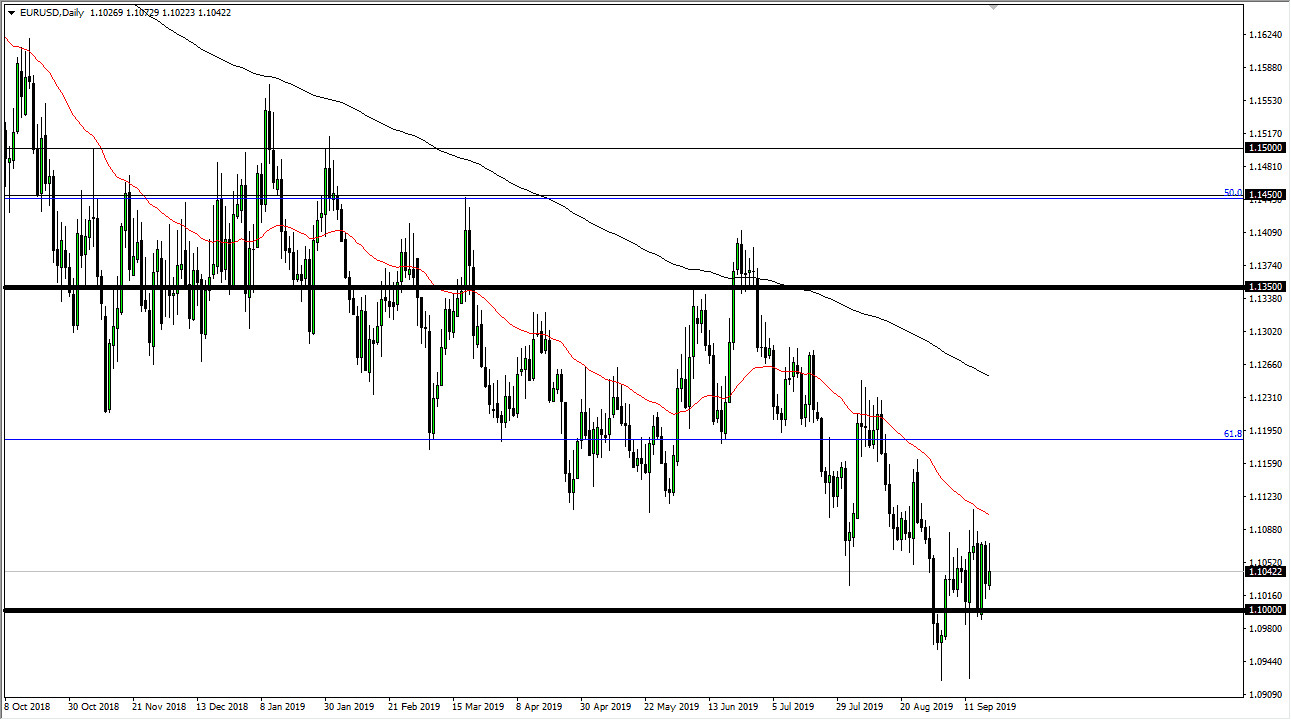

The Euro went back and forth during the trading session on Thursday, initially trying to rally but gave back most of the gains to form a very ugly looking candle stick. There is a lot of resistance above at the 50 day EMA which is painted in red, and of course the shooting star that happened from a couple of days ago. Signs of exhaustion continue to be a trigger for selling, and therefore I find that the fading of short-term rallies makes the most sense.

If we break down below the 1.10 EUR level it’s likely that we will go towards the lows again, and then eventually break down below there. After all, the market is below the 61.8% Fibonacci retracement level and that typically means we go looking towards the 100% Fibonacci retracement level which is closer to the 1.05 handle. Both major moving averages that I follow, the 50 day EMA and the black 200 day EMA, are spread out nicely, and are most decidedly bearish. Remember, this is a longer-term trend that we have been in for some time that has been very negative, and that of course hasn’t changed. In fact, it would take quite a bit to change that overall trend, perhaps closing above the 200 day EMA may convince me.

Based upon the Fibonacci retracement studies, we could go as low as the 1.04 region. In other words, we have quite a way to go, but keep in mind that this market tends to be very choppy and noisy, so that could be a move that takes a good year to happen. The European Union is heading into recession and while the Federal Reserve has just cut rates and likely will do so going forward, the reality is that you can still get yield in the US Treasury markets why you cannot in the European Union for the most part. Money goes to where it’s treated best, and right now it’s treated better in the US than it is in the EU. We also have to worry about the Brexit, because nobody knows how that’s going to end, so that is a bit of a dark cloud across the continent as well. All things being equal I continue to fade rallies going forward on short-term charts, and simply rinse and repeat as time goes forward. I am not a long-term holder in one direction or the other.