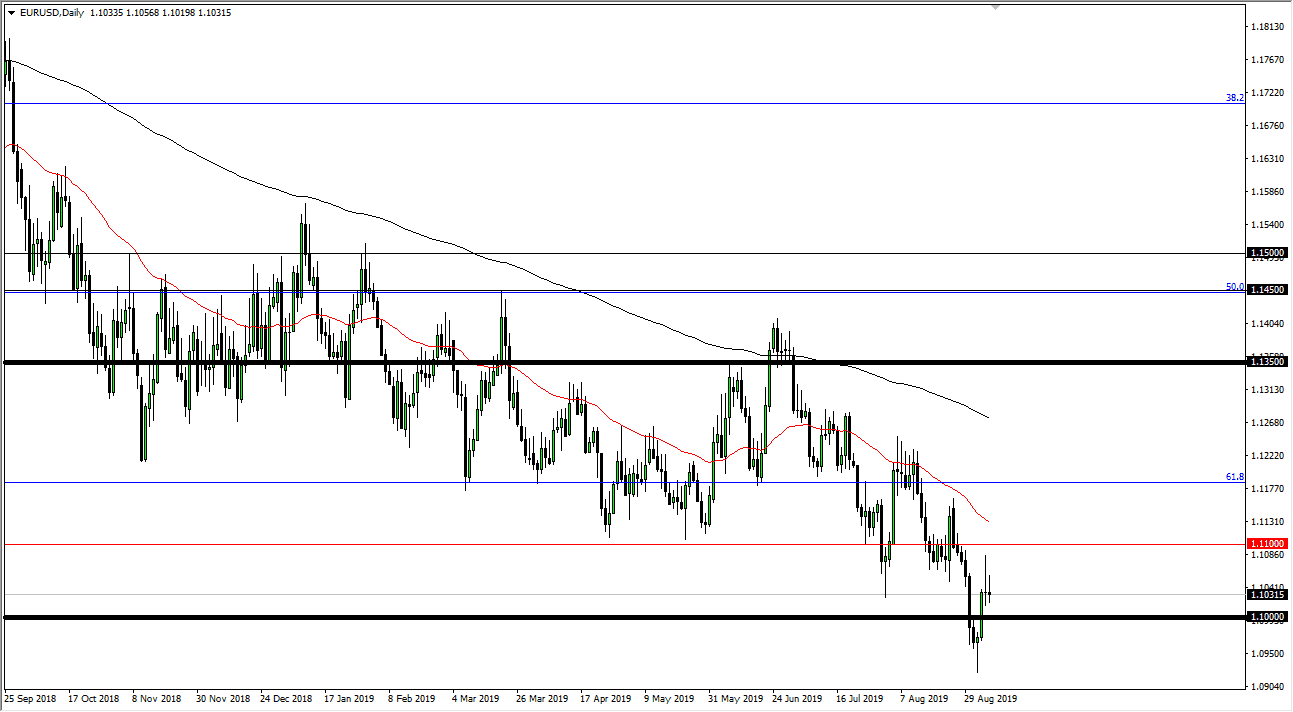

The Euro tried to rally during the trading session on Friday but has rolled over after the initial surge post nonfarm payroll. That being the case, it’s very likely that we are going to continue to go lower, as mandated by the massive shooting star from the Thursday session. The 1.10 EUR level continues to offer psychological importance, but we are in a downtrend and that has not changed.

With the negative yields that are coming out of the European Union, it makes quite a bit of sense that money prefers to be in the United States. Negative interest rates guarantee a loss if bonds are held to maturity. Just above, the 1.11 EUR level is the beginning of significant resistance that extends to the red 50 day EMA, both of which should offer plenty of selling pressure. Remember though, this pair is one of the most choppy and noisy pairs in the Forex world, as we have seen be the case of the last couple of years. We have been in a descending channel, that has been chopping around and in a very tight range.

Looking at the chart though, if we were to break above the 1.12 handle, then we have the 200 day EMA above that could cause issues painted in black. We are in a very long-term downtrend, and it looks very likely that every time we rally there will be a reason to sell. On one hand, there are a lot of concerns out there that weigh upon the attitudes of traders, as the US dollar gains because of that as well. Beyond that, if the US and China get some type of trade deal going, that should be good for the US dollar as well, while the Europeans continue to flounder with a banking crisis and of course the Brexit which seems to be never ending. With all that uncertainty it makes quite a bit of sense that we continue to drop from here. Beyond all of that, we are below the 61.8% Fibonacci retracement level, which generally means we go looking towards the 100% Fibonacci retracement level. That could send this market as low as 1.04 EUR, although obviously it’s a very long term call at this point. In the meantime, simply shorting small bounces that show signs of weakness and exhaustion continues to be the way forward.