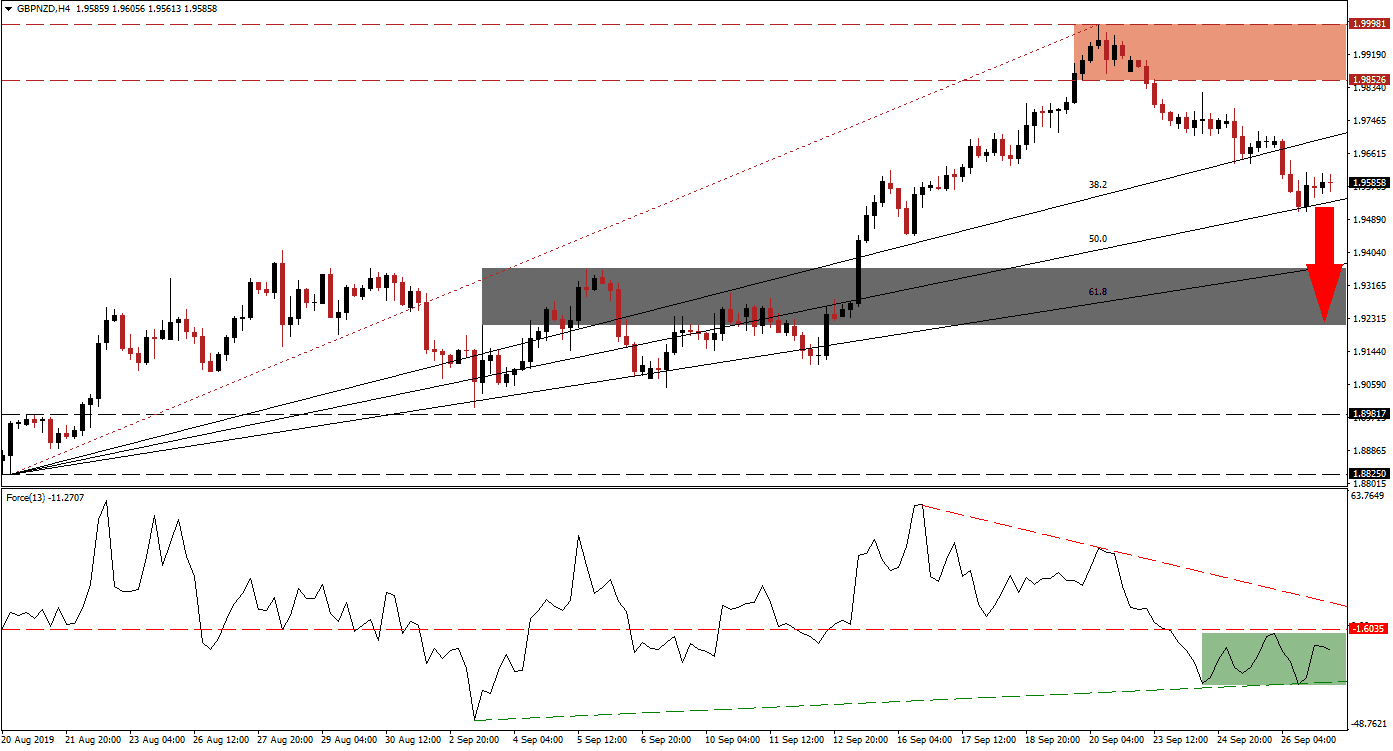

The British Pound is likely to face more downside pressure as Brexit uncertainty and political turmoil will cause more profit taking. After the GBP/NZD descended below its resistance zone which is located between 1.98526 and 1.99981 as marked by the red rectangle, bearish momentum accelerated which pushed price action below its 38.2 Fibonacci Retracement Fan Support Level; this turned it into resistance. The sell-off took a breather as this currency pair moved into its 50.0 Fibonacci Retracement Fan Support Level, but a resumption of the downtrend should be expected.

The Force Index, a next generation technical indicator, formed a negative divergence as price action recorded its intra-day high of 1.99981 while the Force Index contracted. This marked a bearish trading signal which was followed by the breakdown in the GBP/NZD below its resistance zone. The descending resistance level which formed as a result of the negative divergence guided this technical indicator below its horizontal support level and turned it into support. As the sell-off paused at the 50.0 Fibonacci Retracement Fan Support Level, the Force Index started to drift sideways; but it remains above its ascending support level as marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

With bearish momentum in the driver seat, a breakdown below the 50.0 Fibonacci Retracement Fan Support Level is expected to follow. This will turn it into resistance and should provide enough selling pressure to take the GBP/NZD down into its 61.8 Fibonacci Retracement Fan Support Level, located just above its short-term support zone. The intra-day low of 1.95112 should be monitored which marks the low recorded before the current bounce off of support. A move below this level is likely to attract new net sell orders in this currency pair.

As long as the Force Index remains in negative territory and below its descending resistance level, the GBP/NZD can extend its correction. The next short-term support zone is located between 1.92122 and 1.93592 which is marked by the grey rectangle. The fundamental picture also favors more downside in this currency pair with Brexit roughly four weeks away and no deal in sight. The New Zealand Dollar caught a bid as US-China trade talks are approaching and the Reserve Bank of New Zealand held firm on interest rates. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.95850

Take Profit @ 1.92900

Stop Loss @ 1.96500

Downside Potential: 295 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 4.54

In the event that the ascending support level will pressure the Force Index into a reversal above its horizontal resistance level, price action can reverse to the upside. While the current technical picture leaves room for the GBP/NZD to bounce into its ascending 38.2 Fibonacci Retracement Fan Resistance Level before resuming its downtrend, a sustained move above the 1.97313 level could lead to a retracement back into its resistance zone.

GBP/NZD Technical Trading Set-Up - Reversal Scenario

Long Entry @ 1.97450

Take Profit @ 1.99000

Stop Loss @ 1.97000

Upside Potential: 155 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.44