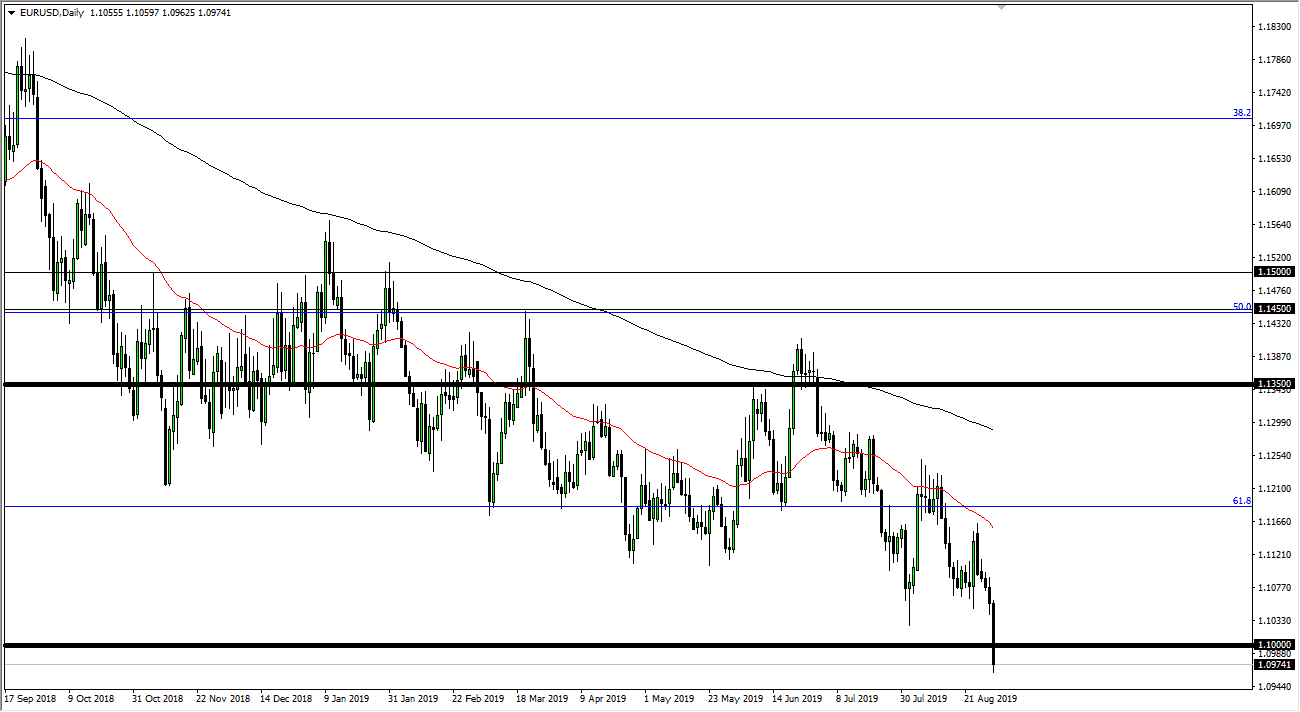

The Euro has broken down significantly during the Friday session, slicing through the 1.10 EUR level. This is an area that obviously will attract a lot of attention in the fact that we are just sitting below there tells me that people are very comfortable with the Euro being underneath that level, and this of course is a major turn of events. The massive black candle on the chart signifies just how bearish things are, and the fact that Germany is entering a recession isn’t going to help the situation either.

Beyond that, the interest rate differential between the two economies is rather strong, especially considering that the bonds in the United States have a positive yield while the European Union bonds continue to offer negative yields. In that scenario it makes quite a bit of sense that the money continues to flow away from Europe, and toward New York. I think given enough time we will probably go looking towards the 100% Fibonacci retracement level which of course is down near the 1.05 EUR level.

I believe going forward we are simply shorting this market as there’s no reason to see it turn around anytime soon. The 1.10 EUR level will continue to cause a lot of attention, so now it will be interesting to see if it can offer significant resistance. If we break above there, then I don’t think it’s until we get above the 1.12 EUR level that it’s ready to go higher. It’s very unlikely at this point, and the 50 day EMA which is painted in red on the chart should continue to offer plenty of resistance.

The US dollar will continue to attract a lot of attention as well, at least in the current environment that we find ourselves in. The world is very concerned about global growth and the global economy, so it makes quite a bit of sense that the US Treasury market continues to attract a lot of flows based upon fear by itself. Ultimately, this is a market that I think short-term traders will continue to short every time they get an opportunity and longer-term traders will have to wait for some type of larger supportive action on perhaps a weekly chart to even begin to think about going long. Eventually, this will be a great “buy-and-hold” situation but it seems very unlikely to happen anytime soon.