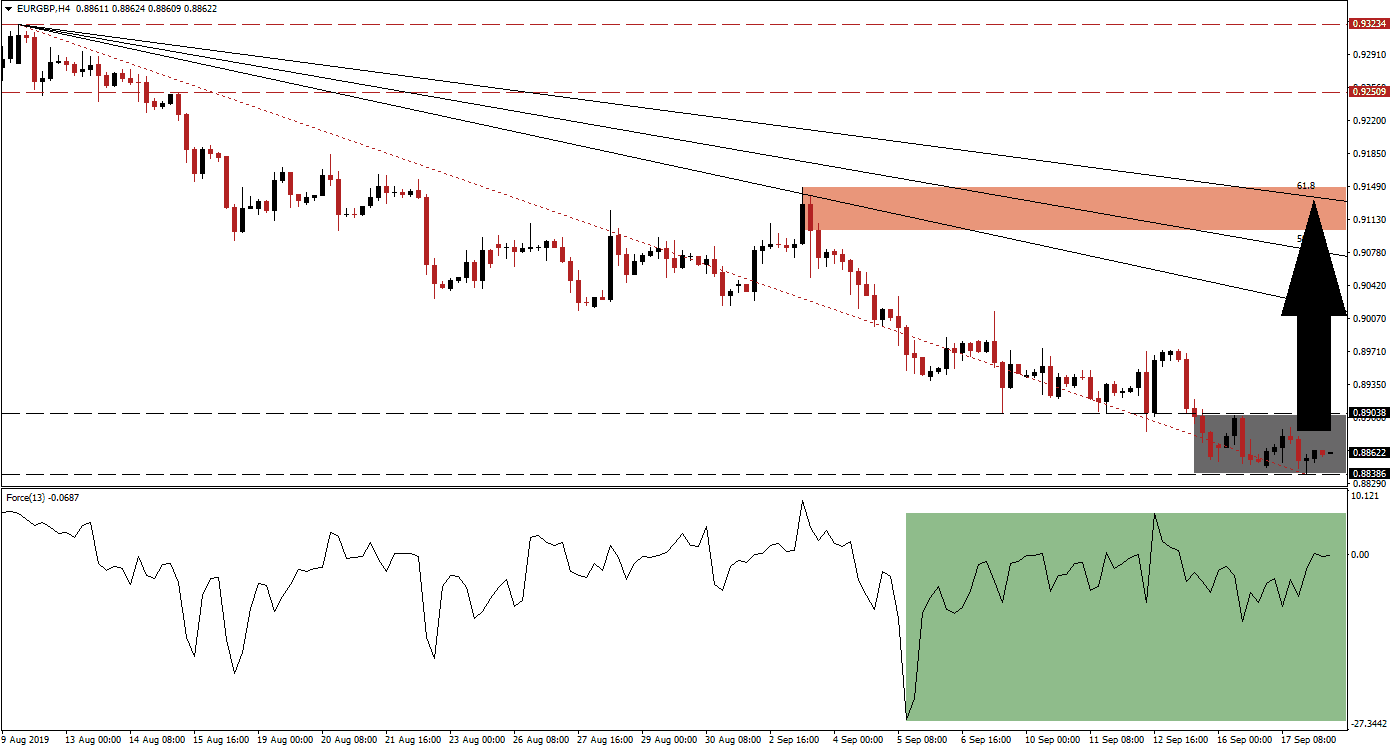

After the UK Parliament removed a no deal option from Brexit negotiations for the time being, the British Pound rallied sharply against the Euro which retraced the preceding rally. The EUR/GBP appears to have exhausted its correction after moving into its support zone with a loss in bearish momentum. The 38.2 Fibonacci Retracement Fan Resistance Level may now act as a magnet for price action and a breakout above its support zone could follow. The last time this currency pair touched its 38.2 Fibonacci Retracement Fan Resistance Level with an intra-day high of 0.91482, the most recent phase of the sell-off materialized.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, suggests that a price action reversal is imminent as a positive divergence formed which is marked by the green rectangle. A positive divergence forms when price action extends further to the downside while the underlying technical indicator moves higher. The Force Index is now approaching the 0 center line and is expected to move into positive territory which will put bulls in charge of price action. A move above 0 is likely to precede a breakout in the EUR/GBP above its support zone.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

A breakout above its support zone which spans between 0.88386 and 0.89038, marked by the grey rectangle, should take the EUR/GBP quickly into its descending 38.2 Fibonacci Retracement Fan Resistance Level. This move is expected to be partially powered by a short-covering rally and while an advance into its 61.8 Fibonacci Retracement Fan Resistance Level is possible, the longer term downtrend should remain intact. Volatility is also expected to rise as the current Brexit deadline of October 31st 2019 is approaching with a suspended UK Parliament which awaits the outcome of a UK Supreme Court decision in regards to the current prorogation.

What is a Support Zone?

A support zone is a price range where bearish momentum is receding and bullish momentum is advancing. They can identify areas where price action has a chance to reverse to the upside and a support zone offers a more reliable technical snapshot than a single price point such as an intra-day low.

Following a successful breakout above its support zone, confirmed by an advance in the Force Index, the EUR/GBP could extend its rally into its next resistance zone. This zone is located between 0.90725 and 0.91482, marked by the red rectangle and the 61.8 Fibonacci Retracement Fan Resistance Level is temporarily nestled inside this zone. Such an advance will keep the long-term downtrend intact. A move above 0.89196 could spark a short-covering rally which will push price action to the upside while an advance past 0.89716 may result in the additions of new net long positions.

What is a Short-Covering Rally?

A short-covering rally refers to traders covering short positions which is done by buying the underlying asset which was previously borrowed for the trade from a third-party. When a short order is placed, traders borrow the asset from a third party and sell it in the market. Once price action declines it is bought back at a lower price and returned to the third-party which creates a short-covering rally, a counter-trend move.

EUR/GBP Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.88650

Take Profit @ 0.91450

Stop Loss @ 0.87950

Upside Potential: 280 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 4.00

With the positive divergence in the Force Index and the exhaustion in the sell-off, a breakdown below the support zone is unlikely unless a fundamental catalyst would provide the foundation for such a move. A breakdown from current levels may be further limited to its intra-day low of 0.87249 which forms the top range of its next support zone and in order for a breakdown to form the Force Index would need to break its current uptrend. Caution is advised as the EUR/GBP is approaching its intra-day low of 0.88386, the bottom range of its current support zone. As long as the uptrend in the Force Index remains, short-term dips below the support zone should not be taken as a sell-signal for a sustained breakdown.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

EUR/GBP Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.88200

Take Profit @ 0.88650

Stop Loss @ 0.87250

Downside Potential: 95 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.11