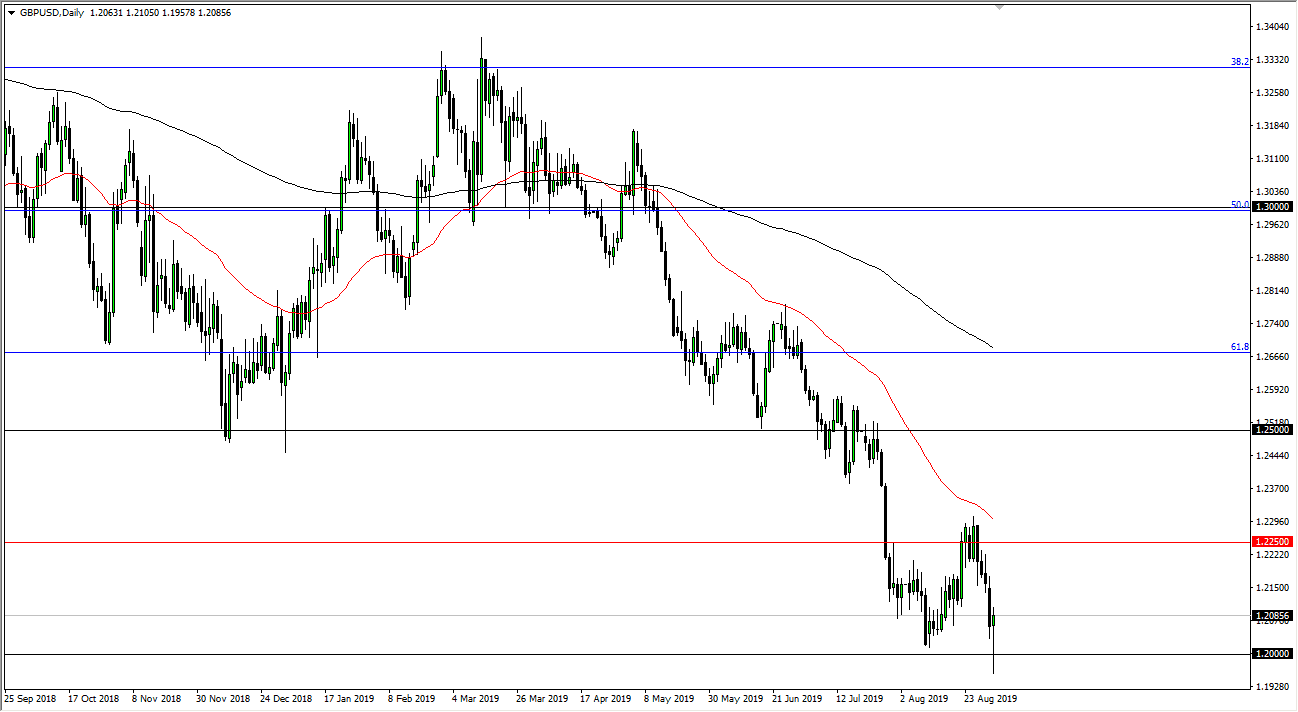

The British pound has rallied quite nicely during the trading session after initially dipping below the crucial 1.20 GBP level. By doing so, it suggests that we are going to break down even further, but I believe that most of this was due to the Standing Order number 24 submitted through Parliament in the United Kingdom suggests that perhaps the UK parliament will force the government to find some type of deal with the European Union. At this point in time it’s likely that this continues to be more noise and confusion, so ultimately this will be another selling opportunity.

Looking to the upside, the 50 day EMA is currently sitting around the 1.2250 level, which of course is an area that has caused resistance in the past. If that’s going to be the case then I think it’s only a matter of time before the sellers get involved on any pop higher. I think there will be a pop higher, but it’s going to be temporary relief more than anything else. After all, any good news involving the Brexit will simply be washed away rather quickly. It has already been noted that if the resolution passes and Boris Johnson is forced to make some type of deal, he may very well call a snap election which of course is going to cause even more uncertainty. In other words, this market continues to go lower under about 99% of the possible scenarios.

Don’t get me wrong, I plan on making a career out of buying the British pound but not quite yet. We have some time to go and we need some type of major capitulation flush lower to offer those cheap British pounds. However, I do think that time comes and I will be more than willing to jump all over it after the Brexit is finally complete and we stabilize. Between now and then, it’s a matter of shorting rallies that show signs of exhaustion, as this market has certainly seen quite a bit of noise attached to it. I still believe that we are going to go down to the 1.18 level, possibly even the 1.15 level given enough time. Rallies are to be faded, and it looks like we may get one in the next couple of days. Buying isn't even a thought at this point as the British pound continues to have too much uncertainty around it.