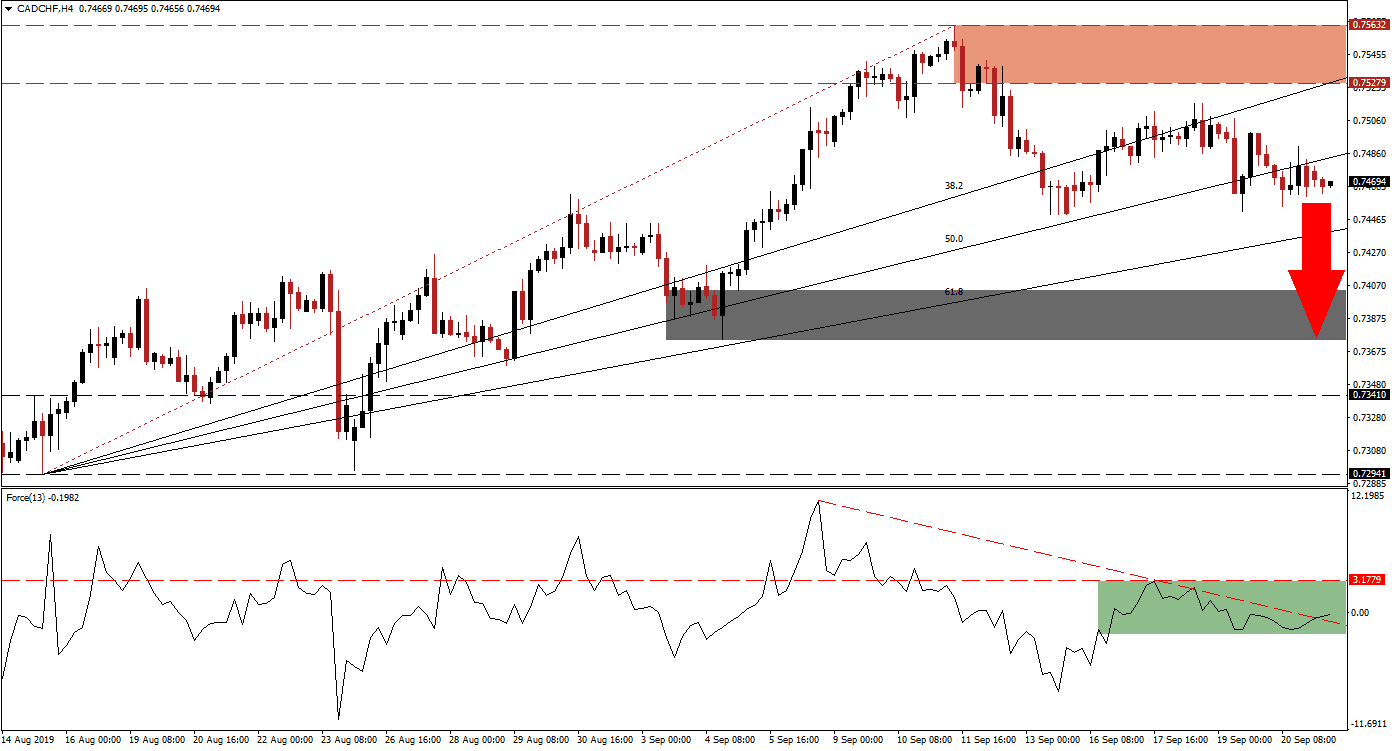

The Canadian Dollar is faced with a rise in bearish momentum, partially due to the political uncertainty about the election outcome. This combined with the safe haven appeal of the Swiss Franc have forced the CAD/CHF into a breakdown below its resistance zone, located between 0.75279 and 0.75632 which is marked by the red rectangle in the chart. This as followed by a breakdown below its 38.2 as well as 50.0 Fibonacci Retracement Fan Support Level, turning them into resistance. The 61.8 Fibonacci Retracement Fan Support Level should now be closely monitored as price action started a sideways trend.

The Force Index, a next generation technical indicator, started a longer term downtrend and formed a negative divergence prior to the breakdown of the CAD/CHF below its resistance zone. A negative divergence forms when price action ascends while the underlying technical indicator starts to contract. After this currency pair reached its 50.0 Fibonacci Retracement Fan Support Level, the Force Index advanced together with price action. Following a rejection by its 38.2 Fibonacci Retracement Fan Resistance Level, the CAD/CHF completed a breakdown below its 50.0 Fibonacci Retracement Fan Support Level which was confirmed by a descend in the Force Index which is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A successful breakdown in the CAD/CHF below its 61.8 Fibonacci Retracement Fan Support Level will turn the entire Fibonacci Retracement Fan into resistance and bring its next short-term support zone into play. This zone is located between 0.73747 and 0.74039 which is marked by the grey rectangle. The Force Index started to move above its descending resistance level, but remains below its horizontal resistance level. A move above this level would be required to terminate the bearish trend in the CAD/CHF. Forex traders should monitor the intra-day low of 0.74495 which represents a short-term reversal from the 50.0 Fibonacci Retracement Fan Support Level into its 38.2 Fibonacci Retracement Fan Resistance Level.

As long as the Force Index can maintain its position below its horizontal resistance level, further downside in this currency pair should be expected. The CAD/CHF may advance into its ascending 50.0 Fibonacci Retracement Fan Resistance Level before attempting a fresh breakdown. A move below its intra-day low of 0.74495 is likely to attract fresh sellers and provide bearish momentum for a breakdown. Any potential advance into its 50.0 Fibonacci Retracement Fan Resistance Level should be followed together with the Force Index and the intra-day high of 0.74902; this level marks the high of the last spike above resistance. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

CAD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.74800

Take Profit @ 0.73800

Stop Loss @ 0.75100

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

Should price action eclipse the intra-day high of 0.74902 together with a breakout in the Force Index, the CAD/CHF could retrace its sell-off back into its resistance zone. A breakout above that level would require a fundamental catalyst as the current scenario suggests more short-term downside in this currency pair.

CAD/CHF Technical Trading Set-Up - Reversal Scenario

Long Entry @ 0.75150

Take Profit @ 0.75600

Stop Loss @ 0.74950

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25