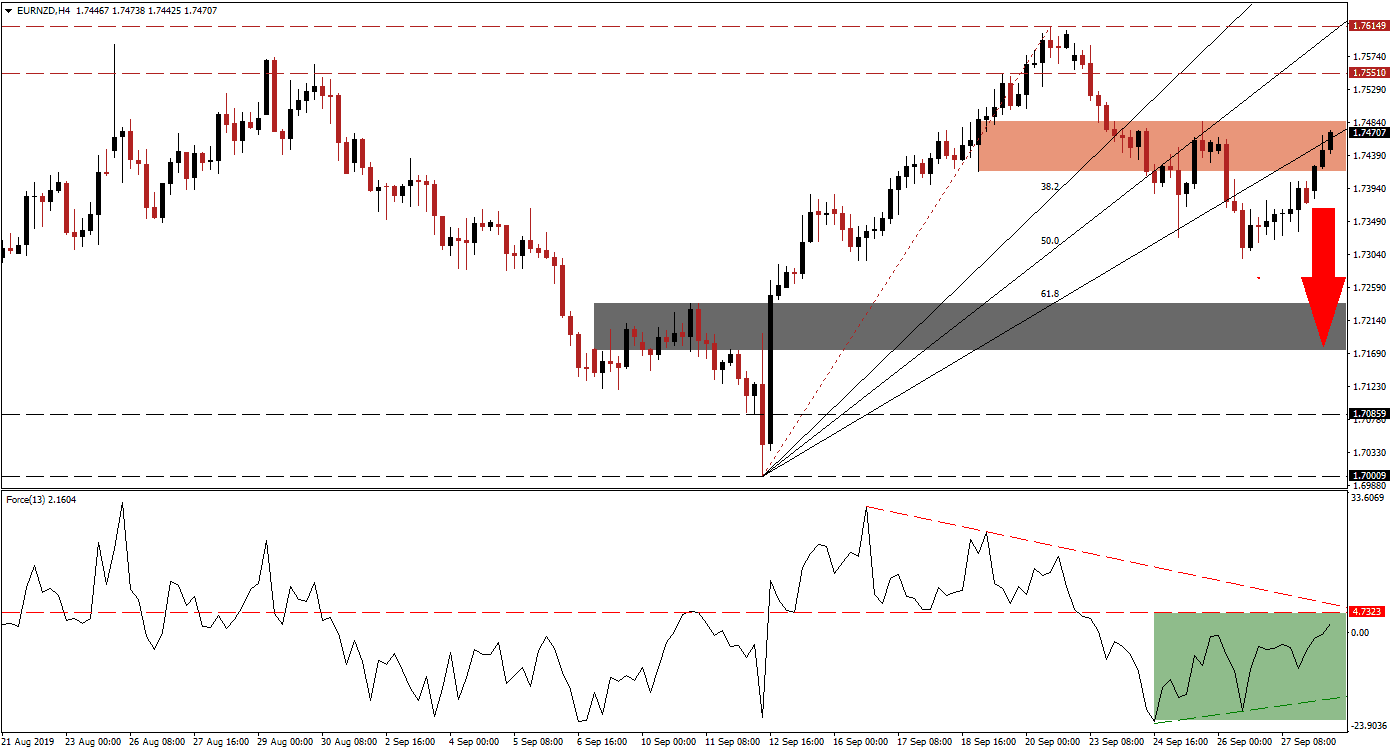

The Eurozone economy is slowing down faster than expected as evident in last week’s economic data which came in below expectations. The WTO is now expected to rule in favor of the US and Boeing in regards to unfair government subsidies for its rival Airbus out of the EU which will allow billions worth of tariffs to be applied on the EU, further pressuring its economy. The EUR/NZD, following a breakdown below its 61.8 Fibonacci Retracement Fan Support Level which turned it into resistance, has now retraced its move back into its new resistance level from where a sell-off is expected.

The Force Index, a next generation technical indicator, started to recover from its lows in negative territory. It does remain below its horizontal resistance level while its descending resistance level is approaching; this is marked by the green rectangle. Forex traders should expect bullish momentum to fade quickly as the Force Index is closing in on a twin resistance level while the EUR/NZD is challenging its 61.8 Fibonacci Retracement Fan Resistance Level which is located inside its short-term resistance zone. Fundamental economic pressure out of the Eurozone makes a price action reversal the most likely scenario. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action inside the short-term resistance zone which is located between 1.74168 and 1.74861, marked by the red rectangle, should be monitored. Given the previous strong rally in the EUR/NZD which resulted in the current Fibonacci Retracement Fan sequence, any reversal should also be expected to be larger in magnitude. Forex traders should pay attention to the intra-day low of 1.73608, the low of the breakdown in this currency pair below its 61.8 Fibonacci Retracement Fan Support Level which turned it into resistance. A move lower is likely to result in a rise in selling pressure.

Economic data released this morning out of New Zealand confirms that the global economic slowdown is ongoing, but Chinese manufacturing data surprised to the upside while remaining in contractionary conditions. As technical resistance is solid with a fundamental picture favoring a weaker EUR/NZD, this currency pair may enter a sell-off which will take it back down into its next short-term support zone. This zone is located between 1.71740 and 1.72368 which is marked by the grey rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/NZD Technical Trading Set-Up - Sell-Off Scenario

- Short Entry @ 1.74650

- Take Profit @ 1.71950

- Stop Loss @ 1.75300

- Downside Potential: 270 pips

- Upside Risk: 65 pips

- Risk/Reward Ratio: 4.15

In the even that the Force Index will push through its twin resistance level followed by a breakout in the EUR/NZD above its short-term resistance zone, price action can extend its advance into its next long-term resistance level which is located between 1.75510 and 1.76149. This should be viewed as a good short-entry opportunity as the longer-term outlook remains bearish for this currency pair.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.75550

- Take Profit @ 1.76100

- Stop Loss @ 1.75350

- Upside Potential: 55 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.75