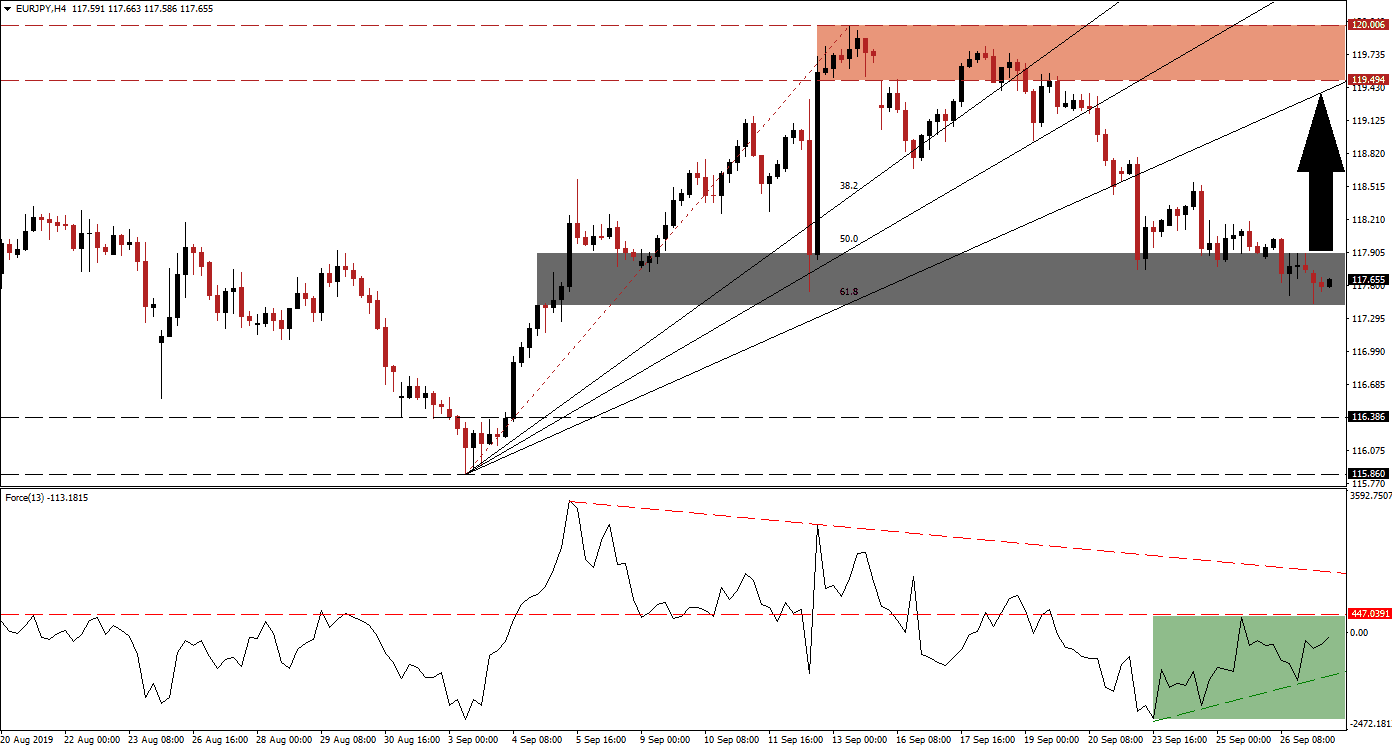

Bearish momentum in the EUR/JPY is receding as the current sell-off took this currency pair into its short-term support zone. Eurozone economic data disappointed once again this week which provided the fundamental catalysts for the complete breakdown below its Fibonacci Retracement Fan Support sequence, turning it into resistance. The breakdown below its 61.8 Fibonacci Retracement Fan Support Level took price action to the top range of its support zone from where this currency pair bounced higher before retracing once again which led to a lower low into the bottom range its support zone.

The Force Index, a next generation technical indicator, started to advance after the EUR/JPY reached the top range of its support zone. This created a positive divergence and suggests that a price action reversal could materialize. The contraction in bearish momentum as price action reached its short-term support zone further confirms the likelihood of an advance. The ascending support level which formed as a result of the positive divergence is pushing the Force Index higher as marked by the green rectangle. A move above its horizontal resistance level may precede a breakout in price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Given the magnitude of the sell-off in the EUR/JPY, there is a severe gap between price action and its ascending Fibonacci Retracement Fan Resistance sequence. This suggests that the sell-off is overextended and further points towards a breakout in this currency pair above its support zone. This zone is located between 117.421 and 117.899 which is marked by the grey rectangle. Forex traders should also pay close attention to the Bank of Japan which has warned markets that it will not tolerate a strong Japanese Yen which hurts its export industry. Central bank interference can therefore not be ruled out at is likely to happen around support levels.

A confirmed breakout above its support zone, by an advance in the Force Index and a higher high, should take the EUR/JPY back into its resistance zone which is located between 119.494 and 120.006; this is marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Support Resistance level has juts approached the bottom range of this resistance zone, with the rest of the Fibonacci Retracement Fan Resistance sequence above it. Following a breakout above its support zone, the intra-day high of 118.191 should be watched as a move higher is expected to result in the addition of new net buy positions in the EUR/JPY; this level marks the high prior to the last push lower in this currency pair. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 117.600

Take Profit @ 119.500

Stop Loss @ 117.100

Upside Potential: 190 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.80

While the technical scenario points towards a price action reversal, forex traders should monitor he Force Index. A failure to move above its horizontal resistance level could result in a breakdown below its ascending support level, this may precede a breakdown in the EUR/JPY below its short-term support zone. The next support zone is located between 115.860 and 116.386.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 116.900

Take Profit @ 115.900

Stop Loss @ 117.350

Downside Potential: 100 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.22