Britain's Supreme Court unanimously found that the British government had violated its authority by closing the parliament. The 11 judges found that there was no good reason to advise the Queen to suspend the parliament, and since the government's evidence was weak, British Prime Minister Boris Johnson's decision was illegal. "As a result, the decision is still null and void," said Chief Justice Lady Hill. Accordingly, House Speaker John Birko confirmed that the parliament will be convened from 11:30 am Wednesday. This positive development will provide support to prevent Brexit without a deal, and thus hampered Prime Minister Johnson's ability to get Britain out of the EU at any cost on Oct. 31. This development did not provide strong support for the GBP / USD pair which moved towards 1.2502 just before settling around 1.2460 at the time of writing. Investors seem to want to know the reaction of the British parliament when it returns.

On the U.S. side, President Trump is under pressure from Democrats ahead of the US elections in 2020.Today, the US House of Representatives will hold an emergency session to judge Trump, for claims that he used his power to distort his rivals in that election. Condemnation means that Trump can be removed from office, and that will not be easy. His conviction needs a two-thirds majority in the Senate. As for the Fed's policy this week, it contains several comments from members of the monetary policy and any change in view could shake confidence in the current dollar gains.

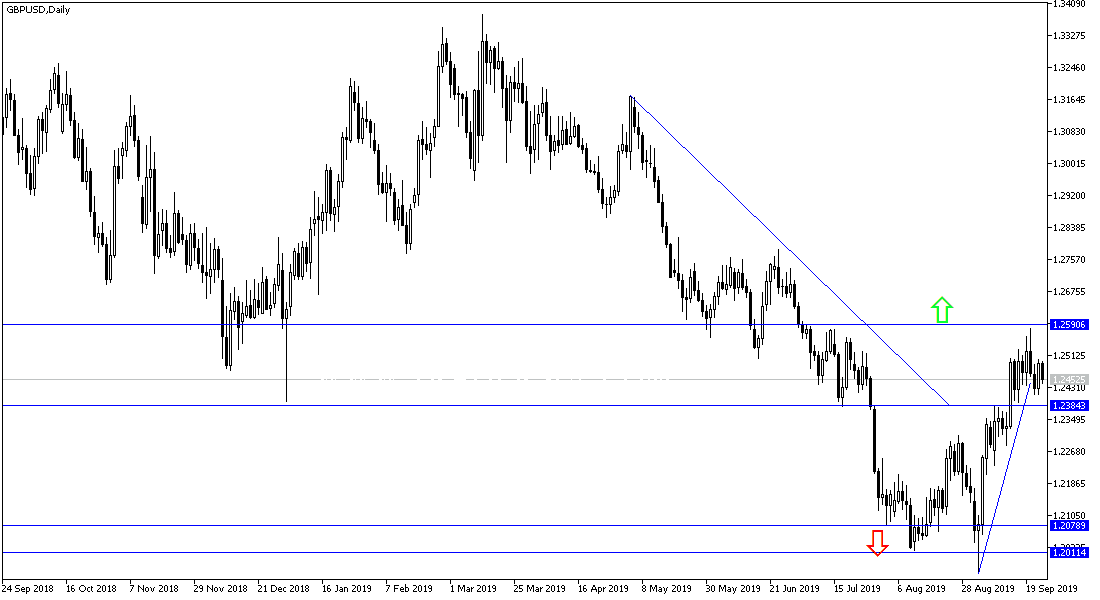

According to the technical analysis of the pair: The stability of GBP / USD around and above the 1.2500 resistance will continue to support the movement within the ascending channel as shown on the daily chart below. If the optimism towards the Brexit continues, the pair may gain additional momentum towards the 1.2590, 1.2665 and 1.2720 resistance levels respectively. On the downside, the closest support levels for the pair are currently 1.2390, 1.2300 and 1.2245 and the last level is the culmination of the bearish trend again, and ending the current optimism. Brexit will remain the most influential factor on the pair's direction in the coming period.

On the economic data front: The economic calendar today includes the announcement of mortgage approvals in Britain. From the US, we will get new home sales and oil inventories as well as remarks by some members of the Federal Reserve's monetary policy.