Since the beginning of this week’s trading, the performance of the EUR / USD pair, as we expected, was in a limited range. The pair is waiting and watching for the ECB's announcement tomorrow after the monetary policy decisions. This is amid expectations that the bank may provide strong stimulus plans to support the slowdown of the Eurozone economy led by Germany, which has suffered the consequences of the prolonged trade dispute between the United States and China. The region's economy relies heavily on manufacturing and exports, which are most affected by the global trade war. The Euro did not react much to the announcement that German exports increased in July by more than expected, as they are still overall weaker.

The lack of any significant economic data for the second day in a row will support the pair's movement in a limited range.

On the US economy front, the US economy succeeded in creating a total of only 130,000 jobs in August, against forecasts of 158,000, and un the latest release, the number was 164,000 new jobs in the non-farm sector. In contrast, there was a rise in the average hourly wage, and the unemployment rate in the country remained unchanged. As for the US Federal Reserve's policy, Jerome Powell stressed on Friday that the Fed ignored Trump's repeated demands for interest rate cuts to make his trade wars successful, and that the Fed was deciding to do what it saw best suited to the country's economic situation, and was fully prepared to act as needed.

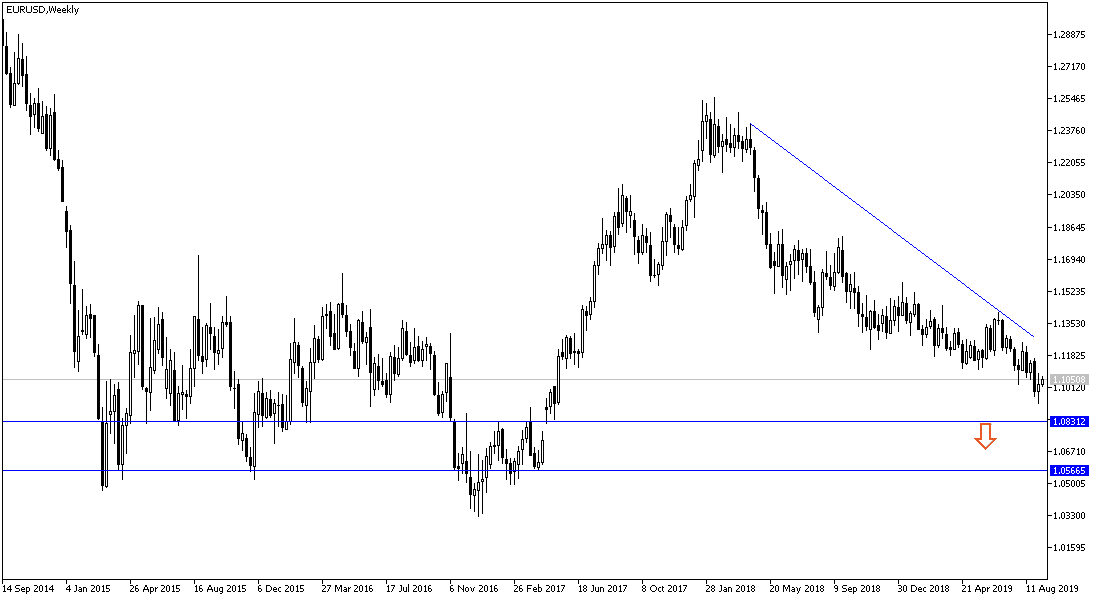

According to the technical analysis of the pair: As we expected, the price of the EUR / USD will continue to hold around the 1.1000 level until the announcement of the European Central Bank decisions next Thursday. Any move below this neutral level will negatively affect the upside correction and support the re-test of 1.0955, 1.0880 and 1.0800 levels, respectively, which support the downside strength again. On the upside, the pair's closest resistance levels are 1.1100, 1.1185 and 1.1265 respectively. Overall, the long-term trend is still bearish and technical indicators have yet to strengthen the bullish outlook.

On the economic data front today: The economic calendar contains data with poor effect on the performance of the pair, which are the announcement of change in French employment, along with industrial production. From the United States of America, the JOLTS employment opportunities numbers.