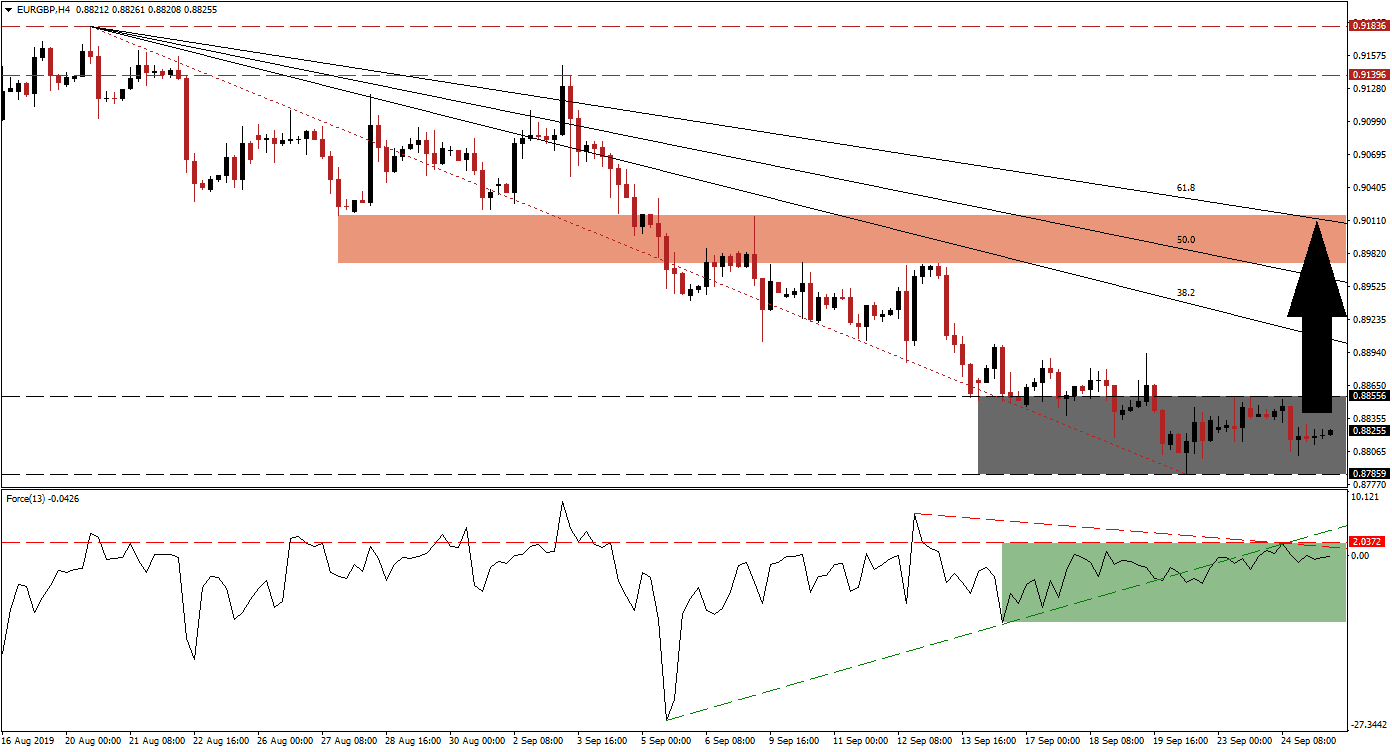

Yesterday’s UK Supreme Court decision which ruled Prime Minister Johnson’s prorogation of Parliament unlawful has take out bearish momentum in the EUR/GBP. As a result this currency pair has entered a sideways trend inside of its support zone. UK Parliament will return back to business as political as well as Brexit uncertainty remains elevated while PM Johnson vowed to continue to fight for Brexit. The sideways trend has allowed the Fibonacci Retracement Fan sequence to narrow the gap to price action with the 38.2 Fibonacci Retracement Fan Resistance Level approaching the support zone.

The Force Index, a next generation technical indicator, formed a positive divergence over the past three weeks as the EUR/GBP extended its sell-off while this technical indicator started to advance from a reaction low. An ascending support level formed, but the sideways trend in price action resulted in the Force Index moving below it as it struggled to push through its horizontal resistance level. A descending resistance level has now approach and while the Force Index remains in negative territory below resistance, the general uptrend is clearly intact. This is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

While the Euro is faced with a slowing economy over the past twelve months, in line with the slowdown in the global economy, a short-term rally in the EUR/GBP should be expected. As price action is trending sideways inside of its support zone, located between 0.87859 and 0.88556 which is marked by the grey rectangle, the Force Index should be closely monitored. In case the current uptrend will be able to push this technical indicator into positive territory and above its descending as well as horizontal resistance level, a breakout in the EUR/GBP should follow. The intra-day high of 0.88937 will play a key role in order to determine if a breakout is sustainable; this market the high recorded during a previously failed breakout and will bring price action close to its 38.2 Fibonacci Retracement Fan Resistance Level.

Should price action successfully push above the 0.88937 level, together with an advance in the Force Index, the EUR/GBP could accelerate back into its short-term resistance zone. This zone is located between 0.88734 and 0.90145 which is marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is nestled inside the resistance zone and may mark the top of a potential short-covering rally. This occurs when traders buy assets in order to cover their short positions and exit those trades. Given the economic worries in the Eurozone, any breakout is expected to be temporary and keep the longer-term downtrend intact. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/GBP Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.88250

Take Profit @ 0.90000

Stop Loss @ 0.87800

Upside Potential: 175 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.89

A reversal in the Force Index could pressure the EUR/GBP into a breakdown if a fundamental catalyst will provide a spark. Given the current uncertainty out of the UK and the Eurozone worries, a sustained breakdown is unlikely. Any move below its support zone is likely to remain limited to its intra-day low of 0.86804 which represents the bottom range of its next support zone, the top range is located at 0.87249.

EUR/GBP Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.87700

Take Profit @ 0.87000

Stop Loss @ 0.88000

Downside Potential: 70 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.33