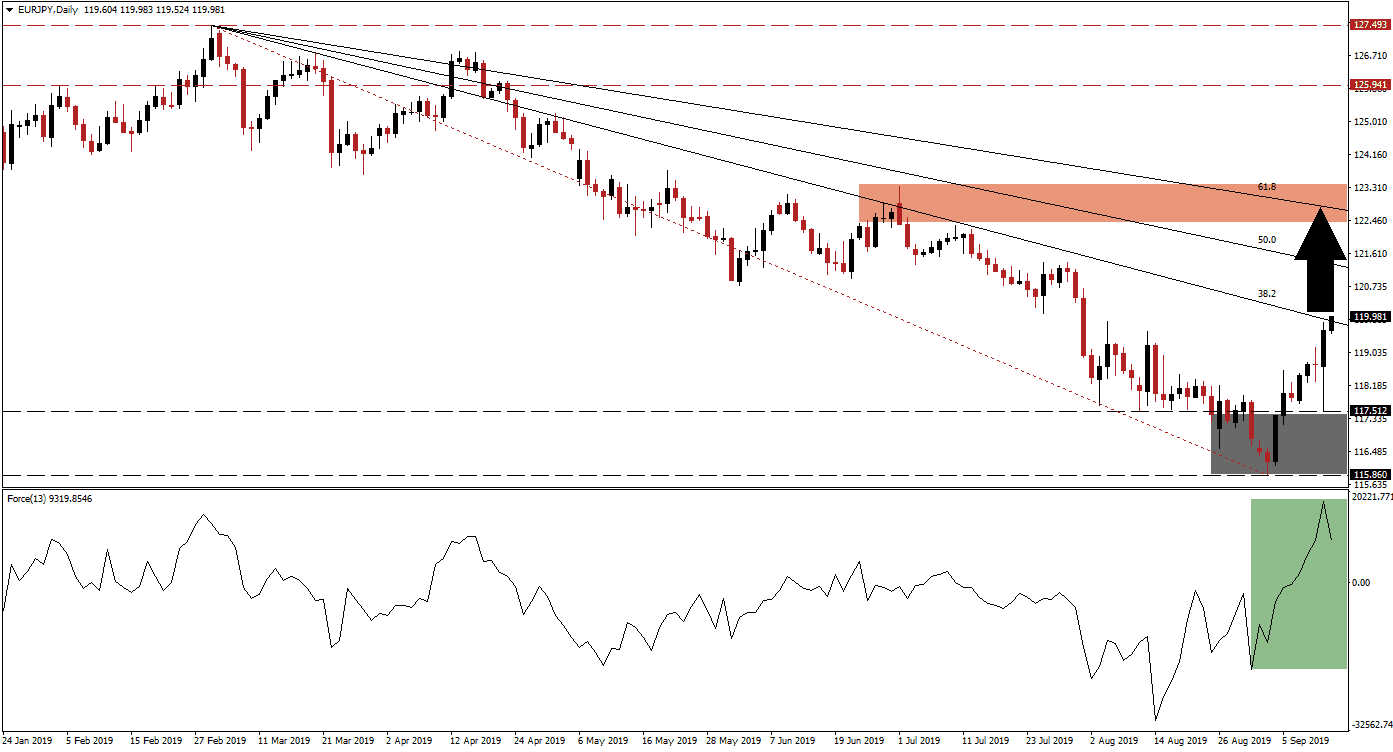

As global financial markets have entered a risk-on face, asset rotations have resulted in heavy selling pressure in the Japanese Yen. The Bank of Japan, expected to announce more stimulus for its ailing economy, has sounded alarm bells over the strength of its currency. Traders flocked to the Japanese Yen which is considered a safe haven currency as the trade war between the US and China intensified while the global economy is slowing down. Following yesterday’s ECB press conference after the announcement of its own stimulus package, the EUR/JPY completed a breakout above its support zone marked by the grey rectangle. Price action is now being pressured by its 38.2 Fibonacci Retracement Fan Resistance Level.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, confirmed the breakout and completed one of its own with a move above the 0 center line. Bulls are now in firm control of price action as this technical indicator surged to new highs marked by the green rectangle. As the EUR/JPY is now trading just below its 38.2 Fibonacci Retracement Fan Resistance Level, the Force Index started to reverse. This is a normal development due to the rise in bearish pressures provided by the 38.2 Fibonacci Retracement Fan Resistance Level. A breakout above this level accompanied by an extension of the uptrend in the Force Index is expected to push the EUR/JPY further to the upside.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

Given the current fundamental scenario together with the rise in bullish momentum, which is expected to extend, more upside in the EUR/JPY should be accounted for. Following a successful move above the 38.2 Fibonacci Retracement Fan Resistance Level, which will turn it into support, the next level to watch out for is the previous intra-day low of 120.774. This level provided a pause in the longer term downtrend in this currency pair and is additionally near the 50.0 Fibonacci Retracement Fan Resistance Level. As long as the Force Index can maintain its reading in positive territory, especially above the 4,814.0774 mark, the current breakout is likely to turn into a stronger rally.

What is a Breakout?

A breakout occurs if price action moves above a support or resistance zone. A breakout above a support zone could signal a short-term move, such as a short-covering rally which occurs when forex traders exit short positions and realize trading profits, or a long-term move such as the start of a trend reversal from bearish to bullish. A breakout above a resistance zone signals strong bullish momentum and an extension of the existing uptrend.

With the Force Index marching to new highs, accompanying breakouts in the EUR/JPY, the next resistance zone comes in play. The 61.8 Fibonacci Retracement Fan Resistance Level is nestled inside this zone which is located between 122.387 and 123.342 and marked by the red rectangle. Forex traders should monitor actions by the Bank of Japan which is expected to ease monetary further, but at the same time vowed to defend a weak Japanese Yen which harms its export industry. The exact level of comfort by the Japanese central bank remains unknown, but any rally in the EUR/JPY beyond its resistance zone is unlikely given the current trading environment.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

EUR/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 119.850

Take Profit @ 123.150

Stop Loss @ 118.750

Upside Potential: 330 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.00

A failure to sustain a breakout above the 38.2 Fibonacci Retracement Fan Resistance Level together with a collapse in the Force Index is expected to lead to a price action reversal. Such a move is likely to remain limited to the downside to its wide support zone located between 115.860 and 117.512. Since the longer term down trend remains dominant until the EUR/JPY can successfully push above its 61.8 Fibonacci Retracement Fan Resistance Level, further analysis would be required should this currency pair revert into its support zone in order to gauge the likelihood of a further breakdown.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

EUR/JPY Technical Trading Set-Up - Reversal Scenario

Short Entry @ 118.550

Take Profit @ 116.000

Stop Loss @ 119.550

Downside Potential: 255 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.55