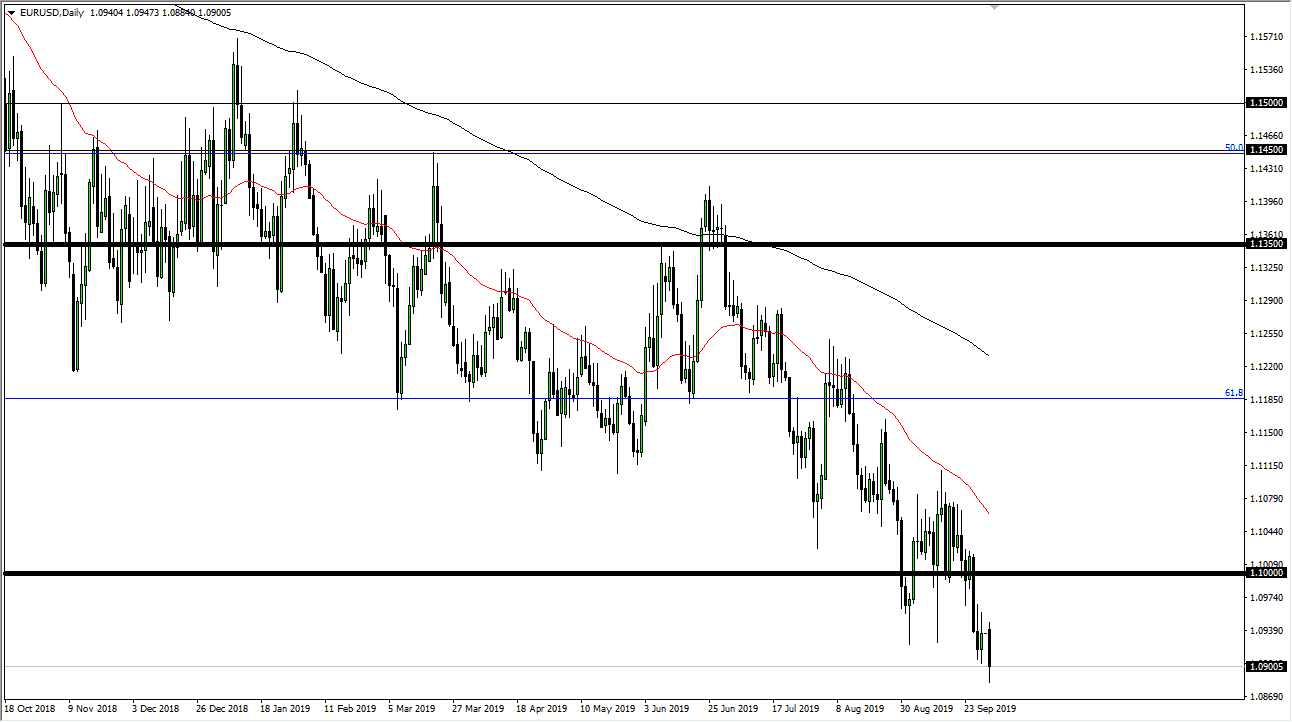

The Euro broke down during the trading session on Monday, slicing through the 1.09 level. Ultimately, this is a market that looks likely to go much lower, and I believe at this point we will probably continue the overall downtrend. As you can see looking back over the last 18 months, there has been a short-term rally followed by selling off repeatedly during that time, so ultimately it’s only a matter time before the sellers come back into this marketplace as we have been in such a longer-term downtrend.

The European Union features a whole plethora of negative yields when it comes to bonds, and I think at this point the money will continue to flow lower based upon that reason alone. Beyond that, we also have Brexit causing all kinds of headaches, so it’s not a huge surprise to see traders running away from the Euro itself. As you can see, the market has been relentless to the downside. When we look at longer-term charts though, there is a gap closer to the 1.0750 level that has yet to be filled. That is likely the target going forward, but it’s going to take some time to get there.

The candle stick for the trading session on Monday of course is very negative but we did see a little bit of a bounce to break back above the 1.09 level, showing signs of at least ability in the short term. That doesn’t matter though, because as you can see the market has been very choppy and jagged, so any rally at this point will simply be the same thing. To the upside, I see the 1.10 level in the 50 day EMA both offer and resistance. If we were to break above there, then the 1.12 level of course would cause quite a bit of resistance as well.

Looking at the chart, it will probably take some time to get down to the 1.0750 level, mainly because the Federal Reserve is simply almost as dovish as the ECB, but at least the United States is in better shape. I am very bearish of the Euro, but also recognize that this is more of a short-term trading type of situation, where you fade every short-term rally instead of trying to hold on to a position that will continue to be very noisy going forward. I have no interest in buying this pair.