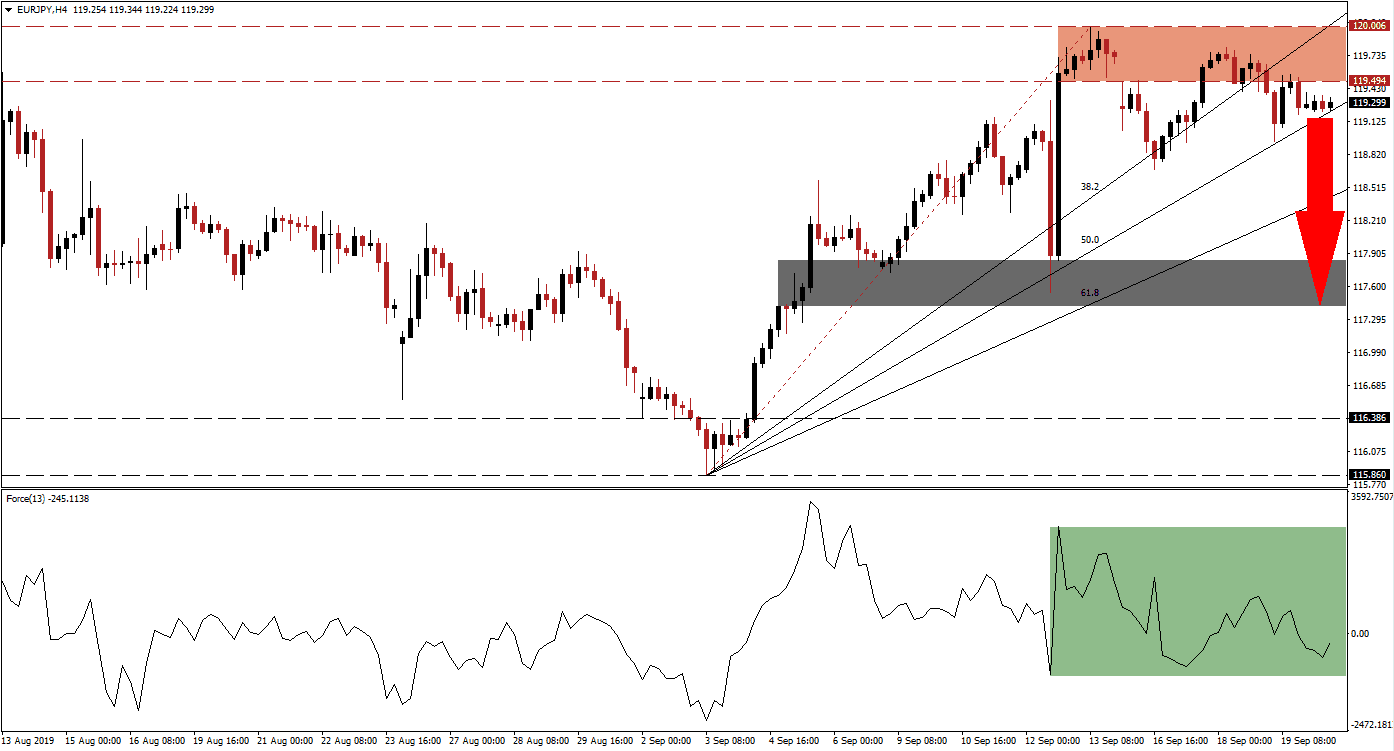

After the breakdown below its horizontal resistance zone, the uptrend in the EUR/JPY is collapsing. The first breakdown resulted into a sell-off into its 38.2 Fibonacci Retracement Fan Support Level from where a push back into its resistance zone followed. This resulted in a lower high and as the 38.2 Fibonacci Retracement Fan Support Level started to move across the resistance zone, located between 119.494 and 120.006 which is marked by the red rectangle, a double breakdown followed and took price action to its 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next generation technical indicator, flashed the first warning signal with the emergence of a negative divergence as the EUR/JPY was advancing to form its intra-day high of 120.006; the top range of its resistance zone. The Force Index recorded a lower high and the negative divergence led to the first breakdown. Since then this technical indicator contracted further and moved below the center line, set at 0, and into negative territory as marked by the green rectangle. This has put the bears in charge of price action and may lead the EUR/JPY back down into its next short-term support zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bullish momentum in the EUR/JPY has started to collapse on the back of a stronger Japanese Yen which is attracting new net buy orders due to its safe haven appeal. Following a confirmed breakdown below its 50.0 Fibonacci Retracement Fan Support Level, the intra-day low of 118.681 should be monitored together with the Force Index. A push lower will open the path for an extension of the sell-off into its short-term support zone which is located between 117.413 and 117.846, marked by the grey rectangle. A breakdown below its 61.8 Fibonacci Retracement Fan Support Level would precede such a move and turn the Fibonacci Retracement Fan Sequence into resistance.

Geopolitical events could further rally the Japanese Yen which will increase the selling pressure on the EUR/JPY. The most recent attacks on Saudi Arabian oil facilities are the most recent example and with a slowing global economy an extension of the sell-off past its short-term support zone and into its next long-term support zone cannot be ruled out. The Force Index would need to break its uptrend and slide further into negative territory in order for an extended move lower. The long-term support zone is located between 115.860 and 116.386. A reversal in the Force Index should lead the EUR/JPY back into its resistance zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 119.300

Take Profit @ 117.500

Stop Loss @ 119.800

Downside Potential: 180 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.60

Given the weakness in the Eurozone, a sustained breakout above its resistance zone is unexpected. A successful breakout, confirmed by the Force Index, would lead the EUR/JPY to the net short-term resistance zone located between 121.018 and 121.368.

EUR/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 120.200

Take Profit @ 121.300

Stop Loss @ 119.850

Upside Potential: 110 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.14