The EUR/USD rate finally caught the attention of traders by the end of last week's trading once the European Central Bank (ECB) announced massive stimulus plans to revive the Eurozone economy, which is facing a recession due to the continuation of the global trade war. The pair moved up to the 1.1109 resistance level, its highest level in three weeks, before closing the week around 1.1070 resistance. Investors are now wondering, as markets have absorbed the ECB's decisions; will the pair complete the upward correction?

The answer will depend on the Fed's monetary policy decisions this week. If the decision comes as expected with a cut to the US interest rate by a quarter point, we may see a stronger bullish move for the pair. The recent gains could collapse if the bank sticks to its position and does not changed their policy.

The Euro fell to its lowest level in 2019 against the dollar last Thursday and then recovered just as quickly, before ending the day higher. The gains came despite the ECB easing policy in a way that usually weakens the currency by increasing the supply of the Euro, or the “liquidity,” in the market. Some see the strong rebound in the Euro due to the facts that markets were pricing the bank to be more aggressive than it had decided. Although the ECB cut the deposit rate for commercial banks from -0.4% to -0.5% (in order to stimulate lending), it has also introduced an arrangement so that negative rates do not apply to a large proportion of deposits held by these banks in European Central Bank.

The EUR may soon be weakened as the ECB has not given a final date for quantitative easing - a move seen as a sign that it is prepared to further ease the policy.

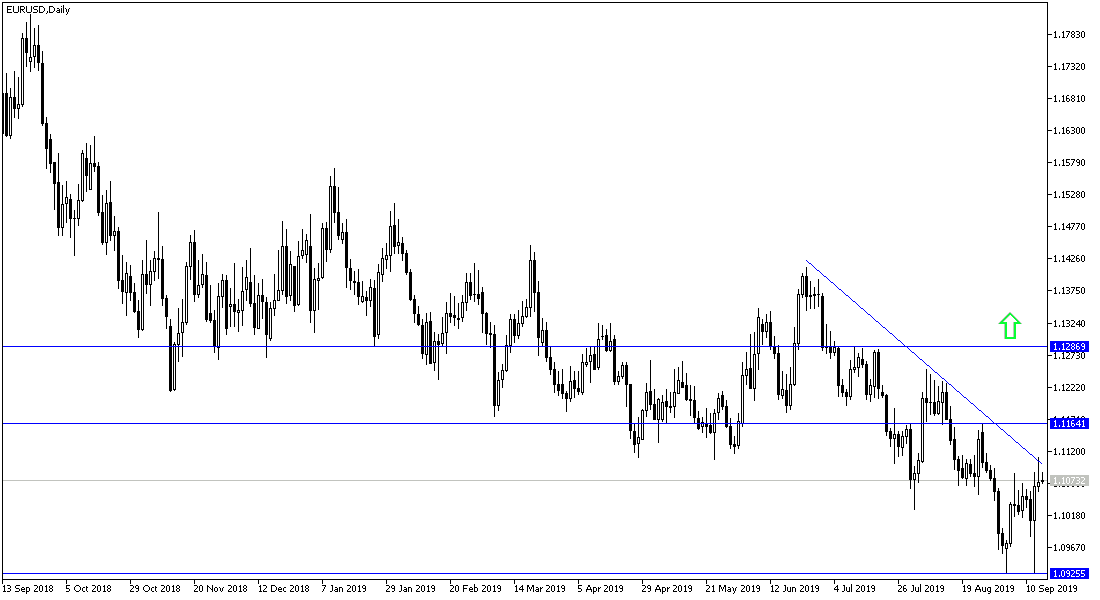

According to the technical analysis of the pair: In the long term, according to the daily chart onwards, the EUR / USD is still inside a violent bearish channel. In the short term, stability above 1.1000 will support the correction higher, especially if it succeeds in testing the resistance levels at 1.1145, 1.1220 and 1.1300 respectively. And should it return to the support levels of 1.1000, 1.0945 and 1.0880 respectively.

On the economic data front, the pair is not expecting any significant data releases today from either the Eurozone or the US.