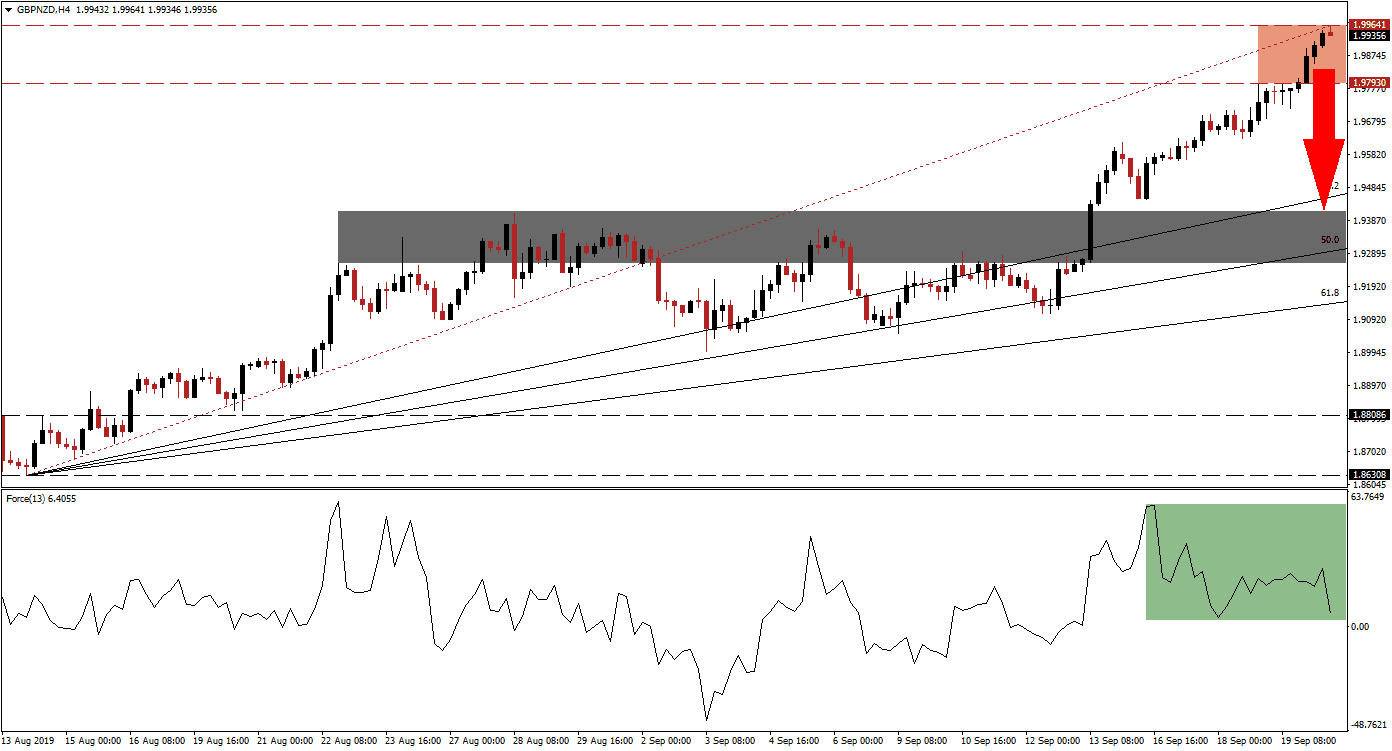

Upside in the GBP/NZD has been exhausted as bulls have pushed this currency pair close to the 2.00000 level. Bullish sentiment turned after UK Parliament took a no deal Brexit scenario off the table for the time being, but uncertainty remains. The magnitude of the current rally is unsustainable and a breakdown is brewing. While price action may attempt an intra-day push above the 2.00000 level, a reversal is expected to follow and close the gap to the 38.2 Fibonacci Retracement Fan Support Level. Further upside would require a fundamental catalysts which is currently absent.

The Force Index, a next generation technical indicator, is flashing a sell signal with the formation of a negative divergence; as the GBP/NZD recorded higher highs the Force Index started to contract which is marked by the green rectangle. Momentum in this technical indicator suggests more downside from current levels which will take it below the 0 center line and place bears in control o price action. Such a move is expected to precede a breakdown in price action below its resistance zone. Due to the strength of the rally, any reversal should also be expected to carry strength which may take this currency pair back into its next short-term support zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

While the current push higher came on the back of positive comments out of the EU in regards to a Brexit deal, without more details a short-term breakdown should be expected. The wide gap between price action and the 38.2 Fibonacci Retracement Fan Support Level further points towards a pause in the rally and the Force Index confirms that a breakdown below its resistance zone is pending. The resistance zone is located between 1.97930 and 1.9961, marked by the red rectangle, but the top range could extend to a previous intra-day high of 2.00161 from where a big sell-off materialized.

Closing the gap to the 38.2 Fibonacci Retracement Fan Support Level will keep the longer term uptrend in the GBP/NZD intact. A price action reversal, confirmed by a move lower in the Force Index, could extend into its next short-term support zone. This zone is located between 1.92587 and 1.94082 and marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is moving across this zone right and lends its additional support strength. A breakdown below this zone is unlikely unless commentary in regards to Brexit will point to a deal being possible, but unlikely which may lead to yet another delay. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.99350

Take Profit @ 1.94000

Stop Loss @ 2.00150

Downside Potential: 535 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 6.69

A breakout in the GBP/NZD above its resistance zone carries very limited upside potential without more clarity about Brexit. In addition the technical picture is pointing towards a pending breakdown in price action. The intra-day high of 2.01793 will serve as the next major resistance level and represents the closure of a previous minor price gap from where a sell-off extended further to the downside.

GBP/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 2.00500

Take Profit @ 2.01700

Stop Loss @ 1.99900

Upside Potential: 120 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.00