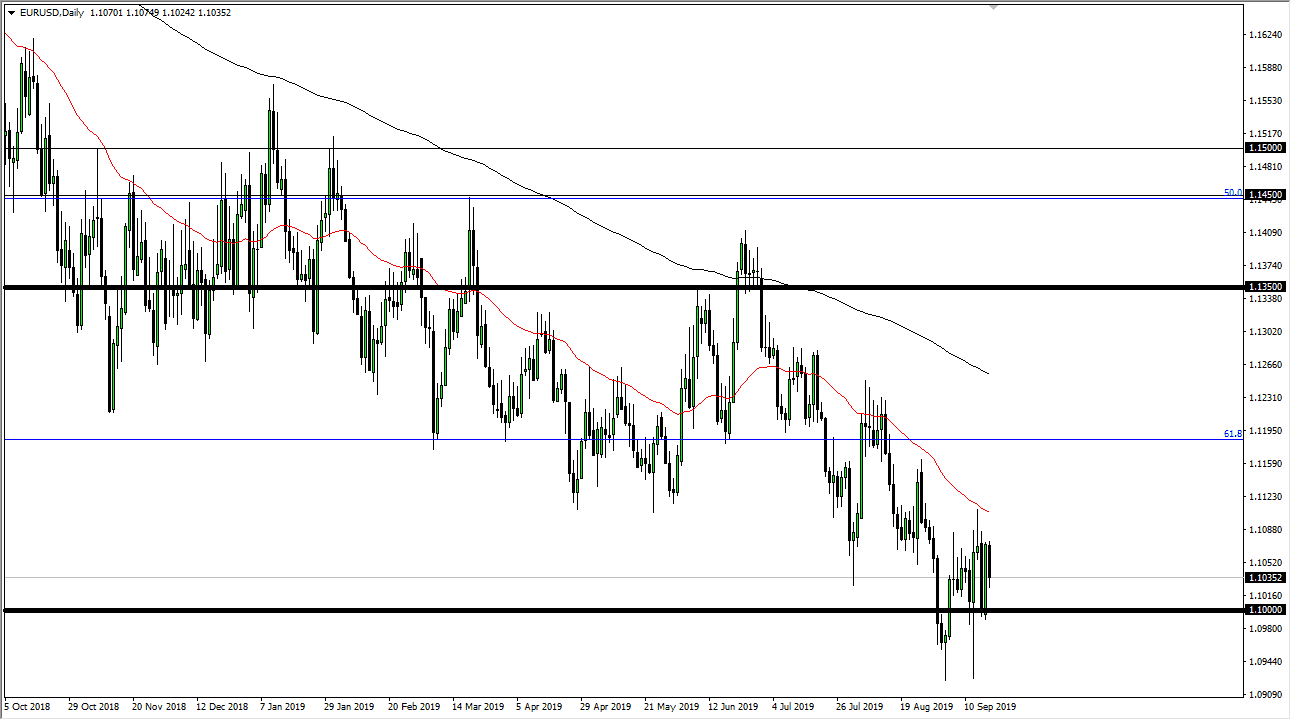

The Euro fell a bit during the trading session on Wednesday, reaching down towards the bottom of the overall consolidation that we have been in for or some time. The 50 day EMA is above and painted in red which of course shows just where the most dynamic resistance is. At this point, it’s very likely that we will then reached down towards the bottom of the overall consolidation. This is a market that will be very interesting to follow because of the dynamics involved between the two central banks.

On one hand, you have the Federal Reserve, which is just done cutting 25 bps, but at this point it’s likely that the less than dovish statement has people looking to buy the US dollar in general. At this point, the Euro has the European Central Bank pushing it lower as well, because it looks very likely that they are going to greatly expand quantitative easing, driving down the value of the common currency by itself.

The market breaking down below the 1.09 EUR level, then it’s likely that we will go looking towards the 100% Fibonacci retracement level, closer to the 1.05 handle. At this point, now that we are below the 61.8% Fibonacci retracement level makes quite a bit of sense that we should continue. However, this is a market that is generally a choppy market longer-term. Longer-term this is a market that takes a lot of patience to take advantage of, so keep that in mind.

This is more of a significant investment than a short-term trading. The 50 day EMA is resistance, but then again so is the 1.12 level after that. I have no interest in buying this pair until we break well above the 200 day EMA, which would be a longer-term trend change. It would take a lot to make that happen, and I don’t see that in the cards anytime soon. I’m looking to fade short-term rallies, and I think that will probably be the way going forward to take advantage of what we have here and of course the grind lower. All things being equal, this is a market that should be looked at as one selling opportunity after another. Every time we make a fresh, new low, we will probably get a bit of a relief rally, and then another opportunity to sell again if you can simply bide your time.