At the beginning of a new week, the EUR / USD is attempting to maintain a stable move above the 1.1000 psychological level to avoid further downside pressure. Today, the focus will be on the release of purchasing managers' indexes for the manufacturing and services sectors, which are important for the Eurozone economies. Germany leads the region's economy. It was adversely affected by the global trade war. This prompted the European Central Bank to pass a stimulus package for the region's economy, including lowering interest rates to negative levels and returning to bond purchases program again.

The US Federal Reserve last week followed the European Central Bank (ECB) move and also cut the US interest rate by a quarter point to counter external risks that threaten the country's longest economic growth period ever. The bank has reaffirmed its confidence in the country's economy and is acting as appropriate and not due to the intervention of the Trump-led political administration, as the Fed enjoys complete independence.

This week we may see an intense activity because of remarks by members of the US Fed Reserve monetary policy. Two chances for remarks from Mario Draghi, governor of the European Central Bank (ECB), in his final days as leader of the bank.

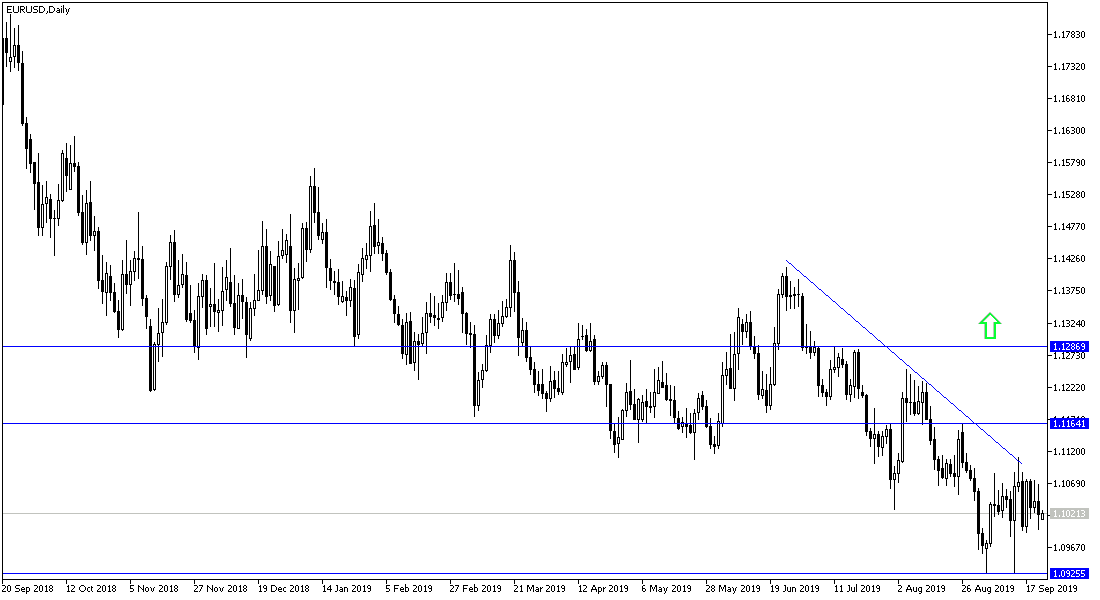

According to the pair’s technical analysis: The EUR / USD failure to stabilize above the 1.1000 resistance will support the return of downward pressure again and we may visit the support levels 1.0945 and 1.0880 and 1.0790, respectively, which consolidate the downward strength and end the hopes of the rise for a while Longer. A fresh momentum could push the price to resistance levels at 1.1090, 1.1145 and 1.1220 respectively. The lack of confidence in the Euro will continue to support the pair's sell-off in the event of a rebound at any time.

On the economic data front: Today's economic calendar will focus on the release of PMIs for the manufacturing and services sectors of Germany, France and the Eurozone. Later on, comments by ECB Governor Draghi. From the US, there will be the manufacturing PMI data.