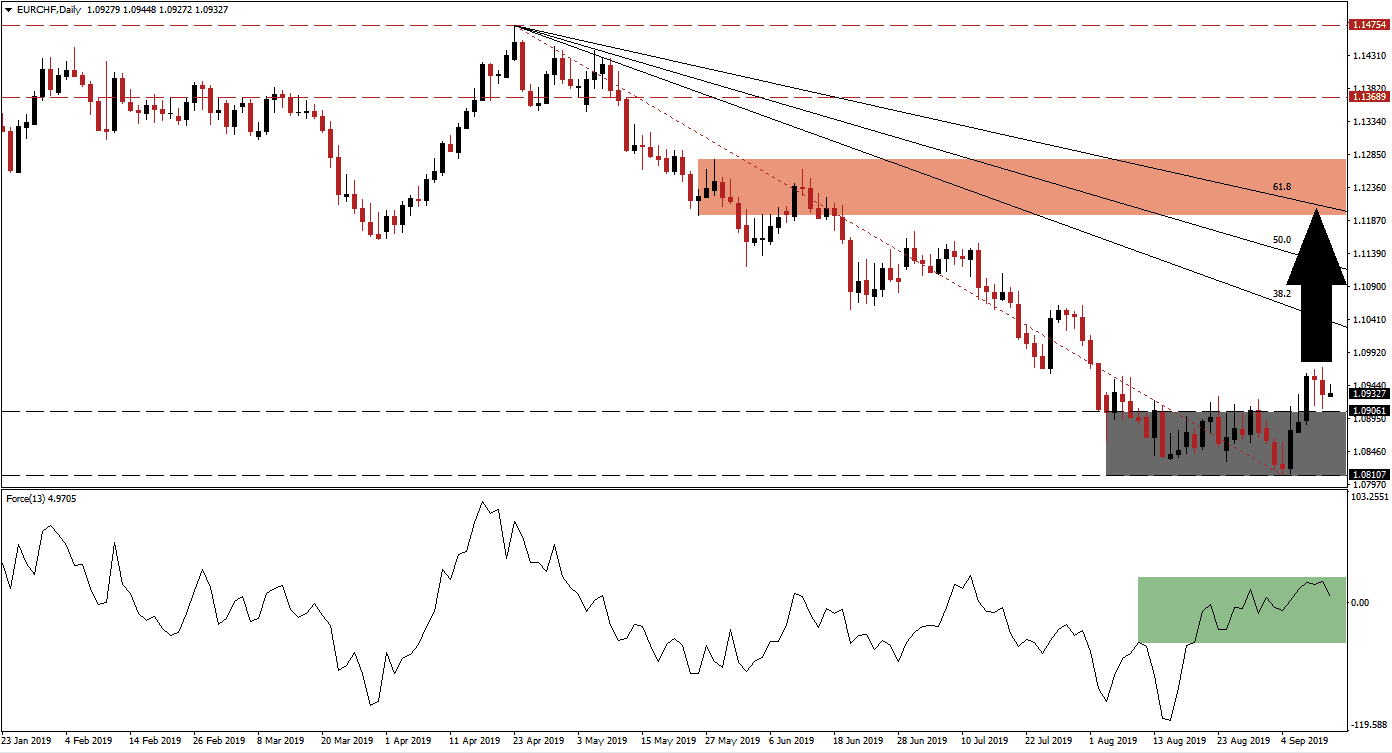

The Eurozone economy has struggled in 2019 and economic reports have been disappointing with a few isolated upside surprises. This has caused the Euro to face heavy selling pressure and call for the European Central Bank to provide more stimulus have grown. During the last ECB meeting, an interest rate cut was delayed. Forex traders are advised to hold any Euro trading decisions until after today’s ECB announcement. Interest rates are expected to remain unchanged with the exception of Deposit Facility Rate which may see a 10 basis point cut to -0.50%. Despite the bearish outlook, the EUR/CHF managed a breakout above its support zone and is now well positioned to close the gap to the 38.2 Fibonacci Retracement Fan Resistance Level.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, has confirmed the breakout above its support zone which is marked by the grey rectangle. Prior to the breakout, it has formed a minor positive divergence which occurs when price action declines while the underlying technical indicator increases. The Force Index was able to cross above the 0 center line which indicates the bulls are in control of the EUR/CHF, but caution is advised as volatility could expand after today’s ECB press conference 45 minutes after the official interest rate announcement.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

The breakout above the 1.08107 to 1.09061 support zone has resulted in a bullish shift for this currency pair. The Swiss economy has largely outperformed expectations which contributed to the heavy sell-off in the EUR/CHF. In addition the Swiss Franc is viewed as a safe haven currency which further increased its appeal to risk averse traders. The 38.2 Fibonacci Retracement Fan Resistance Level is now posing the next resistance level and the breakout is expected to result in a delayed short-covering rally unless the ECB acts more aggressively towards easing than is currently priced into the market.

What is a Short-Covering Rally?

A short-covering rally refers to traders covering short positions which is done by buying the underlying asset which was previously borrowed for the trade from a third-party. When a short order is placed, traders borrow the asset from a third party and sell it in the market. Once price action declines it is bought back at a lower price and returned to the third-party which creates a short-covering rally, a counter-trend move.

The Force Index should be closely monitored as the EUR/CHF is advancing closer to its 38.2 Fibonacci Retracement Fan Resistance Level, new highs could lead to another breakout which could clear a rally into its 61.8 Fibonacci Retracement Fan Resistance Level. This is currently at the bottom range of its next resistance zone between 1.11946 and 1.12778, marked by the red rectangle. An advance into its 61.8 Fibonacci Retracement Fan Resistance Level would keep the long-term downtrend intact and further analysis is required in order to assess the next price action move beyond that. For the time being, an extension of the current breakout in the EUR/CHF is the most likely outcome as downside risk from current levels remains limited.

What is a Breakout?

A breakout occurs if price action moves above a support or resistance zone. A breakout above a support zone could signal a short-term move, such as a short-covering rally which occurs when forex traders exit short positions and realize trading profits, or a long-term move such as the start of a trend reversal from bearish to bullish. A breakout above a resistance zone signals strong bullish momentum and an extension of the existing uptrend.

EUR/CHF Technical Trading Set-Up - Breakout Extension

Long Entry @ 1.09150

Take Profit @ 1.11850

Stop Loss @ 1.08000

Upside Potential: 270 pips

Downside Risk: 115 pips

Risk/Reward Ratio: 2.35

Post ECB volatility could lead to the EUR/CHF descending back into its support zone and the Force Index may temporarily cross below the 0 center line. Barring any negative surprise by the ECB, this will represent an excellent buying opportunity in this currency pair. A sustained move in the Force Index into negative territory could result in a breakdown of the support zone which will make price action vulnerable to more downside pressure. The 1.07793 will be a key level to watch as it represents the intra-day low from a previous price gap to the upside. A breakdown below this this level is expected to result into new net short positions in the EUR/CHF as the gap will be closed.

What is a Price Gap?

A price gap occurs when the opening price of an asset at the start of a new trading session is well above or below the previous day’s close with no trading in between. This results in a blank space in the chart. A price gap usually occurs when a fundamental event causes buyers or sellers to crowd an assets. This can mark the start of a new trend, but over time gaps may be closed. The closing of a price gap can also happen shortly after its creation. It depends on the type of gap, the reason behind it and if volume has supported the direction of the move.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.07750

Take Profit @ 1.06300

Stop Loss @ 1.08150

Downside Potential: 145 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.63