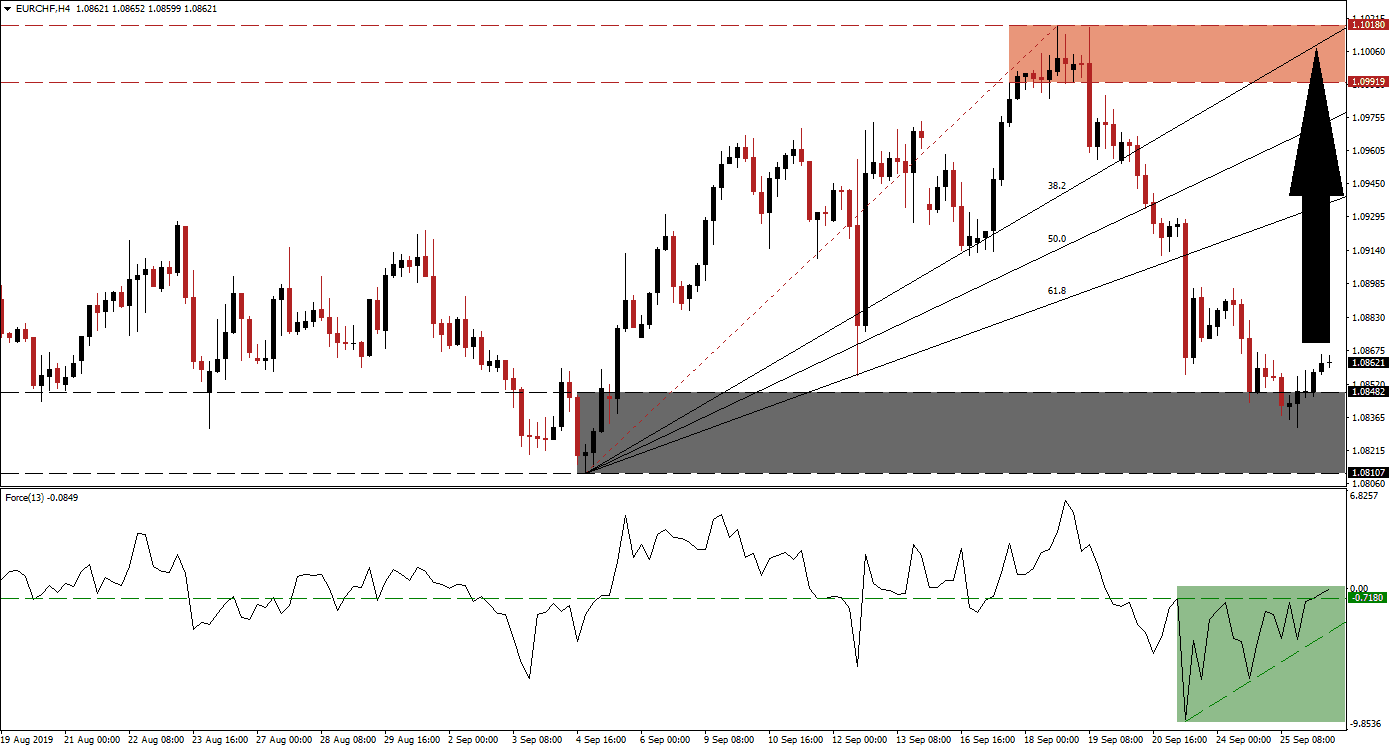

A rise in optimism in regards to a US-China trade deal was enough to pause the sell-off in the EUR/CHF. The Euro has been under bearish pressures following a series of disappointing PMI reports out of the Eurozone while the Swiss Franc enjoyed safe have demand. This combination forced price action into a move below its resistance zone which was followed by a complete breakdown of the Fibonacci Retracement Fan sequence, turning it from support into resistance. The EUR/CHF descended into its support zone, where it recorded a higher low before completing a breakout. This is a bullish development.

The Force Index, a next generation technical indicator, formed a steep positive divergence prior to the breakout above its support zone. A positive divergence is formed when price action descends and the technical indicator ascends. Bullish momentum in the EUR/CHF has recovered fast which resulted in a breakout of the Force Index above its horizontal resistance level, turning it into support. This is marked by the green rectangle and this technical indicator now points towards more upside potential in this currency pair. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Given the strong sell-off which took the EUR/CHF into its support zone, located between 1.08107 and 1.08482 as marked by the grey rectangle, the next resistance level is posed by the ascending 61.8 Fibonacci Retracement Fan Resistance Level. While price action may retrace its breakout above the support zone and re-test the top range, more upside is expected as long as the Force Index can remain above its ascending support level. The intra-day high of 1.08966 should be watched closely as a move above this level could provide the next wave of buy orders in the EUR/CHF. This level marks the high before price action moved into its support zone.

Following a successful move above the 1.08966 level, with a continuation in the advance of the Force Index, price action should be cleared to complete a breakout above the 61.8 Fibonacci Retracement Fan Resistance Level, turning it back into support. This may be followed by a pause in the rally, but the EUR/CHF could extend into its resistance zone which is located between 1.09919 and 1.10180 as marked by the red rectangle in the chart. With this currency pair fundamentally oversold, the technical picture favors a short-term recovery; this may keep the long-term downtrend intact as a breakout above its resistance zone is not expected. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.08650

Take Profit @ 1.10150

Stop Loss @ 1.08300

Upside Potential: 150 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 4.29

A reversal in the Force Index below its ascending support level could result in a breakdown in the EUR/CHF below its support zone. This would bring the intra-day low of 1.07793 in play which represents the low of a previous price gap to the upside. The next support zone is located between 1.06702 and 1.07186, but a fundamental catalyst would be required to accelerate price action to the downside.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.07700

Take Profit @ 1.06850

Stop Loss @ 1.08100

Downside Potential: 85 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.13