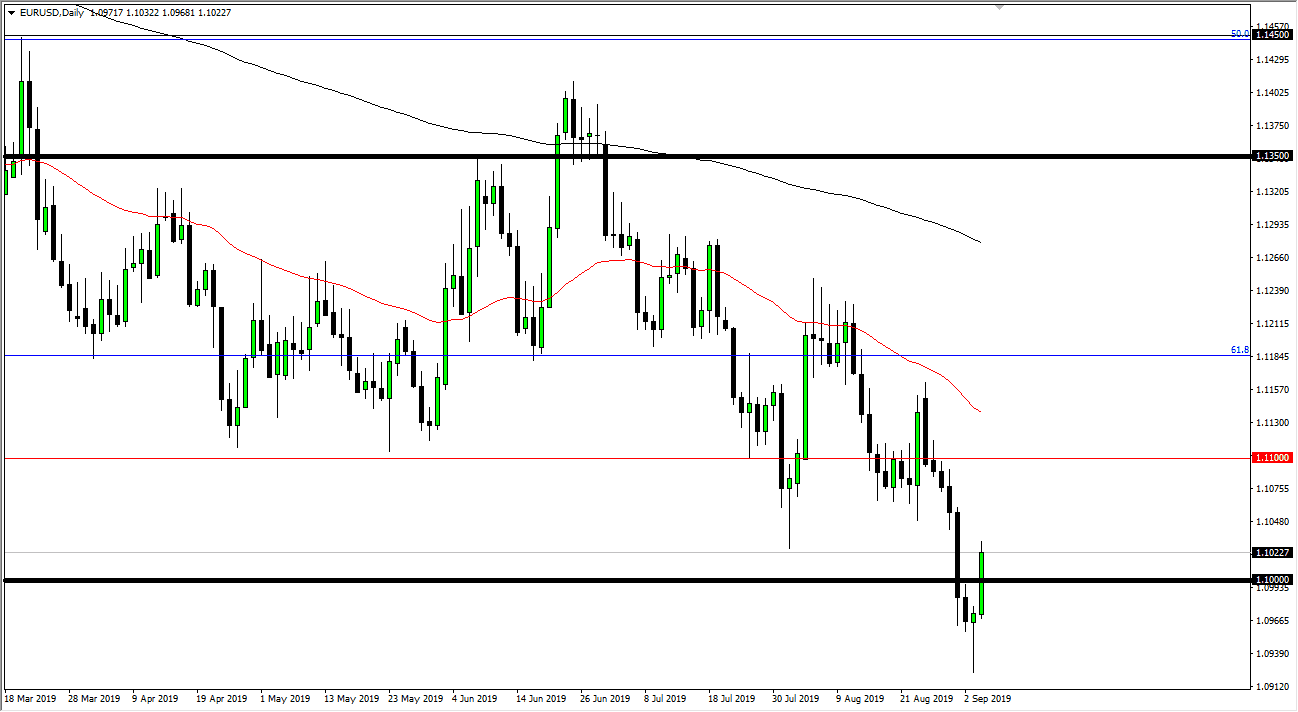

The Euro has rallied during the trading session on Wednesday to break back above the 1.10 level. This has been rather impressive move by the Euro in general but it’s obvious to me that there is significant resistance above. With that in mind, I think that what we are about to see is a move towards the 1.1050 level, with a bit of a “ceiling at the 1.11 handle. With the jobs number coming out on Friday it’s hard to imagine a sudden jump into the Euro, especially considering everything that’s going wrong right now in the European Union.

You have the Germans entering a recession which is essentially the same thing as saying Europe is entering a recession. If that’s going to be the case it’s difficult to imagine a scenario where the European Central Bank does anything to protect the value of the currency. Granted, the Federal Reserve will do what it can to bring down the value of the US dollar but that seems to be very unlikely to be successful at this point while the rest of the world is slowing down.

Because of this, I believe that this move we have seen over the last couple of days will more than likely be a nice opportunity to short the market yet again. I believe that somewhere near the 1.1050 level you will start to see a lot of resistance, and once we break back down below the 1.10 level it’s likely that the selling will accelerate. Beyond that, we have the jobs number coming out of the United States and that could of course move the US dollar which by extension will move the Euro. With all of that possible noise and of course the nonsense coming out of both London and Brussels as far as the Brexit is concerned, it’s difficult to imagine a scenario where the Euro is the pillar of stability. I believe that this is a “dead cat bounce” and nothing more. I fully anticipate plenty of resistance to the 1.11 EUR level, and of course the red 50 day EMA above there. With that I’m looking for the first signs of exhaustion to start selling yet again, as the Euro is most certainly in a negative trend. Granted, there is a lot of noise just below but I do think that it’s only a matter of time before that gets resolved as well..