As we have mentioned since the beginning of this week’s trading, the EUR/USD will remain in a tight range awaiting the announcement of the Federal Reserve's monetary policy decisions and the comments of its Governor Jerome Powell. The pair is moving between the 1.0990 support level and the 1.1075 resistance with full focus of what will be announced. The Federal Reserve is preparing to cut interest rates for the second time in a row this week, in a bid to protect the economy from the global economic slowdown consequences, amid a fierce trade war between the United States and China. If the bank cut interest rates today, the markets will increase expectations that it will do that again before the end of this year.

Since the last Fed meeting ended on July 31, financial markets have been in turmoil. On that day, they announced the first US rate cut in more than a decade - since the financial crisis erupted in 2008. In an explanation of what they did, the US central bank cited the weakness of the global economy due to Trump-led trade wars and chronic low inflation. They made the cut as a proactive step to maintain the country's economic growth.

The European Central Bank (ECB) took the lead in announcing massive stimulus plans, albeit below market expectations, to save the Eurozone economy from deflation. They cut interest rates and reinstated the bond purchase plans that they terminated at the end of last year.

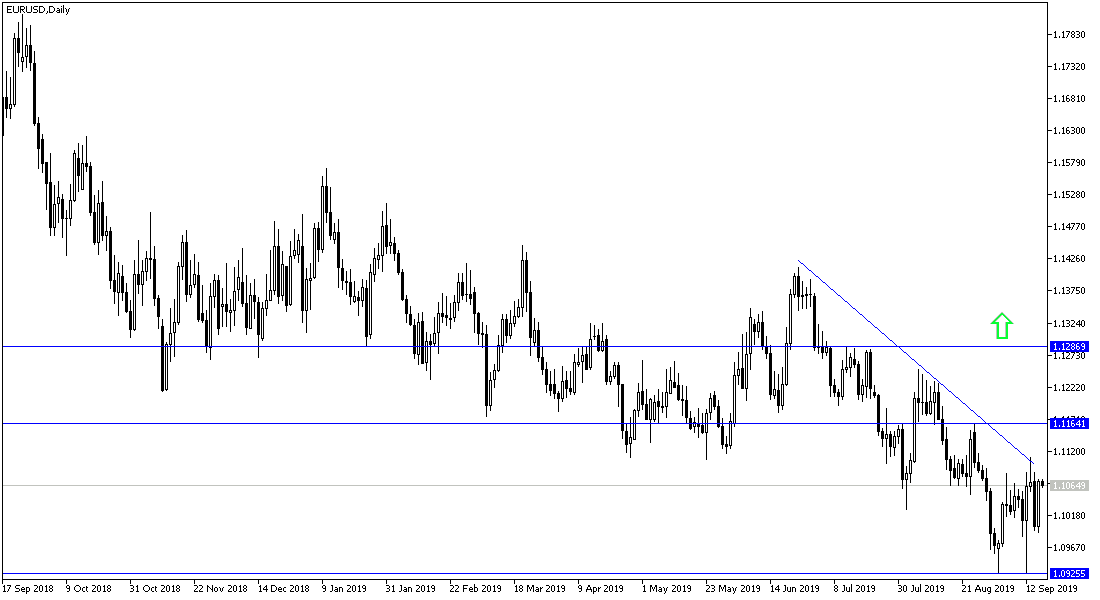

According to the technical analysis of the pair: Our technical view of the EUR/USD performance remains unchanged; the general trend will remain bearish, especially if it reestablished below 1.1000 psychological support. Currently, the closest support levels for the pair are 1.0955, 1.0880 and 1.0800 respectively. On the daily chart, a break back above the 1.1100 resistance level will give the upward correction a new hope. The pair will then be ready to move towards the resistance levels of 1.1145, 1.1220 and 1.1300 respectively. Taking into consideration that today is the most important and absolutely most influential on the performance of the pair.

On the economic data front: Today's economic calendar will focus on the release of the Eurozone CPI. From the United States, the housing market figures and the monetary policy decisions from the Federal Reserve Bank, followed by remarks by Governor Jerome Powell.