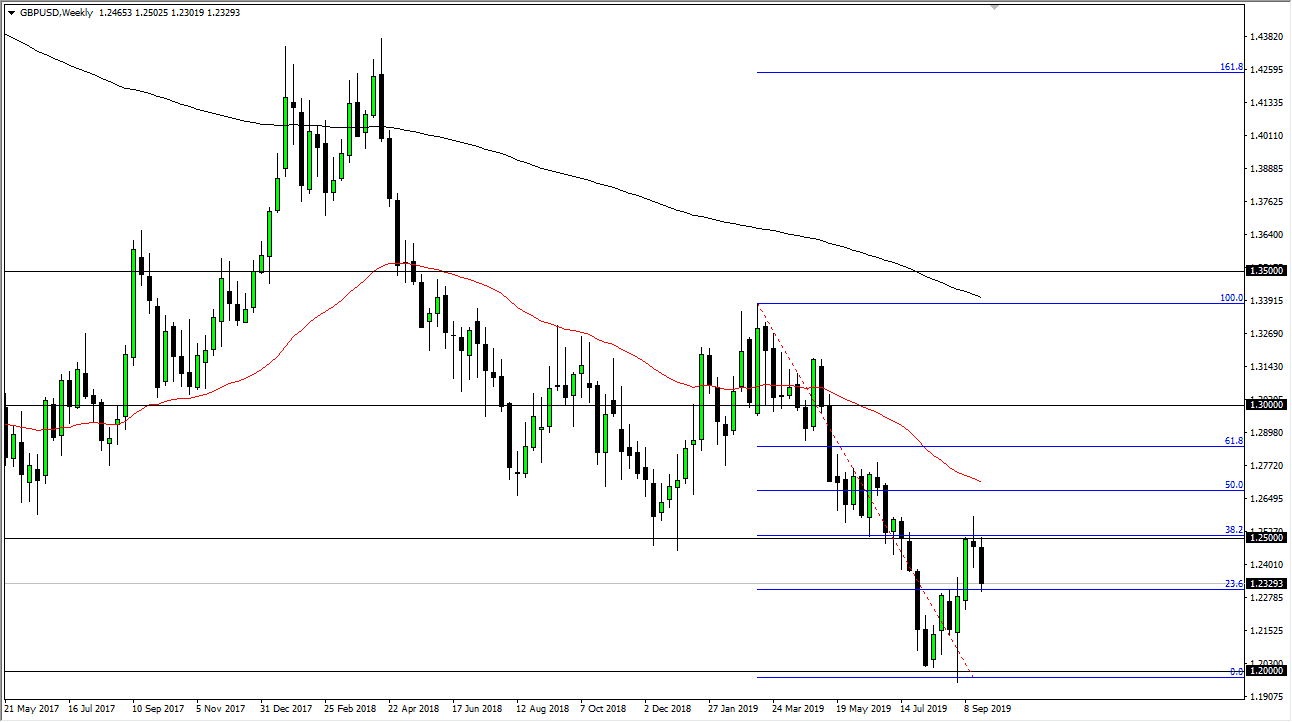

The British pound of course has been all over the place of the last couple of years, grinding back and forth but with more of a downward tilt. Early in the month of August, the market had rallied a bit but as you can see on the weekly chart, we have found quite a bit of trouble at the 1.25 handle. By showing exhaustion in that area, the market looks as if it is ready to roll over and continue to go to the 1.20 level underneath. After all, that was where the market had reached towards previously, and had a major bounce.

That being said, the major bounce was only a 38.2% Fibonacci retracement level pull back, so the fact that the market has shown such negativity from that level suggests that the downtrend is still accelerating, or at least relatively strong. To bounce from the 1.20 GBP level isn’t a huge surprise quite frankly, because it is such a large, round, psychologically significant figure and of course would have attracted a lot of attention.

With that being said, if we were to break down below the 1.20 GBP handle that could open up the floodgates to lower pricing. What will be particularly interesting in the month of October is that supposedly there is a deadline at the end of the month that the United Kingdom leaves the European Union by. The question is whether or not we actually will, but at this point I think it’s becoming obvious that whatever happens isn’t going to be good. By breaking through the bottom of the neutral candle stick from the second to last week of September, it does suggest that momentum is starting to pick up to the downside yet again.

Looking at the month of October, is very likely that short-term rallies should show signs of exhaustion that you can take advantage of. Keep in mind that this pair will be moved by headlines more than anything else, so you will get sudden volatile moves in both directions. That being said though, it’s been the case for some time, that every time the market tries to climb, sooner or later somebody says something to push the British pound lower again. Beyond that, we also have the US dollar out there picking up a bit of a bid due to a “safety bid” in general. With that, I continue to fade rallies in the month of October.