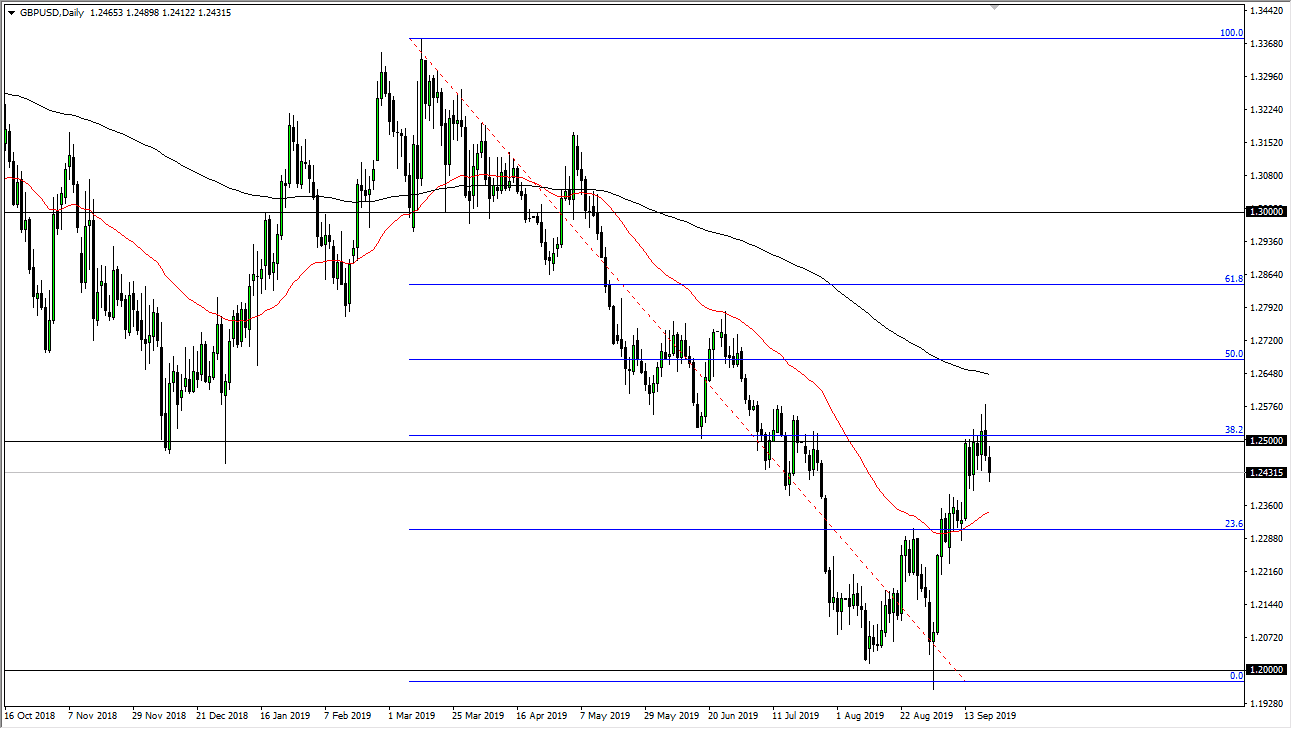

The British pound continues to be very volatile, which makes quite a bit of sense considering that the Brexit is still a complete mess. Beyond that, the market had gotten a bit ahead of itself, as it had been parabolic for a couple of weeks. The 1.25 GBP level has offered a significant psychological barrier, and also is backed up by the 38.2% Fibonacci retracement level. Furthermore, that’s an area that was previous support so it should now be significant resistance.

Above all of that, the 200 day EMA is sitting just below the 50 day Fibonacci retracement level, which of course also will attract a lot of attention. We have been in a downtrend for quite some time, so even though this bounce has been somewhat impressive, it’s likely that we will eventually break down as the market had gotten too extended. Beyond that, we also have the US dollar on the other side of the equation, which is one of the favored currencies for traders around the world.

The US Treasury market has been very bullish for some time, so that of course attract a lot of monetary flow. In order to buy bonds, you need to own US dollars. There are also serious concerns with available US dollars globally, so therefore the greenback has been bid higher against most currencies. Add to that the idea of a messy and chaotic situation for Brexit at the same time, you have a bit of a “perfect storm” going forward.

Underneath, we have the 50 day EMA which is painted in red, sitting near the 1.2350 level, and of course the 1.23 level has previously been resistance. If we were to break down below there, then the market could go down to the 1.20 level after that. That was an area that has been supportive and formed a bit of a “double bottom.” However, the market is most decidedly negative longer term and it’s likely that they will in fact try to reach towards that 1.20 level and break it down even further. It’s not until we get some type of certainty with the Brexit that the British pound will be able to take off to the upside for the longer-term, so we have a while to go before that happens and therefore the last couple of weeks may have ended up being a perfect opportunity to start selling again.