As we expected from the beginning of this week, the EUR/USD will continue to move in a limited and narrow range, which occurred, as the move remained between the 1.1011 support level and the 1.1068 resistance level and stable around 1.1045 at the time of writing. The pair's recent gains were supported by investor risk appetite amid a breakthrough between the US and China and the recent optimism about the future of Brexit. But the ECB's monetary policy decisions on Thursday may bring headwinds. European Central Bank President Mario Draghi is widely expected to announce a reduction in the euro zone deposit rate to a negative level at 12:45 am London time. The ECB is also likely to resume its quantitative easing program, which it ended in December 2018 in an attempt to achieve its inflation target by stimulating the economy via cutting borrowing costs. The economic slowdown in the Eurozone led by Germany has forced the European Central Bank to realistically make urgent plans to revive the region's economy.

Overall, the divergence in economic performance and monetary policy between the United States and the Eurozone remains favorable for the dollar. Recently, figures were released confirming the strength of the US labor market to historical figures. US Federal Reserve Governor Jerome Powell noted that the US economy is far from recession, but Trump's ongoing trade wars increased the external risks to the economy.

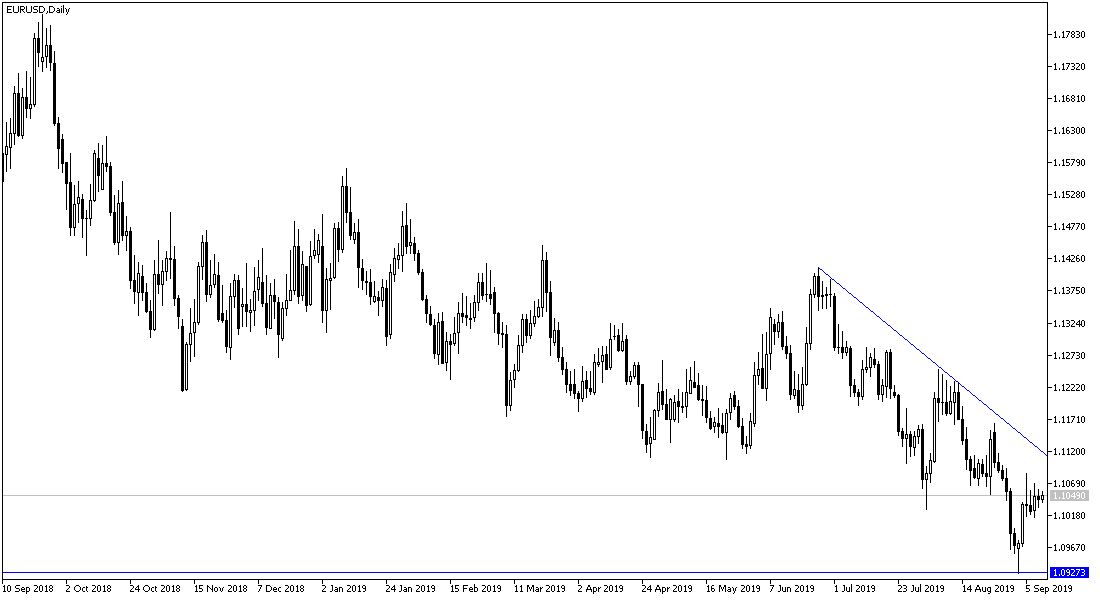

According to the technical analysis of the pair: The waiting situation dominates the price of the EUR / USD pair which is trying to hold around the 1.1000 high until the actual announcement of monetary policy decisions from the European Central Bank on Thursday. Any move below this neutral level will support the continuation of the bearish trend and the pair will move to the support levels at 1.0955, 1.0880 and 1.0800 respectively. Completing the bullish correction needs stronger catalysts and may occur if the pair moves to the resistance levels at 1.1120, 1.1200 and 1.1290 respectively. In the long term, the general trend is still down.

On the economic front today, there are no significant data releases from the Eurozone. From the US, the PPI and Crude Oil Inventories data will be released.