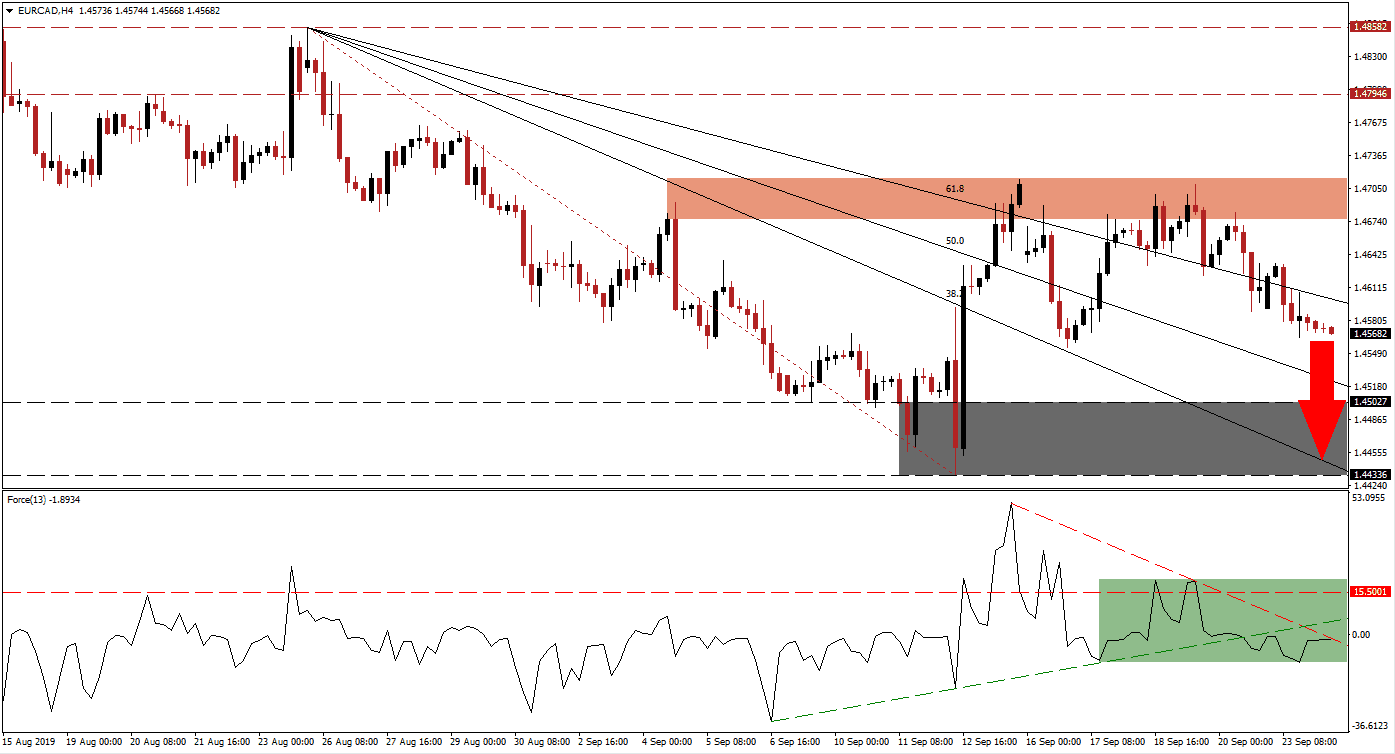

Following disappointing PMI data out of the Eurozone which was published yesterday, the Euro came under selling pressure. The German Manufacturing PMI led the string of disappointments and the severity of the drop also dragged the German Composite PMI below 50.0 which indicates contraction. The EUR/CAD extended its sell-off which started after a breakdown below its short-term resistance zone and extended to a breakdown below its 61.8 Fibonacci Retracement Fan Support Level, turning it into resistance.

The Force Index, a next generation technical indicator, peaked following a price spike in the EUR/CAD which briefly took this currency pair above its 61.8 Fibonacci Retracement Fan Resistance Level. The subsequent sell-off guided this currency pair down into its 38.2 Fibonacci Retracement Fan Support Level from where the EUR/CAD rallied once again, resulting in a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level. Throughout this volatile price action, the Force Index descended and a downtrend established which took this technical indicator below its ascending support level; this is marked by the green rectangle, suggests that bears are in firm control and that more downside is possible. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

The two breakouts above the 61.8 Fibonacci Retracement Fan Resistance Level which preceded the current sell-off formed a lower high which served as an early warning that the rally isn’t sustainable. The first intra-day high of 1.47135, which also marks the top range of its short-term resistance zone with the bottom range at 1.46760 as marked by the red rectangle, was slightly above the second intra-day high of 1.47088. While this is only a small difference and within a range given, it showed that the uptrend is unlikely to be sustained. Together with the lower peak in the Force Index it offered a strong sell-signal prior to the sell-off in the EUR/CAD.

Following the breakdown below its 61.8 Fibonacci Retracement Fan Support Level, now once again a resistance level, bearish pressures increased and more downside is likely. Price action is expected to push through its its 50.0 Fibonacci Retracement Fan Support Level and contract back into its support zone. This zone is located between 1.44336 and 1.45027 which is marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level is currently located inside this support zone. The intra-day low of 1.45554 should be monitored as a breakdown below it is likely to accelerate the sell-off; this level represents the last time price action action touched its 38.2 Fibonacci Retracement Fan Support Level. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.45750

Take Profit @ 1.44400

Stop Loss @ 1.46150

Downside Potential: 135 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.38

A reversal in the Force Index followed through by a breakout above its descending resistance level as well as above its ascending resistance level, which was previously support, could push the EUR/CAD back into its short-term resistance zone from where a breakout is unlikely to emerge. Any move back into its resistance zone should be viewed as a solid selling opportunity.

EUR/CAD Technical Trading Set-Up - Reversal Scenario

Long Entry @ 1.46400

Take Profit @ 1.47000

Stop Loss @ 1.46150

Upside Potential: 60 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.40