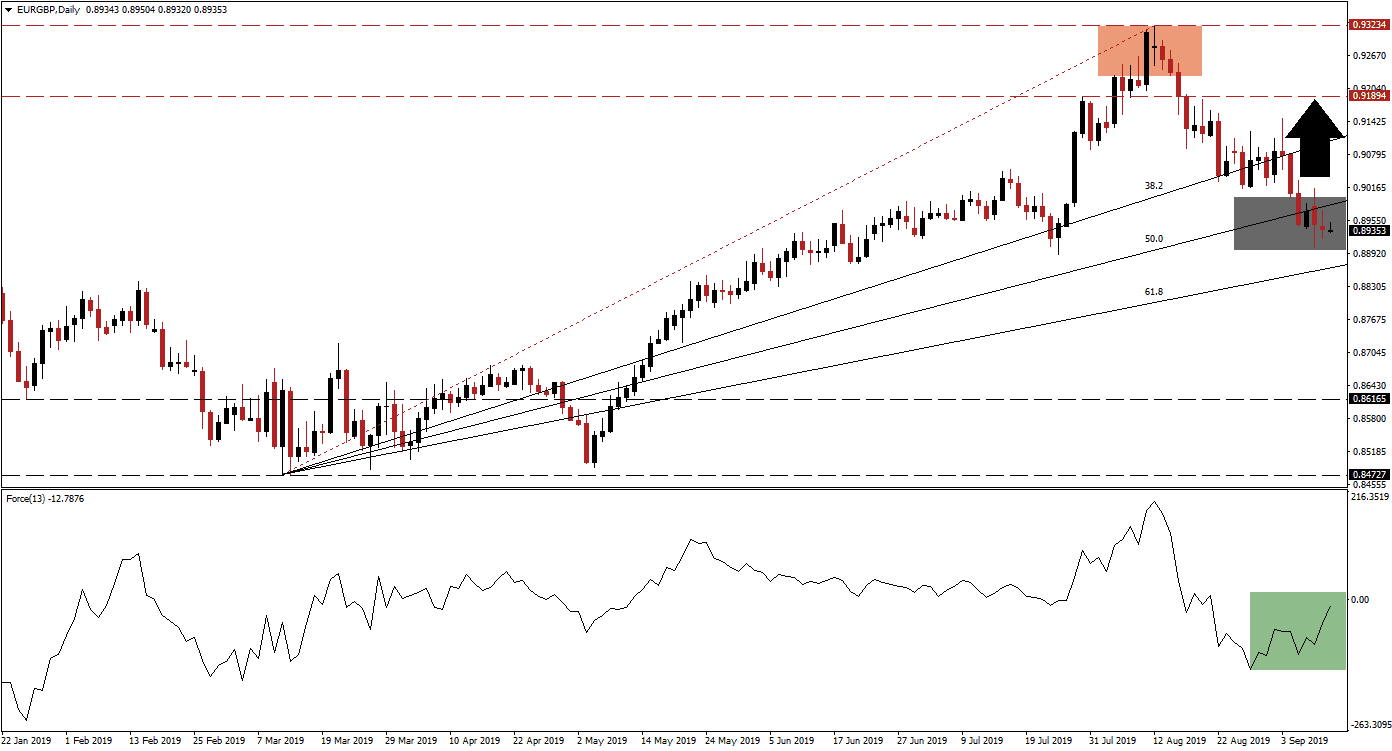

The EUR/GBP started a correction after recording an intra-day high of 0.93234 which is marked by the red rectangle in the chart. This has resulted in a breakdown below its resistance zone and price action also pushed below its 38.2 as well as 50.0 Fibonacci Retracement Fan Support Levels. As this currency pair is approaching its 61.8 Fibonacci Retracement Fan Support Level, bearish momentum started to decrease which suggests that the correction is gearing up for a pause. This would also represent a great opportunity for a short-covering rally which occurs when forex traders close short positions and have therefore to buy. Economic data will be a non-event today, but forex traders await Thursday’s ECB decision on interest rates and monetary policy. Brexit developments will also be closely followed.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, started to advance as the EUR/GBP extended its slide which created a positive divergence. Price action started to stabilize between its 50.0 and 61.8 Fibonacci Retracement Fan Support Levels as marked by the grey rectangle. At the same time the Force Index has recovered from its lows and while it remains in negative territory, it is approaching the center line which separates bullish momentum from bearish momentum; this is marked by the green rectangle. The 61.8 Fibonacci Retracement Fan Support Level will be critical as it will dictate the direction of the EUR/GBP moving forward.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

The current phase of the correction in the EUR/GBP appears overextended which makes price action vulnerable for a short-term reversal. The 61.8 Fibonacci Retracement Fan Support Level will offer forex traders an excuse to realize floating trading profits and encourage bulls to seek new net long positions. The rise in the Force Index and the emergence of a positive divergence is further supportive of an advance, but any such move is likely to remain limited to the bottom range of its resistance zone. While a positive divergence in the Force Index did form, it remains in negative territory and any reversal should be considered as a short-term trading opportunity.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

The breakdown by the EUR/GBP below its resistance zone has ended the strong bullish uptrend in this currency pair. The strong sell-off has created a short-term buying opportunity in this currency pair, but the overall bearish sentiment is expected to increase and an extension of the breakdown is expected long-term. A short-covering rally can extend into the 0.91482 to 0.91894 zone which represent its last intra-day high prior to the breakdown below its 38.2 Fibonacci Retracement Fan Support Level and the bottom range its resistance zone. With the long-term trend intact, a short-covering rally remains the recommended short-term recommendation.

What is a Short-Covering Rally?

A short-covering rally refers to traders covering short positions which is done by buying the underlying asset which was previously borrowed for the trade from a third-party. When a short order is placed, traders borrow the asset from a third party and sell it in the market. Once price action declines it is bought back at a lower price and returned to the third-party which creates a short-covering rally, a counter-trend move.

EUR/GBP Technical Trading Set-Up - Short-Covering Rally

Long Entry @ 0.89350

Take Profit @ 0.91500

Stop Loss @ 0.88750

Upside Potential: 215 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 3.58

Forex traders are advised to closely monitor the 61.8 Fibonacci Retracement Fan Support Level. A fundamental event could result in a breakdown which would end the long-term uptrend in the EUR/GBP and result in further downside. With the Force Index advancing, it is expected that support will hold for the time being. The ECB announcement may provide a downside catalyst and while a long-term trend change cannot be ruled out amid weakening economic data out of the Eurozone, it is expected to occur following a short-covering rally. A sustained move below the 61.8 Fibonacci Retracement Fan Support Level would bypass the rally and lead to more selling pressure following the breakdown.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

EUR/GBP Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.88350

Take Profit @ 0.87250

Stop Loss @ 0.88750

Downside Potential: 110 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.75