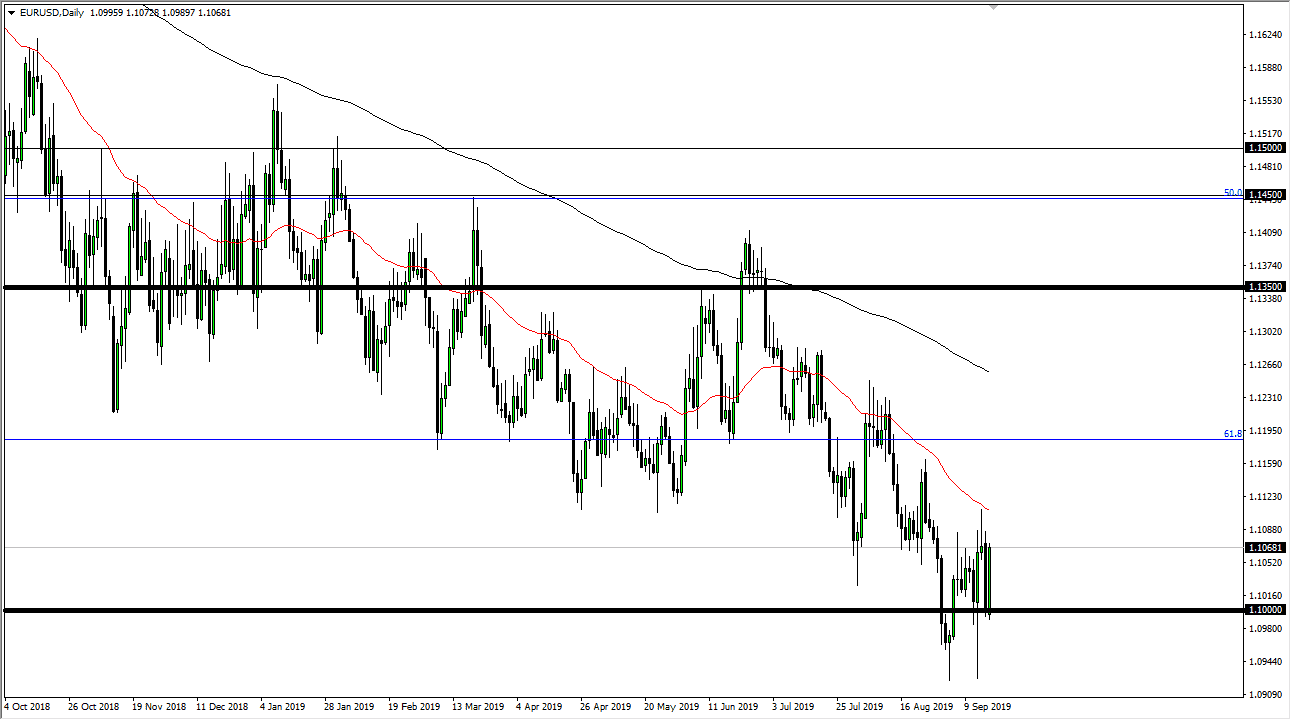

The Euro rallied a bit during the trading session on Tuesday, reaching towards the shooting star from a couple of days ago. At this point, the 50 day EMA is just above and it should offer a bit of dynamic resistance. With the Federal Reserve coming out with a statement on Wednesday, it’s very likely that we will see a lot of volatility.

The ferocity of this bounce is something to pay attention to, but I think a lot of it is people squaring oppositions before the Federal Reserve news conference which of course will have a massive influence on what happens next. The shooting star from the Friday session dictates that we are still very much in a downtrend from what I see, especially considering that the 50 day EMA is above that candlestick so I think it’s only a matter time before the sellers would return. If we do break above the 50 day EMA, then it’s likely that the market could go looking towards the 1.12 EUR level, or perhaps even the 200 day EMA after that.

To the downside I see the 1.09 EUR level as a bit of a barrier for the sellers, but if we can break down below there, we are likely to go looking towards the 100% Fibonacci retracement level, closer to the 1.05 EUR level. We are significantly below the 61.8% Fibonacci retracement level, so therefore it makes sense that we could go down to there. All things being equal it’s likely that the Euro should continue to sell off due to the fact that Germany is likely to head into a recession, while Italy is also already in a recession. The US dollar should continue to get a bit of a boost though, because although the Federal Reserve is cutting interest rates, the reality is that the US economy is doing better than the European Union, and probably will going forward.

This has been a messy and choppy downtrend, but that should continue to be the case going forward. I continue to look for rallies to fade on signs of exhaustion, and as a result it’s likely that the trend should continue and therefore I will be trying to set up positions to do so. In fact, I don’t have a scenario where I’m willing to buy this market, but that could change after the press conference.