The Euro continues the chop around without any type of direction, as per usual. This will be especially bad during the week though, because we have the European Central Bank in focus this week, and they will certainly be easing monetary policy. At this point, the question is “how much”, and exactly what mechanism will use. With that, the Euro will be very difficult to deal with in the short term, but I think at this point it’s obvious that rallies are to be sold.

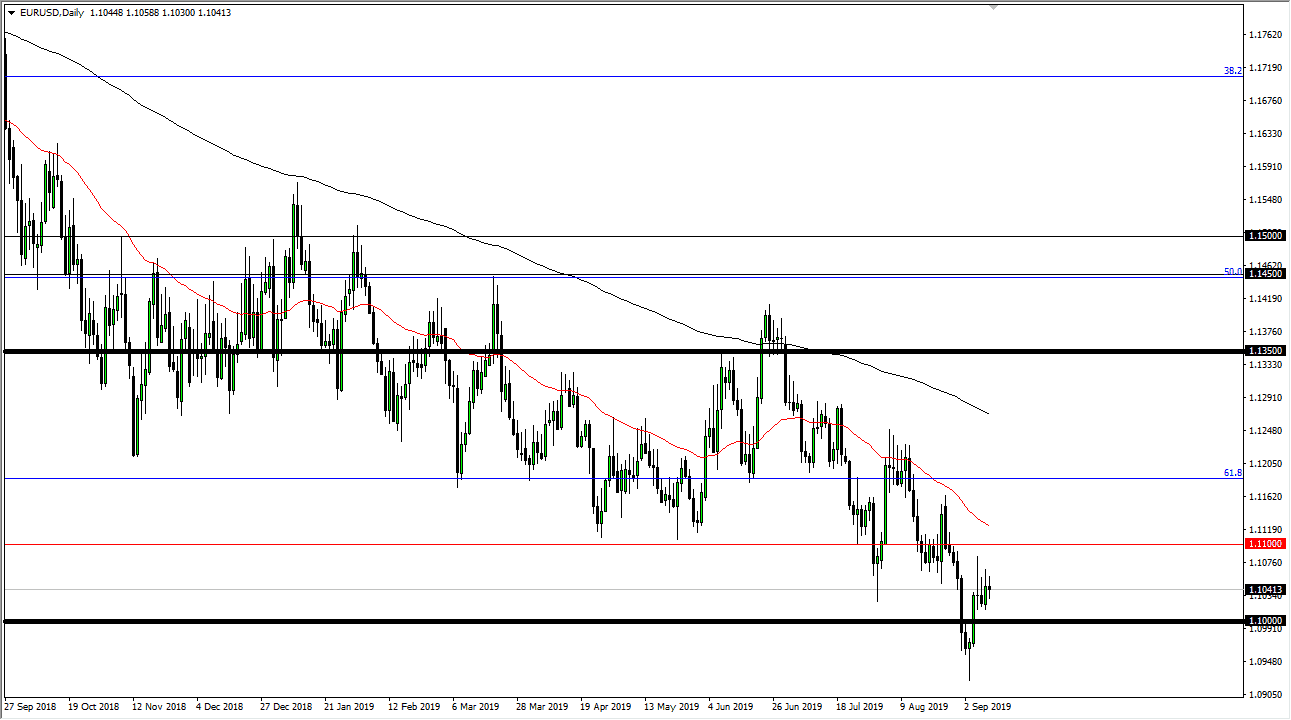

The 1.11 EU are level above is massive resistance and will be backed up by the 50 day EMA which is reaching towards it. Rallies are not to be trusted, as the Euro has been very bearish for quite some time. That doesn’t mean that we will get the occasional bounce, but the reality is those are opportunities to pick up the US dollar “on the cheap.” After all, look at the bond markets in the United States, as they offer positive yield, something that the European Union can’t seem to do.

With all that being said, I expect a short-term choppy move to the downside, perhaps reaching towards the lows, perhaps even below there as well. Based upon the longer-term charts, we have broken through the 61.8% Fibonacci retracement level, and that could open up the door to the 1.05 level underneath longer-term. It may take months if not a couple of years to get down there though, because the EUR/USD market doesn’t tend to move very quickly overall. With that being the case it’s very likely that we are going to continue to “fade the rallies” going forward, even if we were to somehow break above the 1.11 EU are handle. I believe it is only a matter time before the sellers takeover, and if the European Central Bank gets very aggressive, we may see this market break down quite significantly.

That being said, I think any bounce offers an opportunity to trade and therefore I just don’t have a buying opportunity unless of course the ECB decides to raise rates, something that I put at about a 0% chance. Inflation in the European Union is running well below the ECB target, and economies are very weak, it including Germany. In other words, the ECB has to do something very drastic and that should weigh upon this market.