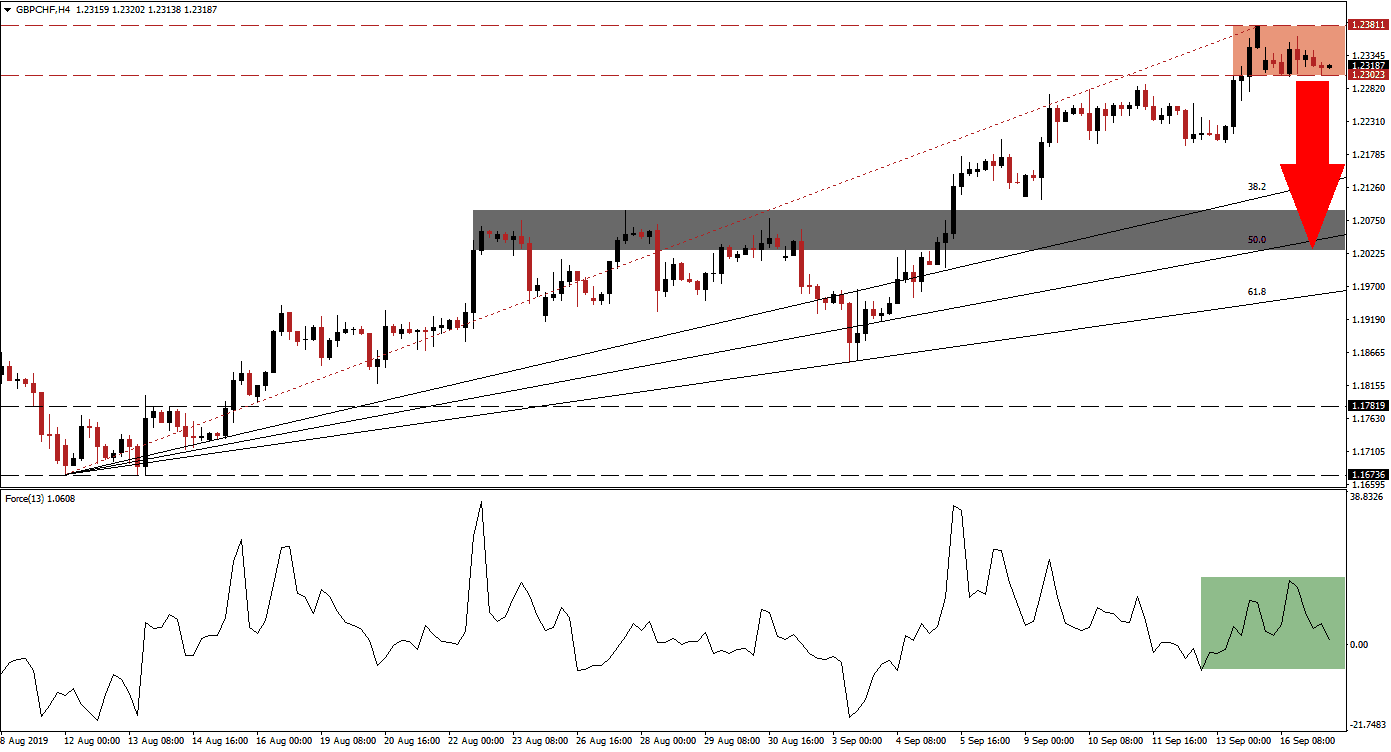

As the likelihood of a no deal Brexit decreased, the British Pound rallied off extremely depressed levels. The risk-on mood additionally resulted in a sell-off in the Swiss Franc, a safe haven currency, which further accelerated the rally in the GBP/CHF. The most recent part of this rally originated from its intra-day low of 1.18506, after touching its 61.8 Fibonacci Retracement Fan Support Level. Bullish momentum is now fading inside of its resistance zone which is marked by the red rectangle. The relative strength of the Swiss economy as compared to its peers should not be ignored, especially in the current central bank environment and global economic slowdown.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, is flashing a bearish trading signal with the emergence of a negative divergence. The most recent peak in this technical indicator, marked by the green rectangle, is well below its previous peak. At the same time, the GBP/CHF rallied to new multi-month highs. With the Force Index now approaching the 0 center line from where a breakdown is expected to put bears in charge of price action, a sell-off in this currency pair is brewing.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

A successful breakdown by the GBP/CHF, confirmed by the Force Index, could lead to a bigger reversal especially if the Force Index manages to record a lower low. Profit taking is likely to power part of the sell-off as forex traders will realize floating trading profits once the uptrend is violated. Following a move below its resistance zone, the next key level to watch out for will be the intra-day low of 1.22642 from where the current push into its resistance zone followed.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

The current resistance zone is located between 1.23023 and 1.23811 and a sustained breakdown should be followed by a sell-off into its 38.2 Fibonacci Retracement Fan Support Level. Should the Force Index record a lower low, an extension of the sell-off in the GBP/CHF into its next support zone which is marked by the grey rectangle is expected. This support zone is located between 1.20280 and 1.20896 and is also temporarily housing the 50.0 Fibonacci Retracement Fan Support Level.

What is a Support Zone?

A support zone is a price range where bearish momentum is receding and bullish momentum is advancing. They can identify areas where price action has a chance to reverse to the upside and a support zone offers a more reliable technical snapshot than a single price point such as an intra-day low.

GBP/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.23150

Take Profit @ 1.20450

Stop Loss @ 1.23850

Downside Potential: 270 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.86

With Brexit developments very dynamic and the October 31st 2019 deadline approaching, the GBP/CHF is vulnerable to unexpected developments which have a grave impact on price action. While bullish momentum is fading, if the Force Index fails to sustain a move below the 0 center line and a positive development in regards to Brexit will be circulated, a breakout could be the result. This may lift price action to the bottom range of its next resistance zone which is located at 1.24966, but a breakout remains unlikely without a fundamental catalyst in current technical conditions.

What is a Breakout?

A breakout occurs if price action moves above a support or resistance zone. A breakout above a support zone could signal a short-term move, such as a short-covering rally which occurs when forex traders exit short positions and realize trading profits, or a long-term move such as the start of a trend reversal from bearish to bullish. A breakout above a resistance zone signals strong bullish momentum and an extension of the existing uptrend.

GBP/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.23950

Take Profit @ 1.24950

Stop Loss @ 1.23450

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00