Ahead of the UK GDP growth figures, the GBP/USD pair is trying to stop the recent losses, which pushed it towards the 1.2270 support level, as the pair stabilizes around 1.2300 at the time of writing. A full month separates us from the historic and most influential event on the Pound's future on October 31, as Britain will exit the European Union. Up to the moment, the exit features are not clear but are closer to a no-deal Brexit, which will be catastrophic for the British economy and the GBP. The British government reinforces its position on the UK's removal from the EU on October 31 regardless of whether there is a deal or not. In return, the opposition is seeking to extend the deadline for Brexit if Boris Johnson does not have an agreement by October 19. The government is threatening to impose emergency law in the country if no formula is agreed with the opposition to get the country out of the bloc by the Oct. 31 deadline. Continued pessimism towards Brexit will continue to have a negative effect on any GBP attempts to rise.

If the government led by Boris Johnson reaches an agreement with the EU, then that will be positive for the GBP, this is more possible given the growing willingness of both sides to return to the table. The latest government proposals to resolve the Irish backstop issue are likely to be published this week and may also affect the GBP. If the proposals seem viable, the pound could rise strongly.

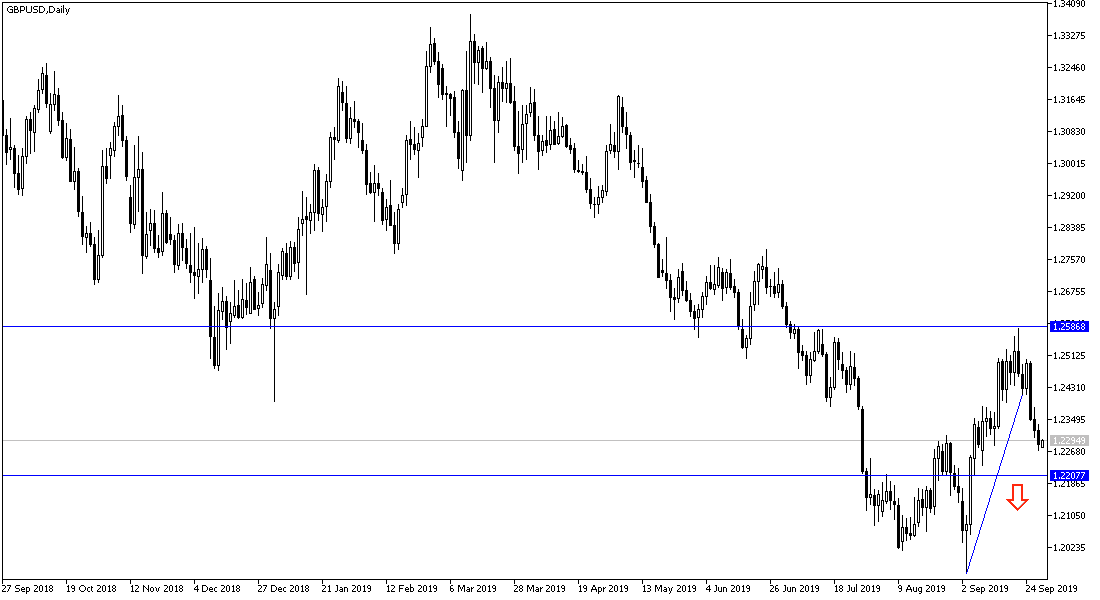

According to the technical analysis: Stabilizing the price of the GBP/ USD below 1.2300 support will increase selling and then push the pair to stronger support levels that may reach 1.2245 and 1.2190 and then 1.2000 psychological support respectively. Growing concerns about Brexit will support continued downward pressure on the pair's performance. In case of an upward correction, it will not strengthen the bounce based on the pair's performance on the daily chart without moving above 1.2500 resistance again.

On the economic data front: Today's economic calendar will focus first on the release of British data on GDP, current account, money supply, mortgage approvals, net lending to individuals and asset investment. And for the US, the PMI from Chicago.