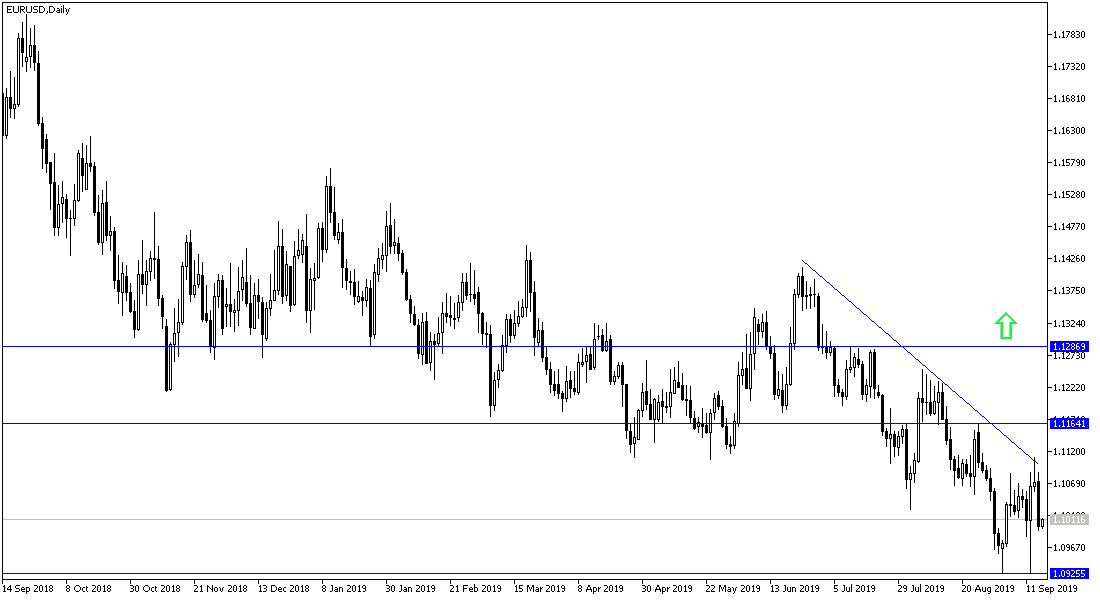

EUR/USD fell back to the 1.0993 support level as the pair failed to overcome the 1.1109 resistance which was successfully tested last week after the ECB announced its monetary policy and introduced more stimulus plans for the Eurozone economy. This performance confirms the strength of the downtrend as mentioned in previous technical analysis. After a long wait, the ECB last week cut interest rates and reinstated its bond purchase plans, which it terminated at the end of last year. The Euro did not react as strongly as expected, as markets wanted stronger plans and more stimulus as the Eurozone economy continues to suffer the consequences of the global trade war, which still lingers, with a loss of hope for a nearby solution to the dispute that threatens the future of global economic growth as a whole.

On Wednesday, the pair will be have the most important date for this week, as the Federal Reserve will announce its monetary policy amid expectations that the bank will cut the US interest rate by a quarter-point , and if that happens and the bank abandoned further tightening policy, the Euro will have a better chance of making stronger gains again. Should the US central bank, led by Jerome Powell, stick to its monetary policy and show confidence in the US economy as usual, the pair's price could come under new downward pressure.

The EUR may be weakened in the near future as the ECB did not give a final date for quantitative easing plans, which would pave the way for easing its monetary policy for a longer period, putting strong downward pressure on the Euro.

According to the technical analysis of the pair: There is no change in our technical analysis, as the general trend will remain bearish, especially if the EUR / USD returns to stability below the 1.1000 psychological support. At the moment, the nearest support levels for the pair are at 1.0955, 1.0880 and 1.0800 respectively. On the daily chart, a break back above the 1.1100 resistance level will give the upward correction a new hope. The pair will then be ready to move towards the resistance levels at 1.1145, 1.1220 and 1.1300 respectively.

On the economic data front: From the Euro-Zone the German IFO Economic Sentiment will be released. From the US, industrial production, capacity utilization rate and NAHB housing market index will be released.