During Thursday's trading, the most important event for the Euro this week will be the monetary policy announcement from the ECB. As we had expected since the beginning of this week, the EUR / USD will remain in a limited range, as the pair did not exceed the 1.0985 support level tested on Wednesday. It is stable around 1.1010 at the time of writing, and its gains did not exceed the 1.1065 resistance. Markets expect the European Central Bank (ECB) to announce inevitable stimulus plans on Wednesday to revive the Eurozone economy, which is suffering the consequences of the global trade war, with Germany leading the economic weakness in the region. With the success of the bank's plans to cope with the economic recession in the global financial crisis 10 years ago, it is heading into the same scenario. It is also expected to lower the deposit rate from the current -0.4% to - 0.5% or even - 0.6%. A negative interest rate is a penalty designed to push banks to lend more.

The content of the bank's plans and how they are received by investors, will determine the Euro’s fate until the end of the year.

Whatever the bank's decisions, the Euro will move lower. The Eurozone economy is more open to trade than the US, which means that all imports and exports represent a higher percentage of GDP than the US. The important European automotive sector is within the range of Trump tariffs. Monetary policy divergence between the European Central Bank and the US Central Bank is still in favor of the dollar. Therefore, it is expected that the EUR / USD pair will continue to trade in a range below 1.05 to 1.10 for the rest of the year.

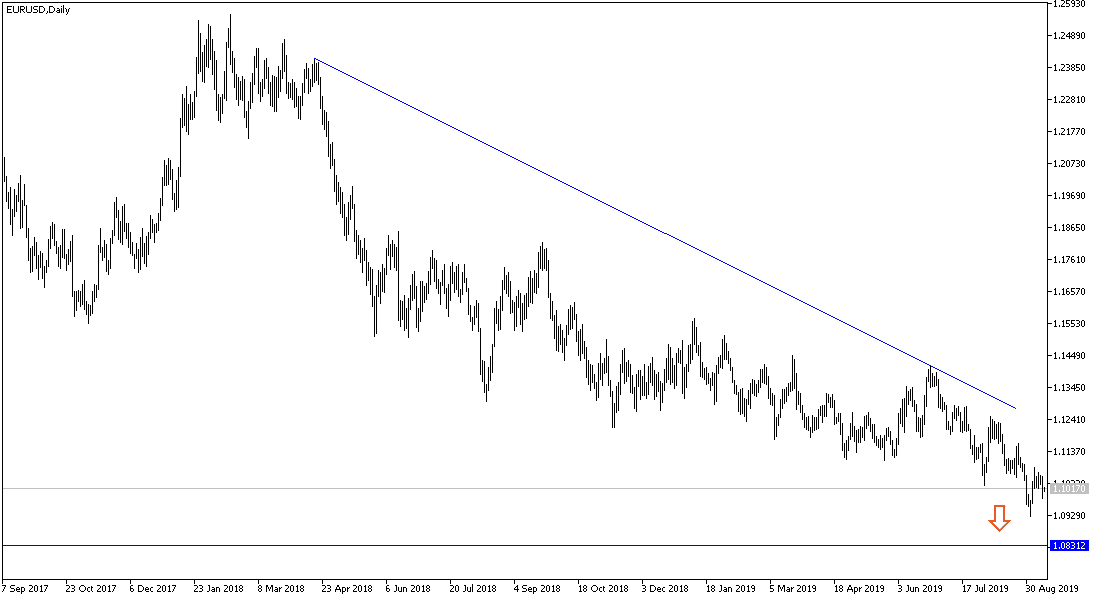

According to the technical analysis of the pair: In the long term, the EUR / USD is still in the vicinity of a violent downward channel, supported by stability below the 1.1000 psychological support. At the moment, the closest support levels for the pair will be 1.0945, 1.0880 and 1.0790 respectively. In the event of an upward correction, the pair will face significant barriers, starting with 1.1085, 1.1145 and 1.1230 respectively. I still prefer to sell the pair from every bullish level.

In the economic data front: The beginning is from the Eurozone with the release of the German and French consumer price index and then industrial production for the Euroarea. In addition, the most important event will be the announcement of ECB monetary policy decisions followed by the press conference of Governor Mario Draghi. From the United States, the CPI figures, the most important inflation data in the country, will be released, and at the same time we will have the weekly jobless claims data.