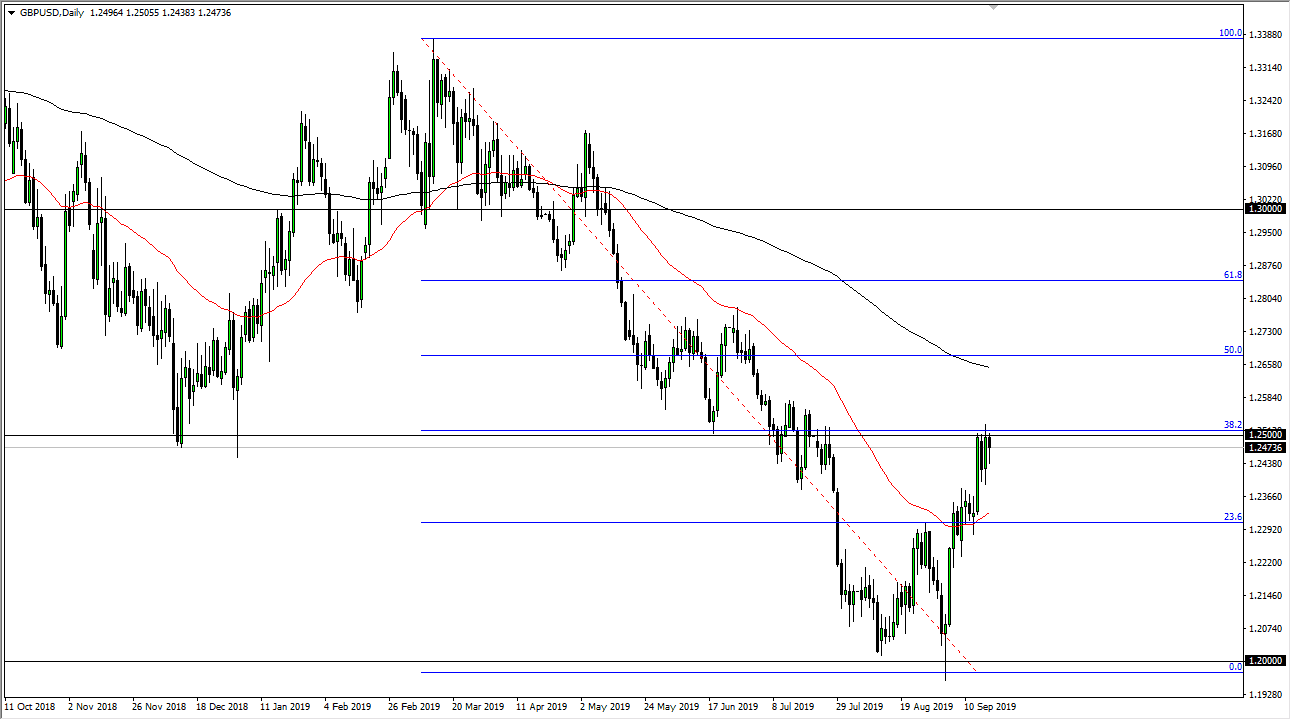

The US dollar has been strengthening during the trading session on Wednesday, as we have seen a fight to the US dollar after the Federal Reserve was not quite as dovish as a lot of people had expected. If that’s going to be the case, then the overbought British pound probably needs to fall a bit. Beyond that, the 1.25 level offers a significant amount of resistance, as it is not only a large, round, psychologically significant figure, but it is also the 38.2% Fibonacci retracement level. With that being the case, the fact that we have seen the lot of noise at this level in the past, it’s likely that we could continue to see a lot of choppiness.

If we were to break down below the Monday and Tuesday candlesticks, then it’s very likely that more bearish pressure will enter this market. If that’s the case, then it’s only a matter time before we will break down based upon the fact that the British pound has a lot of negativity behind it, as the Brexit is still a complete mess. It is only a matter time before British politicians give us a reason to short the pound, so this short covering rally probably causes an opportunity to sell from higher levels again.

Beyond the 1.25 level offering resistance, there is also a lot of noise that extends all the way to the 1.26 handle. I do believe that the 200 day EMA above also offers resistance which is at the top of all the noise as well. I think it’s only a matter time before we find an exhaustive candle that we consider shorting or break down below those of the candles, and then we could go down to the 1.2250 level. At this point, we would then dropped towards the 1.20 level given enough time as well. Keep in mind that it’s only going to take a headline or two out of the United Kingdom to send this market racing to the downside. Beyond that, as the US dollar strengthens due to the Federal Reserve, it’s very likely we will see a pretty big move given enough time. All things being equal, it’s not until we break above the 200 day EMA on a daily close that one can think about a major move to the upside, which of course would be rather impressive at this point.