GBP USD likely to try to bounce.

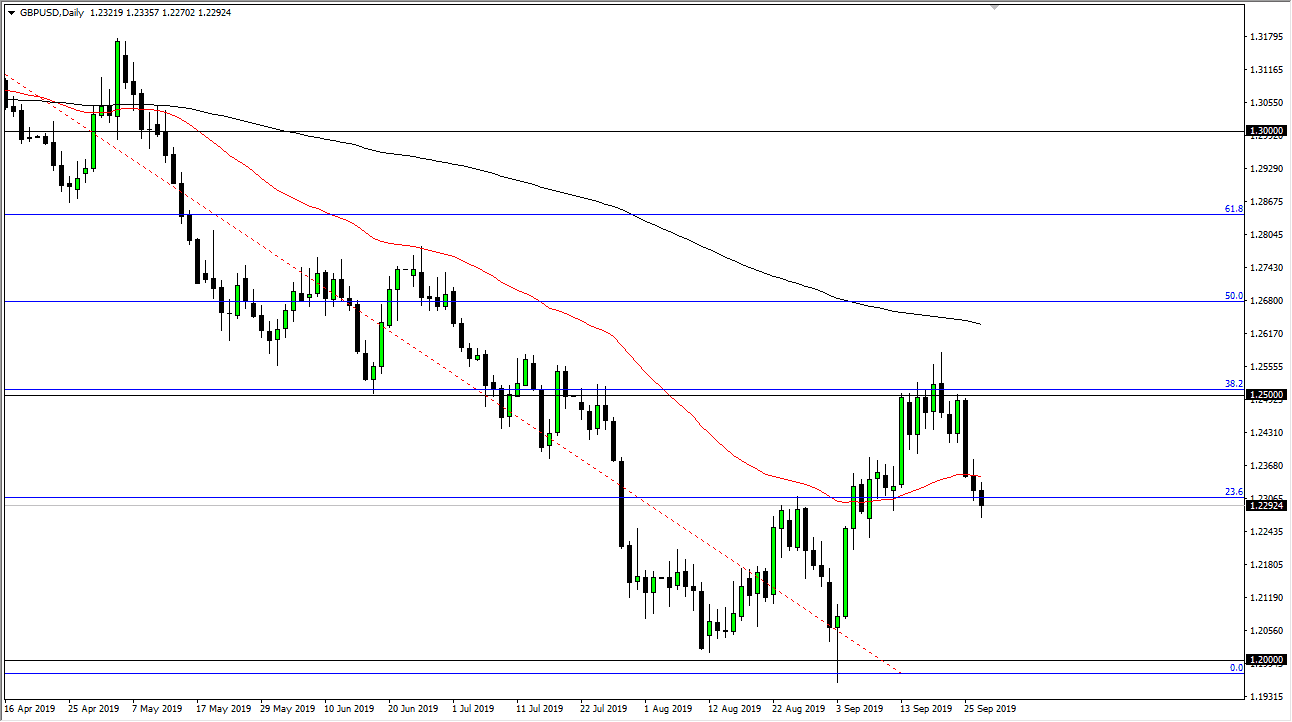

The British pound has pulled back a bit during the trading session on Friday, reaching towards the 1.23 level before stabilizing a bit. At this point, it’s very likely that the market could bounce short term, but I also recognize that longer-term we have been in a very long downtrend. The 1.25 level above is massive resistance and the scene of where the sellers got involved. Beyond that, the 38.2% Fibonacci retracement level sits there, so obviously a lot of people will be paying attention to that level if we do approach it again.

Alternately, if we do break down below the bottom of the trading session for Friday, it’s likely that we would then break down towards the 1.20 level given enough time. Don’t get me wrong, it doesn’t mean that we will get the occasional rally but the British pound continues to be very difficult to hang onto as there are a lot of problems involving the Brexit right now. Beyond that, the US dollar of course is a bit of a safety currency, and safety is something that a lot of people are looking for.

The fact that we have bounced so significantly over the last couple of weeks is a good sign, but the reality is that the bounce has essentially been a “blip on the radar” when it comes to the longer-term trade. There are still a lot of concerns out there when it comes to Brexit, and what happens next. Ultimately, there is still a lot of uncertainty and likely we will continue to see people fade away from owning the British pound until we can get some type of longer-term certainty when it comes down to the leaving of the European Union. There seems to be nothing but noisy reactions occasionally to Brexit and therefore it’s likely that fading rallies continues to work going forward.

That being said, if we can break above the black 200 day EMA we could possibly start to think about a longer-term uptrend. All things being equal, that would probably coincide nicely with Brexit certainty, something that I don’t think we’re going to get in the near term. It’s going to be noisy, but I think short-term rally should be faded for short-term moves more than anything else. Quite frankly, this is a one-way trade but obviously we have gotten a nice pullback that offers plenty of value in the greenback.