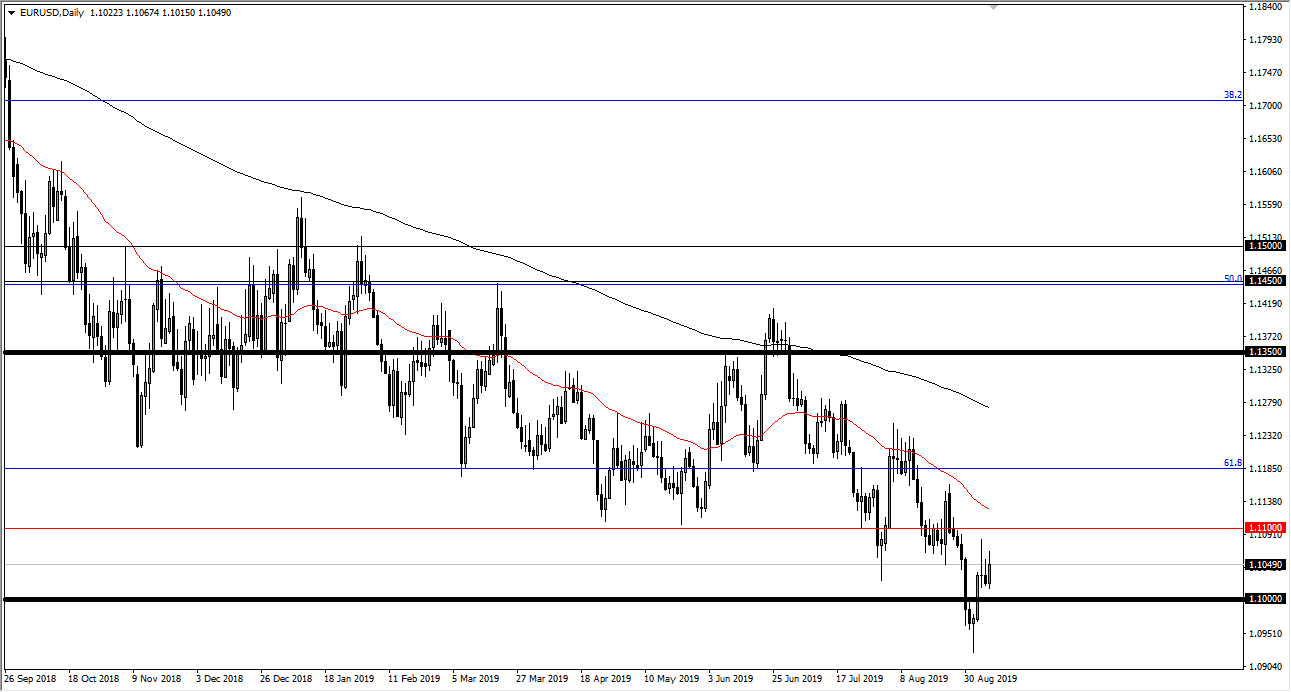

The Euro initially tried to rally during the day on Monday but ran into trouble at the same general region than that we have seen it roll over recently. At this point, I think that the 1.1050 level begins pretty significant resistance all the way to the 1.11 level after that. All things being equal, it’s likely that the market will continue to rollover and reach towards the 1.10 level. The Euro has been in a downtrend for some time, as it’s likely that the downtrend should continue, and for good reason. After all, the Germans are entering a recession, just as European bonds continue to offer negative yields. Think of it this way: you get to guarantee a loss if you buy bonds. Central banks have gotten out of control, and they will continue to distort the markets.

To the downside, the 1.10 level will offer a bit of support but I think it’s only a matter of time before we break down through there and go much lower. Rallies at this point in time it will continue to attract selling pressure, as the US Treasury markets continue to offer positive yields, something that most bonds don’t anymore, especially considering the European Union. Ultimately, the downtrend has been very strong, and it’s very likely that the market should continue as we have seen this market grind lower for a couple of years now. This doesn’t mean that it’s an easy sell, because this has been a very choppy and erratic market. Having said that, that’s typical for the EUR/USD pair, chop-chop-chop. However, if you are a longer-term trader you can probably go short and simply ride out the volatility.

The 50 day EMA above is massive resistance, so if we were to break above the red moving average it would be a very bullish sign and could send this market towards the 1.1250 level. To the downside, we could go as low as the 100% Fibonacci retracement level which is closer to the 1.05 handle. That being the case, I don’t have any interest in trying to try to fight the trend, and I am simply looking for opportunities to fade this market every time it shows signs of exhaustion. In fact, I have no interest in trying to go long anytime soon, I would need to see a longer-term reversal signal, something that is not there.