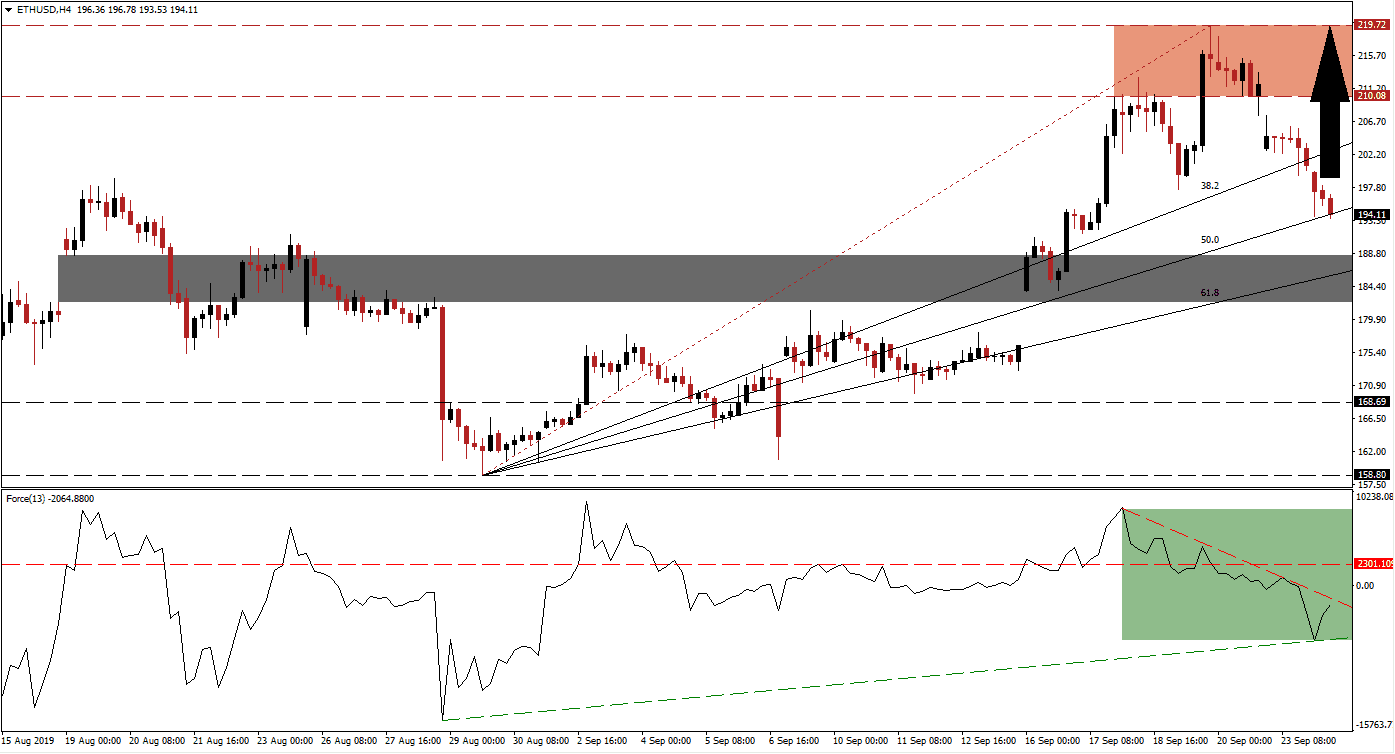

Volatility in cryptocurrencies has increased once again. A strong rally in ETH/USD took price action through its entire Fibonacci Retracement Fan sequence, turning it from resistance into support. Bullish momentum stalled inside its resistance zone from where the current sell-off was emerged with a price gap below resistance. Sellers quickly executed more downside pressure which resulted in a breakdown below its ascending 38.2 Fibonacci Retracement Fan Support Level, turning it back into resistance. A second breakdown occurred which took ETH/USD into its 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next generation technical indicator, preceded the breakdown below its resistance zone with the formation of a negative divergence. A negative divergence forms when price action ascends while the technical indicator descends. As the double breakdown in price action materialized, a downtrend in the Force Index accompanied ETH/USD to the downside. Selling pressure is now easing as this technical indicator started to ascend following the breakdown in the cryptocurrency pair below its 38.2 Fibonacci Retracement Fan Support Level. The Force Index is now trading at its descending resistance level and an unconfirmed ascending support level emerged; this is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A successful move in the Force Index above its descending resistance level would confirm the 50.0 Fibonacci Retracement Fan Support Level and result in a price action reversal. The current magnitude in selling pressure may take ETH/USD into its short-term support zone, located between 182.23 and 188.52 as marked by the grey rectangle, which is also housing the 61.8 Fibonacci Retracement Fan Support Level. Such a move should be viewed as a good buying opportunity if the Force Index will maintain its position above the unconfirmed ascending support level.

The intra-day low of 183.64 should also be monitored if the sell-off extends. This level is located inside the support zone and represents the low of a price gap to the upside which fueled the rally in ETH/USD prior to the breakdown in price action. A price action reversal is expected to take this cryptocurrency pair back into its resistance zone which is located between 210.08 and 219.72 as marked by the red rectangle in the chart. Further upside is unlikely without a fundamental catalyst providing the necessary incentive. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

ETH/USD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 195.00

Take Profit @ 219.50

Stop Loss @ 183.60

Upside Potential: 2,450 pips

Downside Risk: 1,140 pips

Risk/Reward Ratio: 2.15

Should the Force Index fail to push above its descending resistance level as well as above its horizontal resistance level, a price action reversal will not be sustained. A drop below the unconfirmed ascending support level in the Force Index could attract more net sell orders which may result in a breakdown below its 61.8 Fibonacci Retracement Fan Support Level as well as below its short-term support zone. This will then extend the sell-off into its next long-term support zone which is located between 158.80 and 168.69.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 180.00

Take Profit @ 161.00

Stop Loss @ 189.50

Downside Potential: 1,900 pips

Upside Risk: 950 pips

Risk/Reward Ratio: 2.00