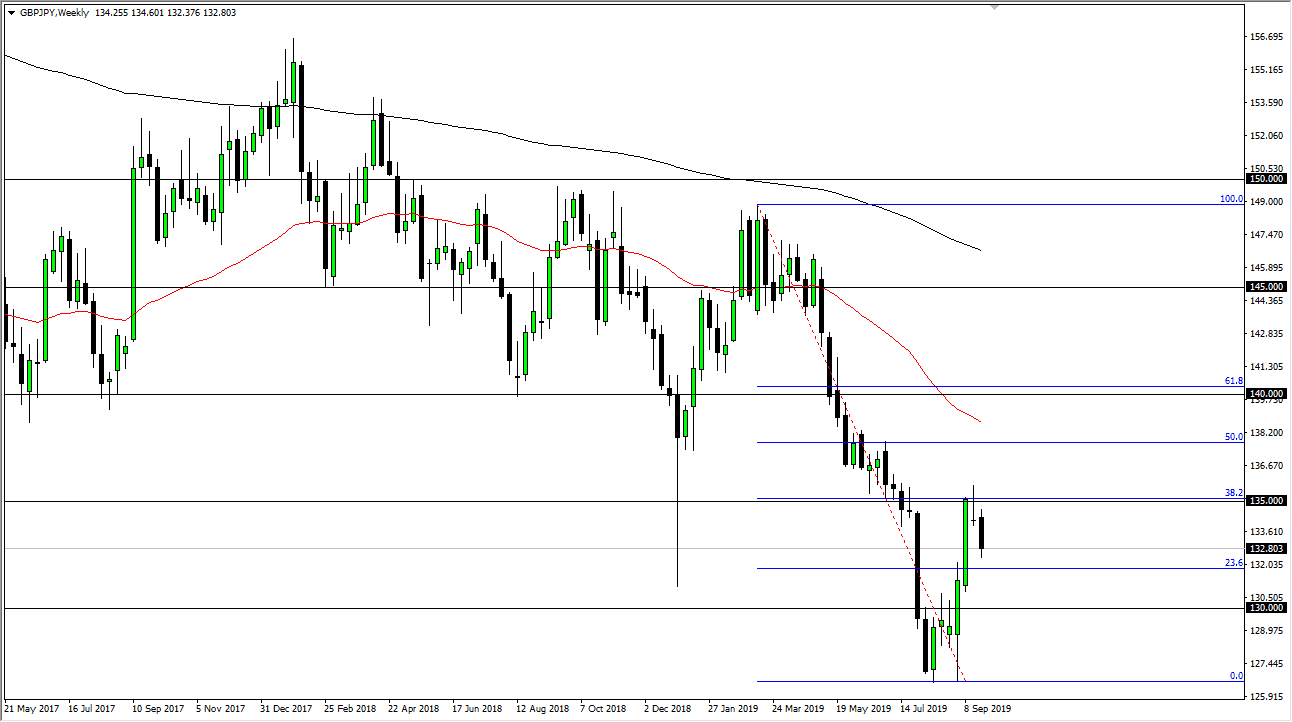

The British pound has been all over the place during the last several months, initially reaching to the ¥135 level before rolling over a bit. In fact, on the weekly chart, you can see that there was a shooting star right at that level after the drone strike in Saudi Arabia. That of course is a major “risk off” event, and it makes quite a bit of sense that there was a gap that kicked off the week, but then the market turned around to fill that gap before rolling over again to form that very bearish candle stick.

The following week, the market broke down below the bottom of the shooting star, and it now looks likely that the GBP/JPY pair will continue to go lower, reaching down towards the ¥130 level during the month. I believe that short-term rallies will continue to be selling opportunities as this is so risk sensitive, and of course we have the problem with the Brexit going on, causing all kinds of confusion and of course headline risk with anything involving the GBP at this point. On the other side of the equation we have the Japanese yen, which of course is a major “safety currency” anyway.

Looking at this chart, the 38.2% Fibonacci retracement level at the ¥135 level makes a lot of sense as resistance as well, and of course there is a lot of noise above there extending to the 50% Fibonacci retracement level. Ultimately, this is a market that looks likely to test the lows again, just like the GBP/USD pair will more than likely do the same as there are far too many dark clouds over the United Kingdom right now.

Beyond that, we also have the US/China trade situation which of course continues to drag on, so there is a certain amount of “risk destruction” as well, so it makes sense that money continues to flow towards the yen. Going towards October, I see no other alternative than to sell this pair every time it rallies on the short-term chart, looking for signs of exhaustion and long wicks to the upside to take advantage of. Quite frankly, it’s not until we break above the 50% Fibonacci retracement level that I even entertain the idea of buying the British pound, even though this initial pop higher was relatively impressive. Having said that, another way to describe that could be “dead cat bounce.”