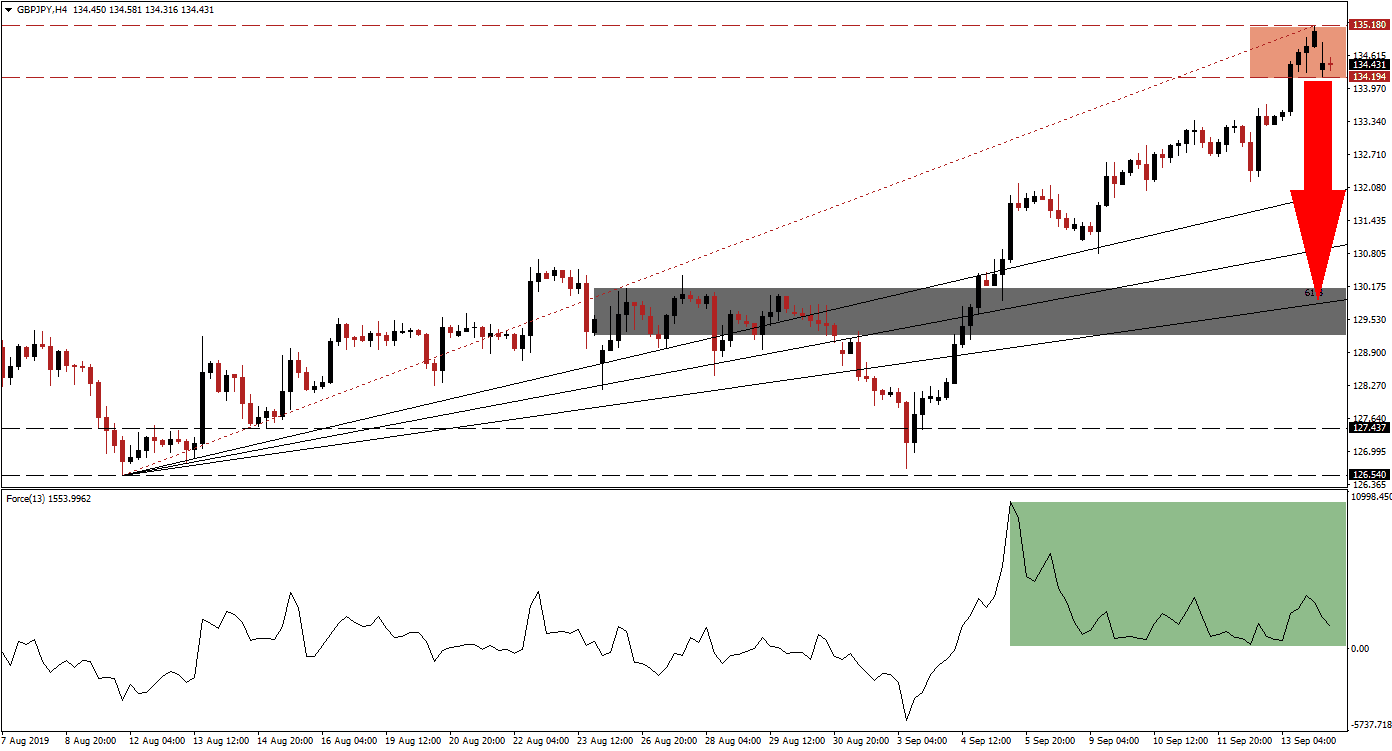

Following a series of Brexit defeats for the Johnson government in the UK, markets started to price out a no deal Brexit which resulted in a sharp rally in the British Pound off of multi-years lows. The overall risk-on sentiment globally following the announcement that trade talks between the US and China will resume in October and the temporary delay of additional tariffs have resulted in an outflow of capital from the safe haven Japanese Yen. This combination has resulted in a sharp rally in the GBP/JPY from its intra-day low of 126.669, located inside of its support zone, and the breakout above its 38.2 Fibonacci Retracement Fan Resistance Level, which is now a support level, added further upside momentum.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, is now flashing a bearish trading signal with the formation of a negative divergence. After the initial breakout above its 38.2 Fibonacci Retracement Fan Resistance Level and the retracement back into its, the Force Index started to contract as the GBP/JPY extended its rally; this is marked by the green rectangle in the chart. While bulls currently remain in control of price action, momentum is fading quickly and move below the 0 center line is expected to confirm a breakdown in price action and signal the end of this rally.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

The GBP/JPY is currently trading inside of its resistance zone which is located between 134.194 and 135.180, marked by the red rectangle. The weekend attacks on Saudi Arabian oil infrastructure have prevented a breakout from a fundamental perspective and the technical picture has turned bearish. Economic data out of Japan has confirmed weakness in the domestic economy and the Bank of Japan is expected to announce further monetary easing. The Force Index should be monitored closely as it is approaching the center line with the GBP/JPY struggling to push through its resistance zone.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

A breakdown in price action confirmed by the Force Index should take the GBP/JPY quickly into its 38.2 Fibonacci Retracement Fan Support Level and close the gap. Given the extend of the preceding rally and the momentum shift to bearish, the sell-off could further extend to the downside as forex traders will realize floating trading profits. The addition of net short positions in this currency pair could take price action into its 38.2 Fibonacci Retracement Fan Support Level which is currently located inside of its support zone between 129.229 and 130.127 and marked by the grey rectangle.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

GBP/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 134.100

Take Profit @ 130.100

Stop Loss @ 135.300

Downside Potential: 400 pips

Upside Risk: 120 pips

Risk/Reward Ratio: 3.33

A potential breakout in the GBP/JPY has limited upside potential from current levels with another resistance level awaiting price action at 136.271. The decrease in bullish momentum which led to the negative divergence in the Force Index is favoring a weaker GBP/JPY and further limits the chances of a sustained breakout. A fundamental catalyst would be required in order to add to the overextension of the current rally through its current resistance zone.

What is a Breakout?

A breakout occurs if price action moves above a support or resistance zone. A breakout above a support zone could signal a short-term move, such as a short-covering rally which occurs when forex traders exit short positions and realize trading profits, or a long-term move such as the start of a trend reversal from bearish to bullish. A breakout above a resistance zone signals strong bullish momentum and an extension of the existing uptrend.

GBP/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 135.350

Take Profit @ 136.250

Stop Loss @ 134.900

Upside Potential: 90 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.00