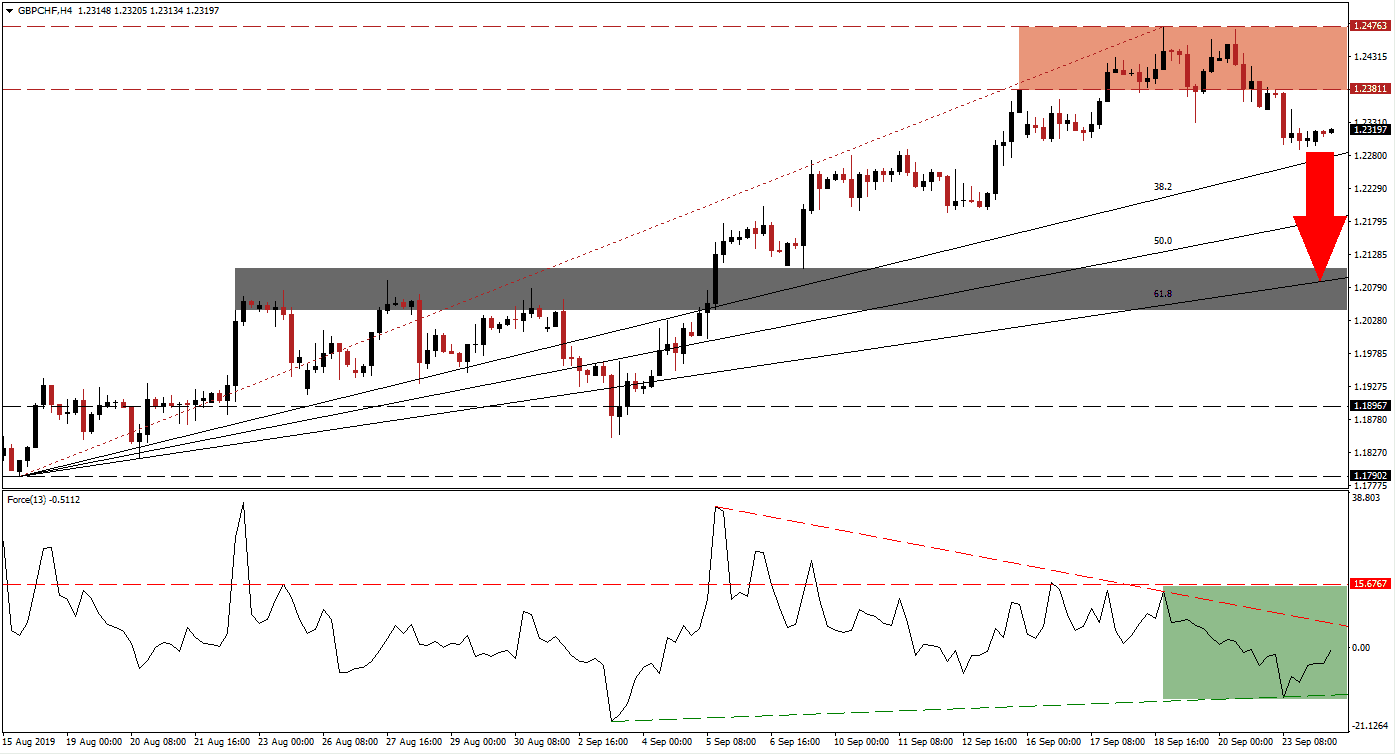

Today at 1030 local time, the UK Supreme Court will hand down its judgement if Prime Minister Boris Johnson’s prorogation of Parliament was lawful or not. A ruling against PM Johnson will recall MP’s and put the future of his government in question. This may have drastic impacts on Brexit which is now roughly five weeks away following a series of extensions. After the GBP/CHF pushed below its resistance zone, selling pressure eased as price action approached its 38.2 Fibonacci Retracement Fan Support Level. A ruling for Johnson is also expected to keep downside pressure on the British Pound as it will keep Parliament prorogued until October 14th 2019.

The Force Index, a next generation technical indicator, has entered a long-term downtrend following a spike over two week’s ago. This spike led to the formation of a long negative divergence which preceded the breakdown in the GBP/CHF. The Force Index suggests more downside ahead as it is trading below its horizontal resistance level as well as below its descending resistance level which is an extension of the negative divergence. This technical indicator started to recover slightly and an unconfirmed ascending support level formed. This is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

During uncertain times, save haven currencies such as the Swiss Franc tend to perform better. This is further adding to breakdown pressures in the GBP/CHF. While the Force Index rose from its lows, it remains well contained inside its bigger downtrend. This is expected to lead to a breakdown below its 38.2 Fibonacci Retracement Fan Support Level, turning it into resistance, and extend a sell-off into its next short-term support zone located between 1.20438 and 1.21083 which is marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is located inside this zone, lending additional support strength.

Volatility is expected to increase as the 1030 Supreme Court decision approached and the Force Index should be monitored closely. The current advance could extend into its descending resistance level as bulls and bears will clash at the 38.2 Fibonacci Retracement Fan Support Level. The intra-day high of 1.22892 should also be watched if price action descends below support; this level represents the high of a previous minor sideways trend. A move below it is expected to result in additional sell orders in the GBP/CHF. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.23150

Take Profit @ 1.20600

Stop Loss @ 1.23850

Downside Potential: 255 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.64

A move above its descending resistance level by the Force Index with price action at its 38.2 Fibonacci Retracement Fan Support Level could result in a price action reversal in the GBP/CHF. Given the negative fundamental picture, any advance is unlikely to push price action above its resistance zone which is located between 1.23811 and 1.24763, marked by the red rectangle. A recall of MPs will not resolve the current Brexit impasse and another delay could push the British Pound into a bigger sell-off amid political uncertainty.

GBP/CHF Technical Trading Set-Up - Reversal Scenario

Long Entry @ 1.23950

Take Profit @ 1.24700

Stop Loss @ 1.23650

Upside Potential: 75 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.50