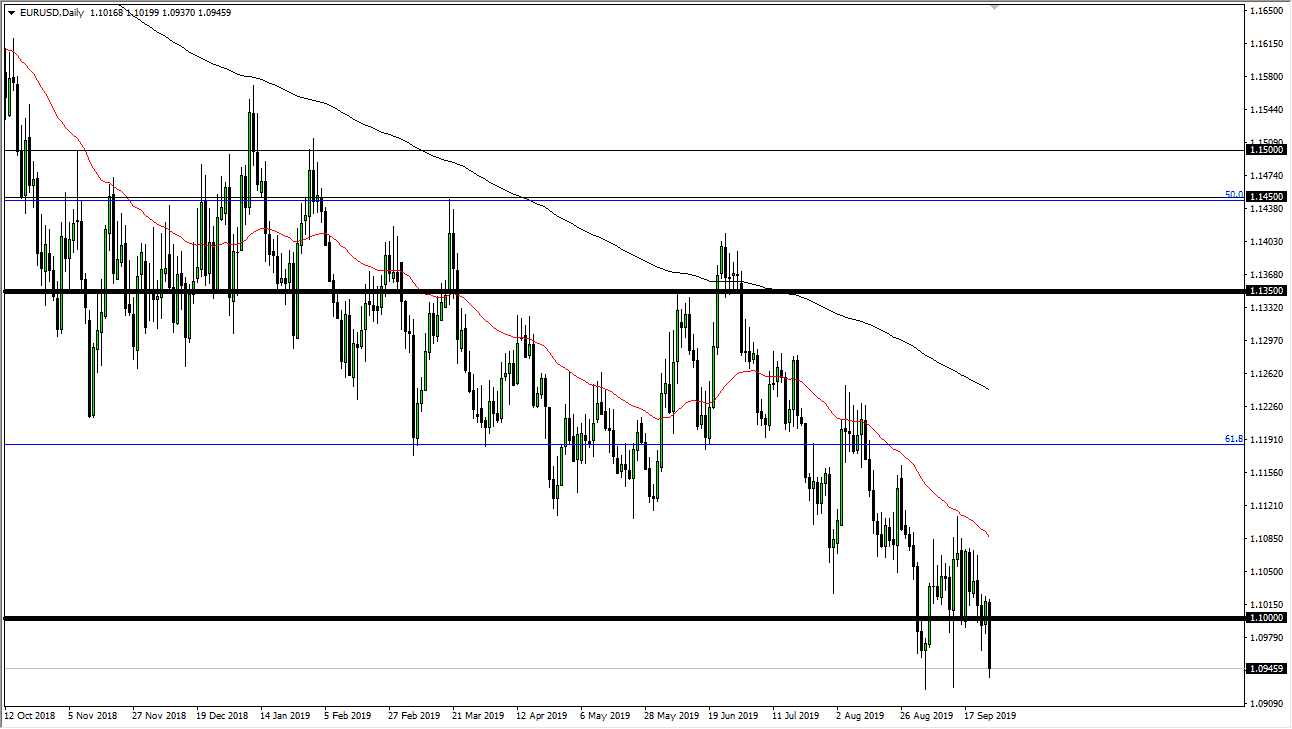

The Euro broke down significantly during the trading session on Wednesday, reaching towards the 1.09 level. That’s where we had seen a bit of a bounce over the last couple of weeks, and at this point it’s likely that the market is going to try to break down through there. If it does, then it’s likely that we just simply continue the overall downtrend that we have been in. There’s no reason for nothing else to happen but that, as the German economy is reaching towards a recession, and of course the Italians are already there. Beyond that, the US treasury markets have been getting a bit of a bid lately, so that of course has money looking towards America which means it needs greenback.

The 50 day EMA is above the most recent high, and it is starting to slope lower. At this point, the 50 day EMA has been rather reliable as of late, so I consider that to be the first amount of “dynamic resistance.” John that, the 200 day EMA which is painted in black should also offer quite a bit of resistance, as well as the 1.12 level just below. Ultimately, this is a market that has no reason to rally and it’s obvious that the US dollar should continue to climb against the Euro as well as other European related currencies as the US economy is far superior to the European economy right now, and that seems to be only extending going forward.

Another thing of interest is the fact that this candlestick is closing towards the bottom of the range, while the last couple of times we have reached down here the market has turned around to bounce and form a long wick. It seems now that we are willing to stay down here, so given enough time it looks as if we will eventually break down. Rallies are to be sold still, and as a result it’s simply a matter of looking for exhaustive short-term candles that we can take advantage of. At this point, the market could be going as low as 1.0450 EUR, as it is roughly the 100% Fibonacci retracement level, something that I look for once the market clears the 61.8% Fibonacci retracement level as decidedly as we have over the last couple of weeks. Negativity continues, so therefore selling is all I can do.