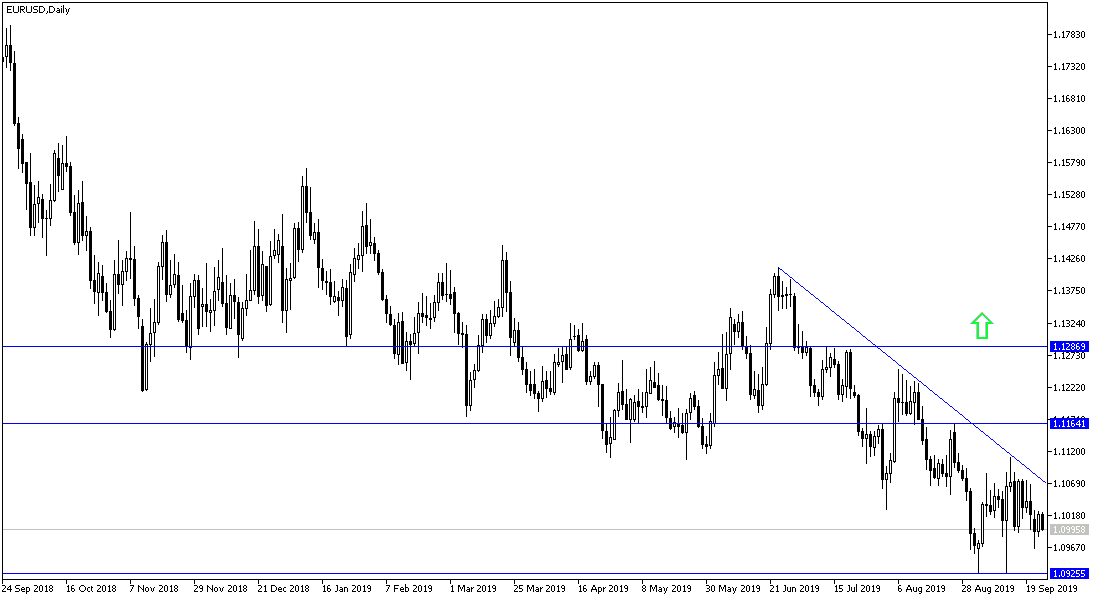

Since the beginning of this week, the EUR / USD has been under stable downside pressure below the 1.1000 psychological support level, with losses reaching the 1.0966 support level before settling around 1.0996 at the time of writing. The recent performance of the pair confirms our expectations that the pair is best sold out at every bullish rebound. Negative economic data from the Eurozone led by Germany, which leads the economy of the bloc to slow down in light of the continuing external risks, most notably the global trade war. European Central Bank Governor Mario Draghi said recently that the region's economy may not recover soon, which already confirms that the region needs more stimulus plans from the bank, more than the recently announced interest rate cuts and bond purchases.

Draghi stressed that the prospect of deflation in the Eurozone remains limited. Mario Draghi is the only ECB governor who has not raised interest rates during his tenure. Eurozone interest rates were raised in July 2011 by 25 basis points. The results of the Purchasing Managers' Indexes of the manufacturing and services sectors of the Eurozone economies confirm the extent of the slowdown in the performance of the European economy. Calls for more stimulus plans by the European Central Bank are increasing.

According to the technical analysis of the pair: No change in our expectations for this pair, as we have mentioned and confirmed that the continues move below the 1.1000 level will continue to support the downtrend. The nearest support levels for the pair are currently at 1.0945, 1.0880 and 1.0790 respectively. Negative economic figures from the region, and pessimism from the European Central Bank, will remain a pressure factor for the Euro for a longer period. In case of an upward correction, the EUR / USD still needs to test the 1.1100 resistance level and stabilize above it for a better correction. Overall I still prefer to sell this pair from each bullish level.

Regarding the economic data: Today's economic calendar does not contain any important European data. From the United States, new home sales and oil inventories will be announced, along with remarks by some members of the US central bank policy.