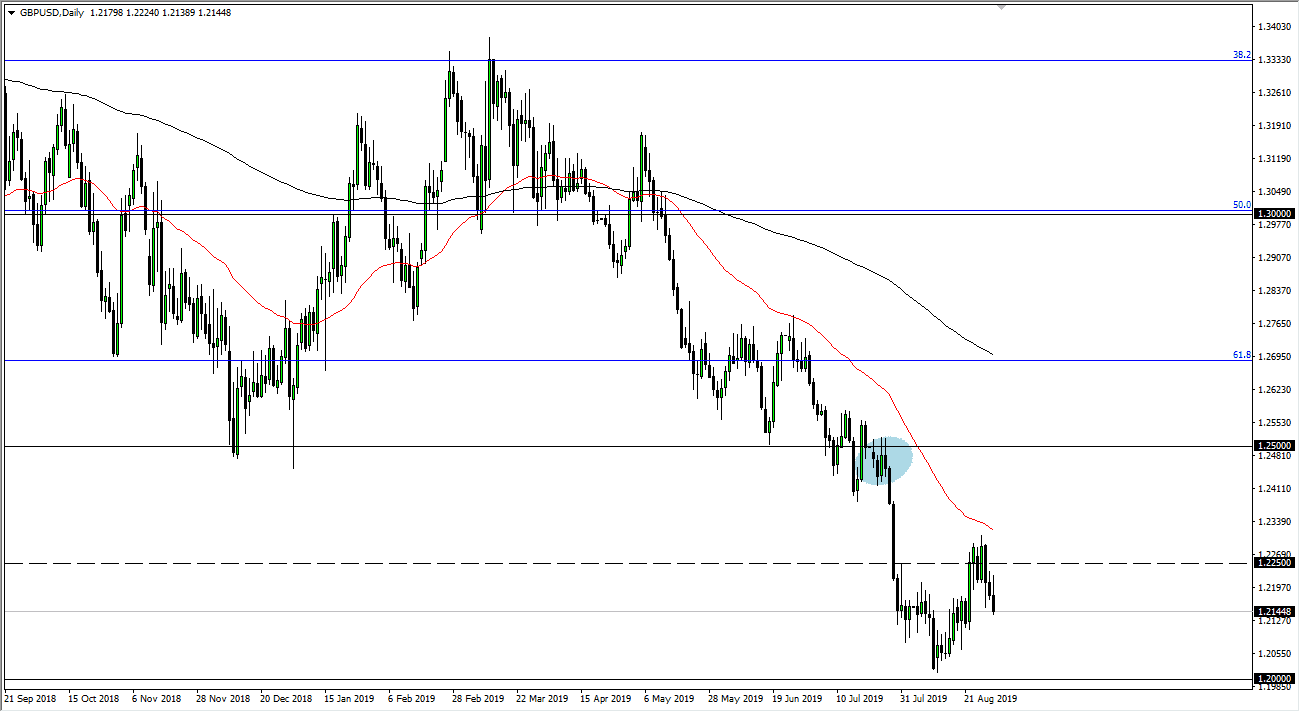

The British pound initially tried to rally during the trading session on Friday, but then broke down significantly to reach below the 1.22 handle yet again. At this point, this is a market that is in a negative trend, so it makes sense that the market will continue to drift lower. At this point, I anticipate that the market goes down to the 1.20 GBP level underneath as it is a massive round number and has caused a major bounce of significance. With that, I think it’s only a matter time before we find a reason to try to break down through there.

Obviously, the Brexit continues to be a major issue as there is still a lot of uncertainty around that, and I do think that the market will eventually find some type of panic moved to break down through there. At that point, the market goes down to the 1.15 handle, which is roughly where the 100% Fibonacci retracement level is. You should also keep in mind that the 50 day EMA above the cluster is likely to continue to cause resistance, and at this point fading rallies that show signs of weakness continues to work.

Keep in mind that the US Treasury market continues to attract a lot of attention as well, so as long as that is strong it’s likely that the pair continues to drop. Ultimately, I think it’s going to be choppy and noisy but it’s only a matter time before reach down to the 1.20 level and I think that is the next move based upon what we have seen on Wednesday, Thursday, and now of course Friday. I don’t see any reason to buy this market and wouldn’t even consider buying this market until we break above the blue circle that I have on the chart near the 1.25 GBP level. If we were to break above there it would be a major turn of events, but I can’t imagine that happening without some type of good news involving the Brexit or some catastrophic new news coming out of the United States. Even then, I suspect that you are better off buying other currencies against the US dollar than the British pound as it continues to see a lot of problems. I continue to fade short-term rallies and recognize that it is going to be very noisy on the way down.