The Euro has been falling rather precipitously against the British pound for several weeks, and of course there was more of the same during the month of September. However, as we close out the month, we are starting to show signs of a potential bit of support that could come into play and send this market back towards the upside.

Keep in mind, I have no interest in owning the Euro in general. If this market does in fact rally and bounce from here rather significantly, it would really be saying something about the British pound, as the Euro looks horrible against the US dollar. That being said, you can use this chart as a bit of a proxy as to decide what to do with some of the more major pairs. In other words, if this pair were to rally from here, that means that the GBP/USD pair should be falling rather hard. So if you don’t want to trade this pair, perhaps you can short the GBP/USD pair in that scenario.

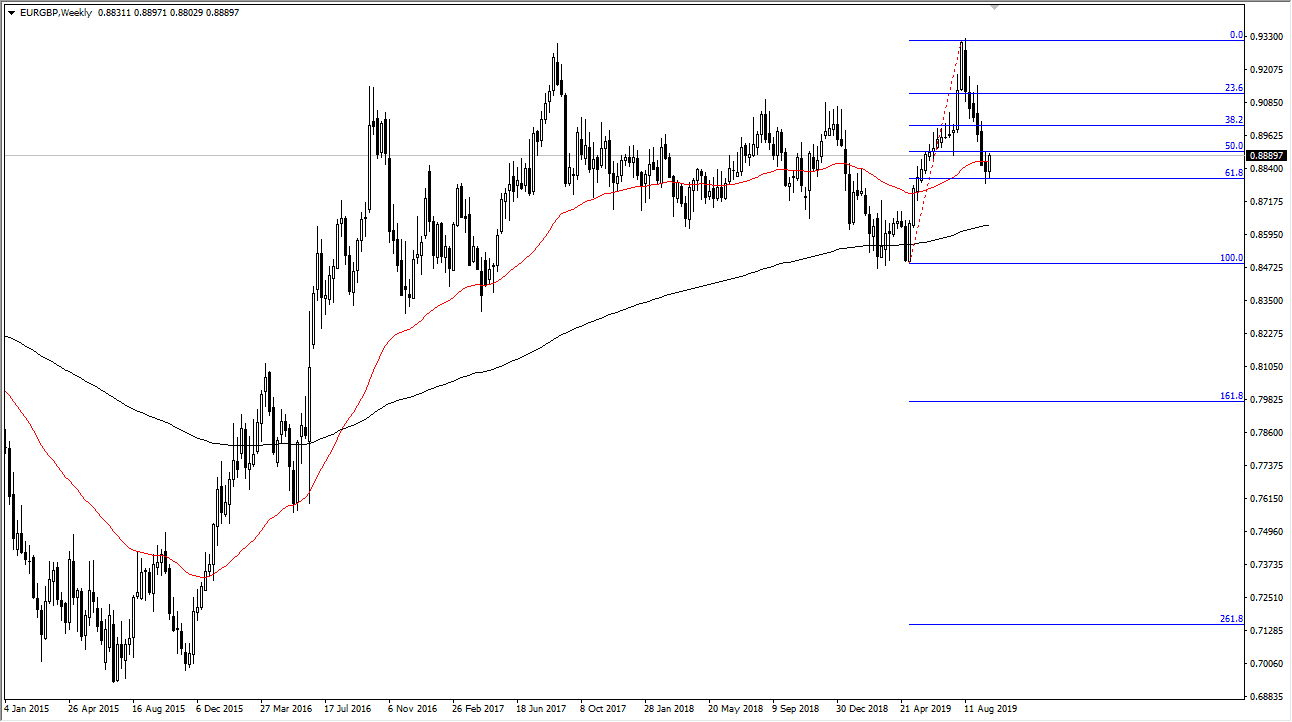

The technical analysis is interesting because we are testing the 50 week EMA but have also seen a bit of support at the 0.88 handle which is also the 61.8% Fibonacci retracement level. Simply put, if we can break above the highs of the last two weeks of the month, then I think the market goes looking towards the 0.90 level at the very least, as it is a large, round, psychologically significant figure and previous resistance from earlier in the year. If we can break above there, then we will more than likely test the highs again.

With the Brexit going on, it doesn’t take a lot of imagination to suggest that perhaps the British pound could be soft, and although the Euro has been soft against the US dollar, and perhaps even the Japanese yen, it doesn’t mean that it can’t be up on the British pound which looks as if it is trying to roll over again several currencies at the moment. That being said, there’s also the alternate scenario, making a fresh low in this pair. If that happens, then it’s very likely that once we are below the 61.8% Fibonacci retracement level, we will then go looking towards the 100% Fibonacci retracement level closer to the 0.85 handle. All things being equal, we have a nice set up coming in one direction or the other so pay attention to the last two weeks.